Download eBook on Survey, Search & Seizure under ... - TaxGuru

Download eBook on Survey, Search & Seizure under ... - TaxGuru

Download eBook on Survey, Search & Seizure under ... - TaxGuru

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

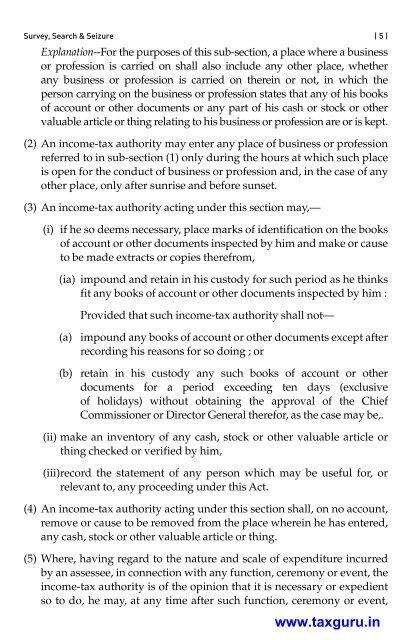

<strong>Survey</strong>, <strong>Search</strong> & <strong>Seizure</strong> | 5 |Explanati<strong>on</strong>--For the purposes of this sub-secti<strong>on</strong>, a place where a businessor professi<strong>on</strong> is carried <strong>on</strong> shall also include any other place, whetherany business or professi<strong>on</strong> is carried <strong>on</strong> therein or not, in which thepers<strong>on</strong> carrying <strong>on</strong> the business or professi<strong>on</strong> states that any of his booksof account or other documents or any part of his cash or stock or othervaluable article or thing relating to his business or professi<strong>on</strong> are or is kept.(2) An income-tax authority may enter any place of business or professi<strong>on</strong>referred to in sub-secti<strong>on</strong> (1) <strong>on</strong>ly during the hours at which such placeis open for the c<strong>on</strong>duct of business or professi<strong>on</strong> and, in the case of anyother place, <strong>on</strong>ly after sunrise and before sunset.(3) An income-tax authority acting <strong>under</strong> this secti<strong>on</strong> may,—(i) if he so deems necessary, place marks of identificati<strong>on</strong> <strong>on</strong> the booksof account or other documents inspected by him and make or causeto be made extracts or copies therefrom,(ia) impound and retain in his custody for such period as he thinksfit any books of account or other documents inspected by him :Provided that such income-tax authority shall not—(a) impound any books of account or other documents except afterrecording his reas<strong>on</strong>s for so doing ; or(b) retain in his custody any such books of account or otherdocuments for a period exceeding ten days (exclusiveof holidays) without obtaining the approval of the ChiefCommissi<strong>on</strong>er or Director General therefor, as the case may be,.(ii) make an inventory of any cash, stock or other valuable article orthing checked or verified by him,(iii) record the statement of any pers<strong>on</strong> which may be useful for, orrelevant to, any proceeding <strong>under</strong> this Act.(4) An income-tax authority acting <strong>under</strong> this secti<strong>on</strong> shall, <strong>on</strong> no account,remove or cause to be removed from the place wherein he has entered,any cash, stock or other valuable article or thing.(5) Where, having regard to the nature and scale of expenditure incurredby an assessee, in c<strong>on</strong>necti<strong>on</strong> with any functi<strong>on</strong>, cerem<strong>on</strong>y or event, theincome-tax authority is of the opini<strong>on</strong> that it is necessary or expedientso to do, he may, at any time after such functi<strong>on</strong>, cerem<strong>on</strong>y or event,www.taxguru.in