The European e-Business Report 2004 - Berlecon Research GmbH

The European e-Business Report 2004 - Berlecon Research GmbH

The European e-Business Report 2004 - Berlecon Research GmbH

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

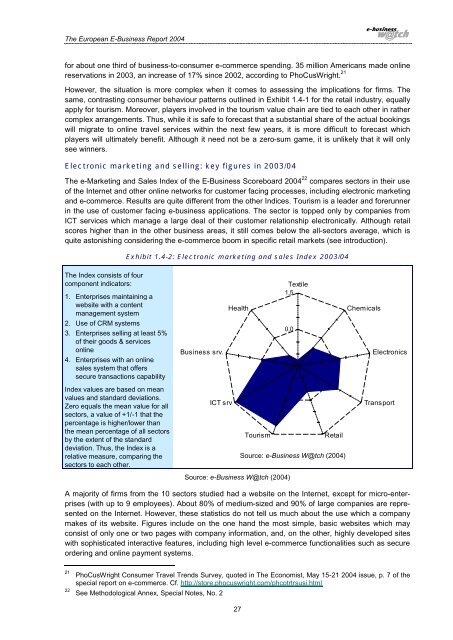

<strong>The</strong> <strong>European</strong> E-<strong>Business</strong> <strong>Report</strong> <strong>2004</strong>for about one third of business-to-consumer e-commerce spending. 35 million Americans made onlinereservations in 2003, an increase of 17% since 2002, according to PhoCusWright. 21However, the situation is more complex when it comes to assessing the implications for firms. <strong>The</strong>same, contrasting consumer behaviour patterns outlined in Exhibit 1.4-1 for the retail industry, equallyapply for tourism. Moreover, players involved in the tourism value chain are tied to each other in rathercomplex arrangements. Thus, while it is safe to forecast that a substantial share of the actual bookingswill migrate to online travel services within the next few years, it is more difficult to forecast whichplayers will ultimately benefit. Although it need not be a zero-sum game, it is unlikely that it will onlysee winners.Electronic marketing and selling: key figures in 2003/04<strong>The</strong> e-Marketing and Sales Index of the E-<strong>Business</strong> Scoreboard <strong>2004</strong> 22 compares sectors in their useof the Internet and other online networks for customer facing processes, including electronic marketingand e-commerce. Results are quite different from the other Indices. Tourism is a leader and forerunnerin the use of customer facing e-business applications. <strong>The</strong> sector is topped only by companies fromICT services which manage a large deal of their customer relationship electronically. Although retailscores higher than in the other business areas, it still comes below the all-sectors average, which isquite astonishing considering the e-commerce boom in specific retail markets (see introduction).Exhibit 1.4-2: Electronic marketing and sales Index 2003/04<strong>The</strong> Index consists of fourcomponent indicators:1. Enterprises maintaining awebsite with a contentmanagement system2. Use of CRM systems3. Enterprises selling at least 5%of their goods & servicesonline4. Enterprises with an onlinesales system that offerssecure transactions capability<strong>Business</strong> srv.HealthTextile1,50,0-1,5ChemicalsElectronicsIndex values are based on meanvalues and standard deviations.Zero equals the mean value for allsectors, a value of +1/-1 that thepercentage is higher/lower thanthe mean percentage of all sectorsby the extent of the standarddeviation. Thus, the Index is arelative measure, comparing thesectors to each other.ICT srvTourismRetailSource: e-<strong>Business</strong> W@tch (<strong>2004</strong>)TransportSource: e-<strong>Business</strong> W@tch (<strong>2004</strong>)A majority of firms from the 10 sectors studied had a website on the Internet, except for micro-enterprises(with up to 9 employees). About 80% of medium-sized and 90% of large companies are representedon the Internet. However, these statistics do not tell us much about the use which a companymakes of its website. Figures include on the one hand the most simple, basic websites which mayconsist of only one or two pages with company information, and, on the other, highly developed siteswith sophisticated interactive features, including high level e-commerce functionalities such as secureordering and online payment systems.2122PhoCusWright Consumer Travel Trends Survey, quoted in <strong>The</strong> Economist, May 15-21 <strong>2004</strong> issue, p. 7 of thespecial report on e-commerce. Cf. http://store.phocuswright.com/phcotrtrsusi.htmlSee Methodological Annex, Special Notes, No. 227