Download eBook on Survey, Search & Seizure under ... - TaxGuru

Download eBook on Survey, Search & Seizure under ... - TaxGuru

Download eBook on Survey, Search & Seizure under ... - TaxGuru

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

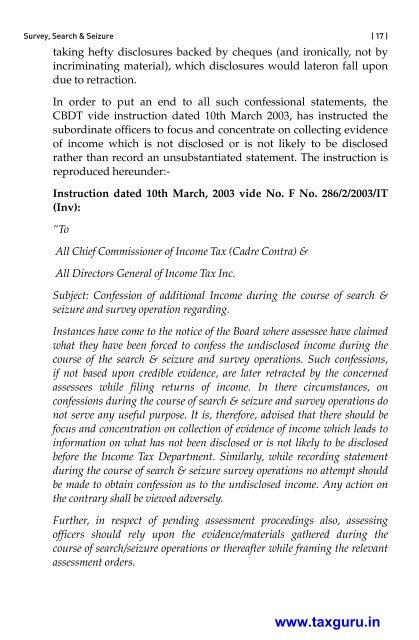

<strong>Survey</strong>, <strong>Search</strong> & <strong>Seizure</strong> | 17 |taking hefty disclosures backed by cheques (and ir<strong>on</strong>ically, not byincriminating material), which disclosures would later<strong>on</strong> fall up<strong>on</strong>due to retracti<strong>on</strong>.In order to put an end to all such c<strong>on</strong>fessi<strong>on</strong>al statements, theCBDT vide instructi<strong>on</strong> dated 10th March 2003, has instructed thesubordinate officers to focus and c<strong>on</strong>centrate <strong>on</strong> collecting evidenceof income which is not disclosed or is not likely to be disclosedrather than record an unsubstantiated statement. The instructi<strong>on</strong> isreproduced here<strong>under</strong>:-Instructi<strong>on</strong> dated 10th March, 2003 vide No. f No. 286/2/2003/IT(Inv):“ToAll Chief Commissi<strong>on</strong>er of Income Tax (Cadre C<strong>on</strong>tra) &All Directors General of Income Tax Inc.Subject: C<strong>on</strong>fessi<strong>on</strong> of additi<strong>on</strong>al Income during the course of search &seizure and survey operati<strong>on</strong> regarding.Instances have come to the notice of the Board where assessee have claimedwhat they have been forced to c<strong>on</strong>fess the undisclosed income during thecourse of the search & seizure and survey operati<strong>on</strong>s. Such c<strong>on</strong>fessi<strong>on</strong>s,if not based up<strong>on</strong> credible evidence, are later retracted by the c<strong>on</strong>cernedassessees while filing returns of income. In there circumstances, <strong>on</strong>c<strong>on</strong>fessi<strong>on</strong>s during the course of search & seizure and survey operati<strong>on</strong>s d<strong>on</strong>ot serve any useful purpose. It is, therefore, advised that there should befocus and c<strong>on</strong>centrati<strong>on</strong> <strong>on</strong> collecti<strong>on</strong> of evidence of income which leads toinformati<strong>on</strong> <strong>on</strong> what has not been disclosed or is not likely to be disclosedbefore the Income Tax Department. Similarly, while recording statementduring the course of search & seizure survey operati<strong>on</strong>s no attempt shouldbe made to obtain c<strong>on</strong>fessi<strong>on</strong> as to the undisclosed income. Any acti<strong>on</strong> <strong>on</strong>the c<strong>on</strong>trary shall be viewed adversely.Further, in respect of pending assessment proceedings also, assessingofficers should rely up<strong>on</strong> the evidence/materials gathered during thecourse of search/seizure operati<strong>on</strong>s or thereafter while framing the relevantassessment orders.www.taxguru.in