Download eBook on Survey, Search & Seizure under ... - TaxGuru

Download eBook on Survey, Search & Seizure under ... - TaxGuru

Download eBook on Survey, Search & Seizure under ... - TaxGuru

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

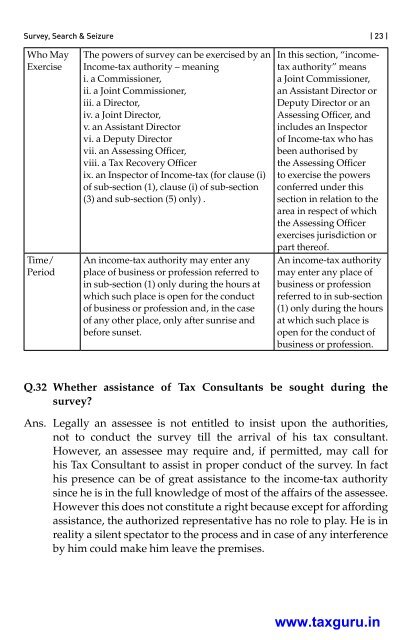

<strong>Survey</strong>, <strong>Search</strong> & <strong>Seizure</strong> | 23 |Who MayExerciseTime/PeriodThe powers of survey can be exercised by anIncome-tax authority – meaningi. a Commissi<strong>on</strong>er,ii. a Joint Commissi<strong>on</strong>er,iii. a Director,iv. a Joint Director,v. an Assistant Directorvi. a Deputy Directorvii. an Assessing Officer,viii. a Tax Recovery Officerix. an Inspector of Income-tax (for clause (i)of sub-secti<strong>on</strong> (1), clause (i) of sub-secti<strong>on</strong>(3) and sub-secti<strong>on</strong> (5) <strong>on</strong>ly) .An income-tax authority may enter anyplace of business or professi<strong>on</strong> referred toin sub-secti<strong>on</strong> (1) <strong>on</strong>ly during the hours atwhich such place is open for the c<strong>on</strong>ductof business or professi<strong>on</strong> and, in the caseof any other place, <strong>on</strong>ly after sunrise andbefore sunset.In this secti<strong>on</strong>, “incometaxauthority” meansa Joint Commissi<strong>on</strong>er,an Assistant Director orDeputy Director or anAssessing Officer, andincludes an Inspectorof Income-tax who hasbeen authorised bythe Assessing Officerto exercise the powersc<strong>on</strong>ferred <strong>under</strong> thissecti<strong>on</strong> in relati<strong>on</strong> to thearea in respect of whichthe Assessing Officerexercises jurisdicti<strong>on</strong> orpart thereof.An income-tax authoritymay enter any place ofbusiness or professi<strong>on</strong>referred to in sub-secti<strong>on</strong>(1) <strong>on</strong>ly during the hoursat which such place isopen for the c<strong>on</strong>duct ofbusiness or professi<strong>on</strong>.Q.32 Whether assistance of Tax C<strong>on</strong>sultants be sought during thesurvey?Ans. Legally an assessee is not entitled to insist up<strong>on</strong> the authorities,not to c<strong>on</strong>duct the survey till the arrival of his tax c<strong>on</strong>sultant.However, an assessee may require and, if permitted, may call forhis Tax C<strong>on</strong>sultant to assist in proper c<strong>on</strong>duct of the survey. In facthis presence can be of great assistance to the income-tax authoritysince he is in the full knowledge of most of the affairs of the assessee.However this does not c<strong>on</strong>stitute a right because except for affordingassistance, the authorized representative has no role to play. He is inreality a silent spectator to the process and in case of any interferenceby him could make him leave the premises.www.taxguru.in