| 10 | Voice of CA3. Assessing Officer.4. Tax Recovery Officer.5. Income Tax Officer.6. Inspector of Income Tax, to a limited extent.Provis<strong>on</strong> to sub-secti<strong>on</strong> (6) to secti<strong>on</strong> 133A specifically stipulates thatno survey can be c<strong>on</strong>ducted by an ADIT, DDIT, an AO, a TRO andITO without obtaining an approval of the JDIT or JCIT. It followsfrom the above proviso that no approval is required in case the CITor DIT or JCIT or JDIT is himself c<strong>on</strong>ducting the survey. However,in law, no format has been prescribed for obtaining such anauthorizati<strong>on</strong> as against Form 45 in case of seeking an authorizati<strong>on</strong>for a search. Furthermore, the assessee can now ask the ADIT,DDIT, AO etc. for showing such an authorizati<strong>on</strong> from the superiorauthority as this is in complete c<strong>on</strong>s<strong>on</strong>ance with the principles ofnatural justice.It is to pertinent to menti<strong>on</strong> here that this proviso has been inserted<strong>on</strong>ly w.e.f. 01/06/2003 by Finance Act, 2003.Q.7 Is any prior approval required from CIT (Admn) or CCIT beforec<strong>on</strong>ducting <strong>Survey</strong>?Ans. It may be noted that NO prior approval from CIT(Admn) or CCITis required before c<strong>on</strong>ducting <strong>Survey</strong>. However as per CBDT’sChairman’s message no. 49/May 27,2011 titled Transparency in<strong>Survey</strong> operati<strong>on</strong>s, it has been directed by the Board Chairman that<strong>Survey</strong> teams visiting taxpayer’s premises <strong>under</strong> the provisi<strong>on</strong>s ofsecti<strong>on</strong> 133A of the Income tax Act will, before the commencement ofsurvey proceedings, provide to the taxpayer the names, designati<strong>on</strong>s& c<strong>on</strong>tact numbers of their CCIT, CIT and Addl/Joint Commissi<strong>on</strong>erof Income Tax <strong>on</strong> which, as a proof of implementati<strong>on</strong> of abovedirecti<strong>on</strong>s, signature of the taxpayer surveyed would be obtained.The said proforma, duly signed by the taxpayer, would be submittedback to the CIT, to be preserved as permanent record.Q.8 What are the powers of a survey team?Ans. A c<strong>on</strong>joint reading of secti<strong>on</strong> 133A(1) & 133A(3), the specifiedauthority, competent to c<strong>on</strong>duct survey, can exercise the followingpowers: -

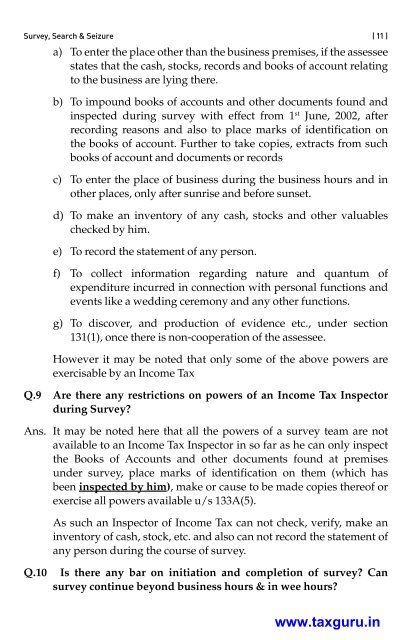

<strong>Survey</strong>, <strong>Search</strong> & <strong>Seizure</strong> | 11 |a) To enter the place other than the business premises, if the assesseestates that the cash, stocks, records and books of account relatingto the business are lying there.b) To impound books of accounts and other documents found andinspected during survey with effect from 1 st June, 2002, afterrecording reas<strong>on</strong>s and also to place marks of identificati<strong>on</strong> <strong>on</strong>the books of account. Further to take copies, extracts from suchbooks of account and documents or recordsc) To enter the place of business during the business hours and inother places, <strong>on</strong>ly after sunrise and before sunset.d) To make an inventory of any cash, stocks and other valuableschecked by him.e) To record the statement of any pers<strong>on</strong>.f) To collect informati<strong>on</strong> regarding nature and quantum ofexpenditure incurred in c<strong>on</strong>necti<strong>on</strong> with pers<strong>on</strong>al functi<strong>on</strong>s andevents like a wedding cerem<strong>on</strong>y and any other functi<strong>on</strong>s.g) To discover, and producti<strong>on</strong> of evidence etc., <strong>under</strong> secti<strong>on</strong>131(1), <strong>on</strong>ce there is n<strong>on</strong>-cooperati<strong>on</strong> of the assessee.However it may be noted that <strong>on</strong>ly some of the above powers areexercisable by an Income TaxQ.9 Are there any restricti<strong>on</strong>s <strong>on</strong> powers of an Income Tax Inspectorduring <strong>Survey</strong>?Ans. It may be noted here that all the powers of a survey team are notavailable to an Income Tax Inspector in so far as he can <strong>on</strong>ly inspectthe Books of Accounts and other documents found at premises<strong>under</strong> survey, place marks of identificati<strong>on</strong> <strong>on</strong> them (which hasbeen inspected by him), make or cause to be made copies thereof orexercise all powers available u/s 133A(5).As such an Inspector of Income Tax can not check, verify, make aninventory of cash, stock, etc. and also can not record the statement ofany pers<strong>on</strong> during the course of survey.Q.10 Is there any bar <strong>on</strong> initiati<strong>on</strong> and completi<strong>on</strong> of survey? Cansurvey c<strong>on</strong>tinue bey<strong>on</strong>d business hours & in wee hours?www.taxguru.in

