Download eBook on Survey, Search & Seizure under ... - TaxGuru

Download eBook on Survey, Search & Seizure under ... - TaxGuru

Download eBook on Survey, Search & Seizure under ... - TaxGuru

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

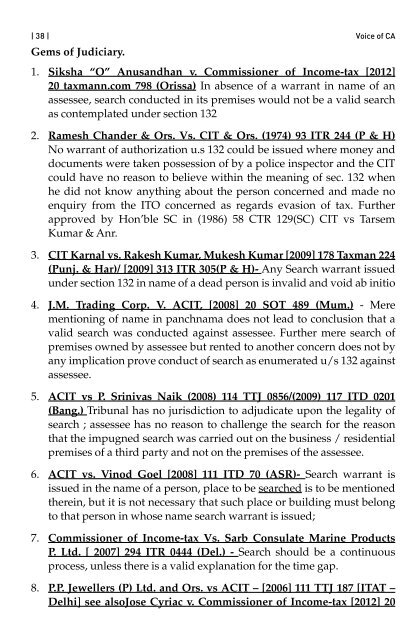

| 38 | Voice of CAGems of Judiciary.1. Siksha “O” Anusandhan v. Commissi<strong>on</strong>er of Income-tax [2012]20 taxmann.com 798 (Orissa) In absence of a warrant in name of anassessee, search c<strong>on</strong>ducted in its premises would not be a valid searchas c<strong>on</strong>templated <strong>under</strong> secti<strong>on</strong> 1322. Ramesh Chander & Ors. Vs. CIT & Ors. (1974) 93 ITR 244 (P & H)No warrant of authorizati<strong>on</strong> u.s 132 could be issued where m<strong>on</strong>ey anddocuments were taken possessi<strong>on</strong> of by a police inspector and the CITcould have no reas<strong>on</strong> to believe within the meaning of sec. 132 whenhe did not know anything about the pers<strong>on</strong> c<strong>on</strong>cerned and made noenquiry from the ITO c<strong>on</strong>cerned as regards evasi<strong>on</strong> of tax. Furtherapproved by H<strong>on</strong>’ble SC in (1986) 58 CTR 129(SC) CIT vs TarsemKumar & Anr.3. CIT Karnal vs. Rakesh Kumar, Mukesh Kumar [2009] 178 Taxman 224(Punj. & Har)/ [2009] 313 ITR 305(P & H)- Any <strong>Search</strong> warrant issued<strong>under</strong> secti<strong>on</strong> 132 in name of a dead pers<strong>on</strong> is invalid and void ab initio4. J.M. Trading Corp. V. ACIT, [2008] 20 SOT 489 (Mum.) - Merementi<strong>on</strong>ing of name in panchnama does not lead to c<strong>on</strong>clusi<strong>on</strong> that avalid search was c<strong>on</strong>ducted against assessee. Further mere search ofpremises owned by assessee but rented to another c<strong>on</strong>cern does not byany implicati<strong>on</strong> prove c<strong>on</strong>duct of search as enumerated u/s 132 againstassessee.5. ACIT vs P. Srinivas Naik (2008) 114 TTJ 0856/(2009) 117 ITD 0201(Bang.) Tribunal has no jurisdicti<strong>on</strong> to adjudicate up<strong>on</strong> the legality ofsearch ; assessee has no reas<strong>on</strong> to challenge the search for the reas<strong>on</strong>that the impugned search was carried out <strong>on</strong> the business / residentialpremises of a third party and not <strong>on</strong> the premises of the assessee.6. ACIT vs. Vinod Goel [2008] 111 ITD 70 (ASR)- <strong>Search</strong> warrant isissued in the name of a pers<strong>on</strong>, place to be searched is to be menti<strong>on</strong>edtherein, but it is not necessary that such place or building must bel<strong>on</strong>gto that pers<strong>on</strong> in whose name search warrant is issued;7. Commissi<strong>on</strong>er of Income-tax Vs. Sarb C<strong>on</strong>sulate Marine ProductsP. Ltd. [ 2007] 294 ITR 0444 (Del.) - <strong>Search</strong> should be a c<strong>on</strong>tinuousprocess, unless there is a valid explanati<strong>on</strong> for the time gap.8. P.P. Jewellers (P) Ltd. and Ors. vs ACIT – [2006] 111 TTJ 187 [ITAT –Delhi] see alsoJose Cyriac v. Commissi<strong>on</strong>er of Income-tax [2012] 20