The European e-Business Report 2004 - Berlecon Research GmbH

The European e-Business Report 2004 - Berlecon Research GmbH

The European e-Business Report 2004 - Berlecon Research GmbH

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

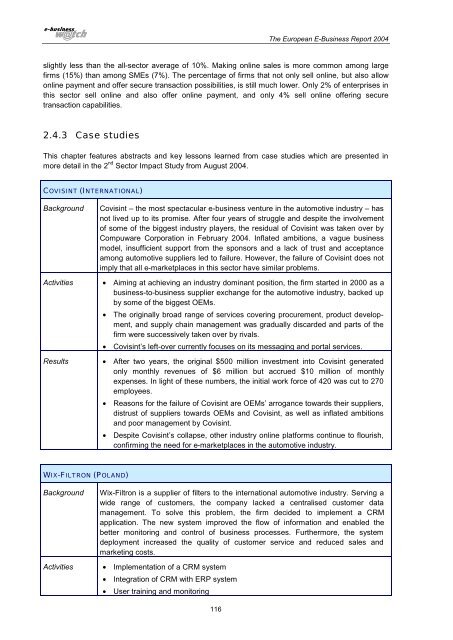

<strong>The</strong> <strong>European</strong> E-<strong>Business</strong> <strong>Report</strong> <strong>2004</strong>slightly less than the all-sector average of 10%. Making online sales is more common among largefirms (15%) than among SMEs (7%). <strong>The</strong> percentage of firms that not only sell online, but also allowonline payment and offer secure transaction possibilities, is still much lower. Only 2% of enterprises inthis sector sell online and also offer online payment, and only 4% sell online offering securetransaction capabilities.2.4.3 Case studiesThis chapter features abstracts and key lessons learned from case studies which are presented inmore detail in the 2 nd Sector Impact Study from August <strong>2004</strong>.COVISINT (INTERNATIONAL)BackgroundActivitiesResultsCovisint – the most spectacular e-business venture in the automotive industry – hasnot lived up to its promise. After four years of struggle and despite the involvementof some of the biggest industry players, the residual of Covisint was taken over byCompuware Corporation in February <strong>2004</strong>. Inflated ambitions, a vague businessmodel, insufficient support from the sponsors and a lack of trust and acceptanceamong automotive suppliers led to failure. However, the failure of Covisint does notimply that all e-marketplaces in this sector have similar problems.• Aiming at achieving an industry dominant position, the firm started in 2000 as abusiness-to-business supplier exchange for the automotive industry, backed upby some of the biggest OEMs.• <strong>The</strong> originally broad range of services covering procurement, product development,and supply chain management was gradually discarded and parts of thefirm were successively taken over by rivals.• Covisint’s left-over currently focuses on its messaging and portal services.• After two years, the original $500 million investment into Covisint generatedonly monthly revenues of $6 million but accrued $10 million of monthlyexpenses. In light of these numbers, the initial work force of 420 was cut to 270employees.• Reasons for the failure of Covisint are OEMs’arrogance towards their suppliers,distrust of suppliers towards OEMs and Covisint, as well as inflated ambitionsand poor management by Covisint.• Despite Covisint’s collapse, other industry online platforms continue to flourish,confirming the need for e-marketplaces in the automotive industry.WIX-FILTRON (POLAND)BackgroundActivitiesWix-Filtron is a supplier of filters to the international automotive industry. Serving awide range of customers, the company lacked a centralised customer datamanagement. To solve this problem, the firm decided to implement a CRMapplication. <strong>The</strong> new system improved the flow of information and enabled thebetter monitoring and control of business processes. Furthermore, the systemdeployment increased the quality of customer service and reduced sales andmarketing costs.• Implementation of a CRM system• Integration of CRM with ERP system• User training and monitoring116