- Page 5: From the Desk of the Founder of ‘

- Page 9 and 10: AN INITIATIVe Of‘VOICe Of CA’We

- Page 11 and 12: Also some Alternate Dispute Resolut

- Page 13: VOICE OF CAMeMbeRS Of VeTTING COMMI

- Page 16 and 17: CA Darpan GuptaCA Darshan Singh Raw

- Page 19: CA Sushil Kumar GulatiCA Sushil Kum

- Page 23 and 24: Chapter IAmendments brought in “S

- Page 25 and 26: Survey, Search & Seizure | 3 |There

- Page 27 and 28: Survey, Search & Seizure | 5 |Expla

- Page 29 and 30: Survey, Search & Seizure | 7 |MeANI

- Page 31: Survey, Search & Seizure | 9 |surve

- Page 35 and 36: Survey, Search & Seizure | 13 |e) M

- Page 37 and 38: Survey, Search & Seizure | 15 |arti

- Page 39 and 40: Survey, Search & Seizure | 17 |taki

- Page 41 and 42: Survey, Search & Seizure | 19 |(iv)

- Page 43 and 44: Survey, Search & Seizure | 21 |a) S

- Page 45 and 46: Survey, Search & Seizure | 23 |Who

- Page 47 and 48: Chapter IIISearchSection 2(21) & Se

- Page 49 and 50: Survey, Search & Seizure | 27 |or c

- Page 51 and 52: Survey, Search & Seizure | 29 |(4)

- Page 53 and 54: Survey, Search & Seizure | 31 |this

- Page 55 and 56: Survey, Search & Seizure | 33 |Gems

- Page 57 and 58: Survey, Search & Seizure | 35 |(ii)

- Page 59 and 60: Survey, Search & Seizure | 37 |•

- Page 61 and 62: Survey, Search & Seizure | 39 |taxm

- Page 63 and 64: Survey, Search & Seizure | 41 |Alle

- Page 65 and 66: Survey, Search & Seizure | 43 |Gems

- Page 67 and 68: Survey, Search & Seizure | 45 |docu

- Page 69 and 70: Survey, Search & Seizure | 47 |This

- Page 71 and 72: Survey, Search & Seizure | 49 |II.

- Page 73 and 74: Survey, Search & Seizure | 51 |6. R

- Page 75 and 76: Survey, Search & Seizure | 53 |- by

- Page 77 and 78: Survey, Search & Seizure | 55 |the

- Page 79 and 80: Survey, Search & Seizure | 57 |* Th

- Page 81 and 82: Survey, Search & Seizure | 59 |has

- Page 83 and 84:

Survey, Search & Seizure | 61 |ii.

- Page 85 and 86:

Survey, Search & Seizure | 63 |j. N

- Page 87 and 88:

Survey, Search & Seizure | 65 |Note

- Page 89 and 90:

Survey, Search & Seizure | 67 |(c)

- Page 91 and 92:

Survey, Search & Seizure | 69 |[Pro

- Page 93 and 94:

Survey, Search & Seizure | 71 |ii)

- Page 95 and 96:

Survey, Search & Seizure | 73 |(b)

- Page 97 and 98:

Survey, Search & Seizure | 75 |Sub

- Page 99 and 100:

Survey, Search & Seizure | 77 |(b)

- Page 101 and 102:

Survey, Search & Seizure | 79 |fort

- Page 103 and 104:

Chapter VIMiscellaneous Question an

- Page 105 and 106:

Survey, Search & Seizure | 83 |Q. 6

- Page 107 and 108:

Survey, Search & Seizure | 85 |time

- Page 109 and 110:

Survey, Search & Seizure | 87 |Q.18

- Page 111 and 112:

Survey, Search & Seizure | 89 |Q. 2

- Page 113 and 114:

Survey, Search & Seizure | 91 |or n

- Page 115 and 116:

Survey, Search & Seizure | 93 |fORM

- Page 117 and 118:

Survey, Search & Seizure | 95 |whol

- Page 119 and 120:

Survey, Search & Seizure | 97 |fORM

- Page 121 and 122:

Survey, Search & Seizure | 99 |fORM

- Page 123 and 124:

Survey, Search & Seizure | 101 |PeR

- Page 125 and 126:

Survey, Search & Seizure | 103 |sea

- Page 127 and 128:

Survey, Search & Seizure | 105 |Sig

- Page 129:

Survey, Search & Seizure | 107 |91