Pg 147 - Berjaya Corporation Berhad

Pg 147 - Berjaya Corporation Berhad

Pg 147 - Berjaya Corporation Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

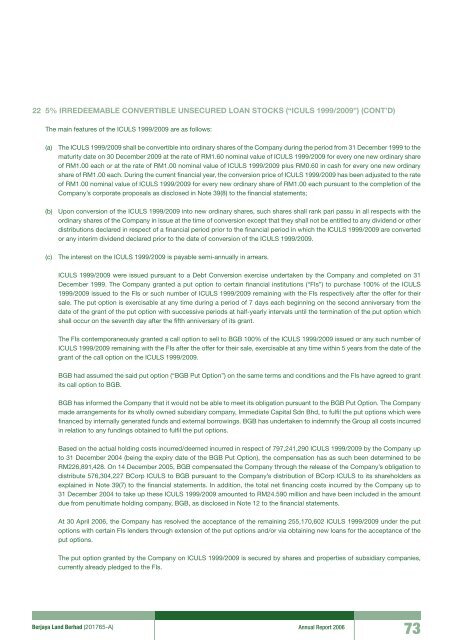

22 5% IRREDEEMABLE CONVERTIBLE UNSECURED LOAN STOCKS (“ICULS 1999/2009”) (CONT’D)The main features of the ICULS 1999/2009 are as follows:(a) The ICULS 1999/2009 shall be convertible into ordinary shares of the Company during the period from 31 December 1999 to thematurity date on 30 December 2009 at the rate of RM1.60 nominal value of ICULS 1999/2009 for every one new ordinary shareof RM1.00 each or at the rate of RM1.00 nominal value of ICULS 1999/2009 plus RM0.60 in cash for every one new ordinaryshare of RM1.00 each. During the current financial year, the conversion price of ICULS 1999/2009 has been adjusted to the rateof RM1.00 nominal value of ICULS 1999/2009 for every new ordinary share of RM1.00 each pursuant to the completion of theCompany’s corporate proposals as disclosed in Note 39(8) to the financial statements;(b) Upon conversion of the ICULS 1999/2009 into new ordinary shares, such shares shall rank pari passu in all respects with theordinary shares of the Company in issue at the time of conversion except that they shall not be entitled to any dividend or otherdistributions declared in respect of a financial period prior to the financial period in which the ICULS 1999/2009 are convertedor any interim dividend declared prior to the date of conversion of the ICULS 1999/2009.(c) The interest on the ICULS 1999/2009 is payable semi-annually in arrears.ICULS 1999/2009 were issued pursuant to a Debt Conversion exercise undertaken by the Company and completed on 31December 1999. The Company granted a put option to certain financial institutions (“FIs”) to purchase 100% of the ICULS1999/2009 issued to the FIs or such number of ICULS 1999/2009 remaining with the FIs respectively after the offer for theirsale. The put option is exercisable at any time during a period of 7 days each beginning on the second anniversary from thedate of the grant of the put option with successive periods at half-yearly intervals until the termination of the put option whichshall occur on the seventh day after the fifth anniversary of its grant.The FIs contemporaneously granted a call option to sell to BGB 100% of the ICULS 1999/2009 issued or any such number ofICULS 1999/2009 remaining with the FIs after the offer for their sale, exercisable at any time within 5 years from the date of thegrant of the call option on the ICULS 1999/2009.BGB had assumed the said put option (“BGB Put Option”) on the same terms and conditions and the FIs have agreed to grantits call option to BGB.BGB has informed the Company that it would not be able to meet its obligation pursuant to the BGB Put Option. The Companymade arrangements for its wholly owned subsidiary company, Immediate Capital Sdn Bhd, to fulfil the put options which werefinanced by internally generated funds and external borrowings. BGB has undertaken to indemnify the Group all costs incurredin relation to any fundings obtained to fulfil the put options.Based on the actual holding costs incurred/deemed incurred in respect of 797,241,290 ICULS 1999/2009 by the Company upto 31 December 2004 (being the expiry date of the BGB Put Option), the compensation has as such been determined to beRM226,891,428. On 14 December 2005, BGB compensated the Company through the release of the Company’s obligation todistribute 576,304,227 BCorp ICULS to BGB pursuant to the Company’s distribution of BCorp ICULS to its shareholders asexplained in Note 39(7) to the financial statements. In addition, the total net financing costs incurred by the Company up to31 December 2004 to take up these ICULS 1999/2009 amounted to RM24.590 million and have been included in the amountdue from penultimate holding company, BGB, as disclosed in Note 12 to the financial statements.At 30 April 2006, the Company has resolved the acceptance of the remaining 255,170,602 ICULS 1999/2009 under the putoptions with certain FIs lenders through extension of the put options and/or via obtaining new loans for the acceptance of theput options.The put option granted by the Company on ICULS 1999/2009 is secured by shares and properties of subsidiary companies,currently already pledged to the FIs.<strong>Berjaya</strong> Land <strong>Berhad</strong> (201765-A) Annual Report 200673