Download eBook on Survey, Search & Seizure under ... - TaxGuru

Download eBook on Survey, Search & Seizure under ... - TaxGuru

Download eBook on Survey, Search & Seizure under ... - TaxGuru

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

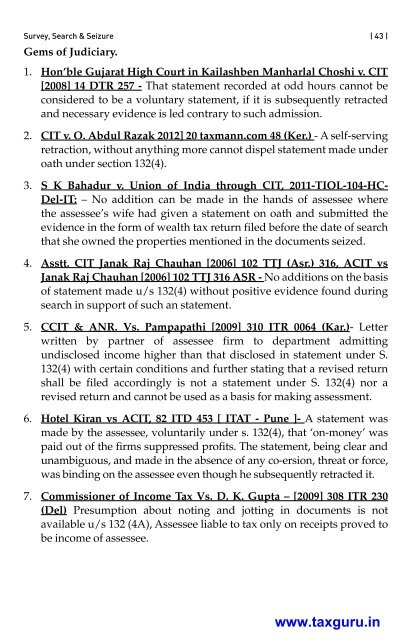

<strong>Survey</strong>, <strong>Search</strong> & <strong>Seizure</strong> | 43 |Gems of judiciary.1. h<strong>on</strong>’ble Gujarat high Court in Kailashben Manharlal Choshi v. CIT[2008] 14 dTR 257 - That statement recorded at odd hours cannot bec<strong>on</strong>sidered to be a voluntary statement, if it is subsequently retractedand necessary evidence is led c<strong>on</strong>trary to such admissi<strong>on</strong>.2. CIT v. O. Abdul Razak 2012] 20 taxmann.com 48 (Ker.) - A self-servingretracti<strong>on</strong>, without anything more cannot dispel statement made <strong>under</strong>oath <strong>under</strong> secti<strong>on</strong> 132(4).3. S K bahadur v. uni<strong>on</strong> of India through CIT, 2011-TIOL-104-hCdel-IT:– No additi<strong>on</strong> can be made in the hands of assessee wherethe assessee’s wife had given a statement <strong>on</strong> oath and submitted theevidence in the form of wealth tax return filed before the date of searchthat she owned the properties menti<strong>on</strong>ed in the documents seized.4. Asstt. CIT janak Raj Chauhan [2006] 102 TTj (Asr.) 316, ACIT vsjanak Raj Chauhan [2006] 102 TTj 316 ASR - No additi<strong>on</strong>s <strong>on</strong> the basisof statement made u/s 132(4) without positive evidence found duringsearch in support of such an statement.5. CCIT & ANR. Vs. Pampapathi [2009] 310 ITR 0064 (Kar.)- Letterwritten by partner of assessee firm to department admittingundisclosed income higher than that disclosed in statement <strong>under</strong> S.132(4) with certain c<strong>on</strong>diti<strong>on</strong>s and further stating that a revised returnshall be filed accordingly is not a statement <strong>under</strong> S. 132(4) nor arevised return and cannot be used as a basis for making assessment.6. hotel Kiran vs ACIT, 82 ITd 453 [ ITAT - Pune ]- A statement wasmade by the assessee, voluntarily <strong>under</strong> s. 132(4), that ‘<strong>on</strong>-m<strong>on</strong>ey’ waspaid out of the firms suppressed profits. The statement, being clear andunambiguous, and made in the absence of any co-ersi<strong>on</strong>, threat or force,was binding <strong>on</strong> the assessee even though he subsequently retracted it.7. Commissi<strong>on</strong>er of Income Tax Vs. d. K. Gupta – [2009] 308 ITR 230(del) Presumpti<strong>on</strong> about noting and jotting in documents is notavailable u/s 132 (4A), Assessee liable to tax <strong>on</strong>ly <strong>on</strong> receipts proved tobe income of assessee.www.taxguru.in