notes to thefinancial statements30 April 200624 DEFERRED TAX (CONT’D)Deferred tax assets have not been recognised in respect of the following items:GroupCompany2006 2005 2006 2005RM’000 RM’000 RM’000 RM’000Unused tax losses 366,165 338,370 - -Unabsorbed capital allowances 191,766 177,122 12,115 11,811Unabsorbed investment tax allowances 102,713 101,810 - -Others 2,021 132 - 52662,665 617,434 12,115 11,863The unused tax losses, unabsorbed capital allowances and investments tax allowances are available indefinitely for offset againstfuture taxable profit of the Company and its respective subsidiaries.25 REVENUEGroupRevenue represents invoiced value of goods sold less returns and trade discounts, invoiced value of services rendered, a proportionof contractual sales revenue determined by reference to the percentage of completion of the development properties, sale of propertyinventories, rental income, revenue from hotel and resort operations, membership fees from vacation time share and recreationalactivities and net house takings from casino operations. In the previous financial year, revenue from gaming and related activitiesrepresented gross stake collection from the sale of betting tickets less gaming tax and sale of betting terminals net of discounts.Intra group transactions are excluded.The main categories of revenue are as follows:2006 2005RM’000 RM’000Gaming and related activities - 109,395Contract revenue and sale of property inventories 161,715 184,828Invoiced value of goods and services soldfrom hotel, resort and theme park operations 245,000 224,663Income from investment properties 66,263 48,552Net house takings from casino operations 6,585 9,071Membership fees and subscriptions 81,978 92,442561,541 668,951CompanyRevenue represents management fees charged to subsidiary companies, gross dividend received and receivable from subsidiaryand associated companies and other investments and share administration fee income. The details of which are as follows:2006 2005RM’000 RM’000Gross dividend received and receivable 317,576 120,206Management fees 1,180 1,180Share administration fee income 1,180 1,187319,936 122,57378Annual Report 2006<strong>Berjaya</strong> Land <strong>Berhad</strong> (201765-A)

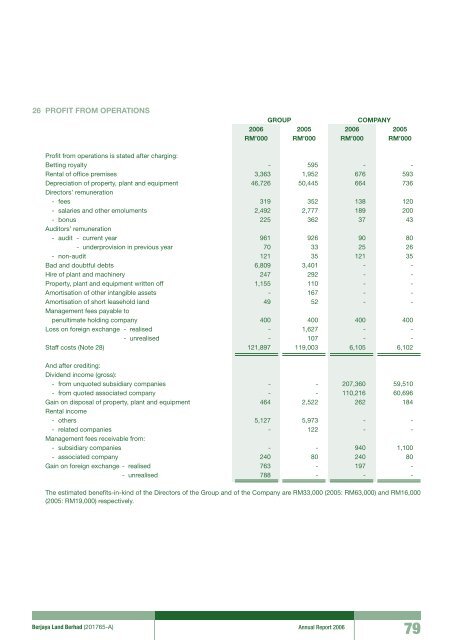

26 PROFIT FROM OPERATIONSGroupCompany2006 2005 2006 2005RM’000 RM’000 RM’000 RM’000Profit from operations is stated after charging:Betting royalty - 595 - -Rental of office premises 3,363 1,952 676 593Depreciation of property, plant and equipment 46,726 50,445 664 736Directors’ remuneration- fees 319 352 138 120- salaries and other emoluments 2,492 2,777 189 200- bonus 225 362 37 43Auditors’ remuneration- audit - current year 961 926 90 80- underprovision in previous year 70 33 25 26- non-audit 121 35 121 35Bad and doubtful debts 6,809 3,401 - -Hire of plant and machinery 247 292 - -Property, plant and equipment written off 1,155 110 - -Amortisation of other intangible assets - 167 - -Amortisation of short leasehold land 49 52 - -Management fees payable topenultimate holding company 400 400 400 400Loss on foreign exchange - realised - 1,627 - -- unrealised - 107 - -Staff costs (Note 28) 121,897 119,003 6,105 6,102And after crediting:Dividend income (gross):- from unquoted subsidiary companies - - 207,360 59,510- from quoted associated company - - 110,216 60,696Gain on disposal of property, plant and equipment 464 2,522 262 184Rental income- others 5,127 5,973 - -- related companies - 122 - -Management fees receivable from:- subsidiary companies - - 940 1,100- associated company 240 80 240 80Gain on foreign exchange - realised 763 - 197 -- unrealised 788 - - -The estimated benefits-in-kind of the Directors of the Group and of the Company are RM33,000 (2005: RM63,000) and RM16,000(2005: RM19,000) respectively.<strong>Berjaya</strong> Land <strong>Berhad</strong> (201765-A) Annual Report 200679