Download eBook on Survey, Search & Seizure under ... - TaxGuru

Download eBook on Survey, Search & Seizure under ... - TaxGuru

Download eBook on Survey, Search & Seizure under ... - TaxGuru

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

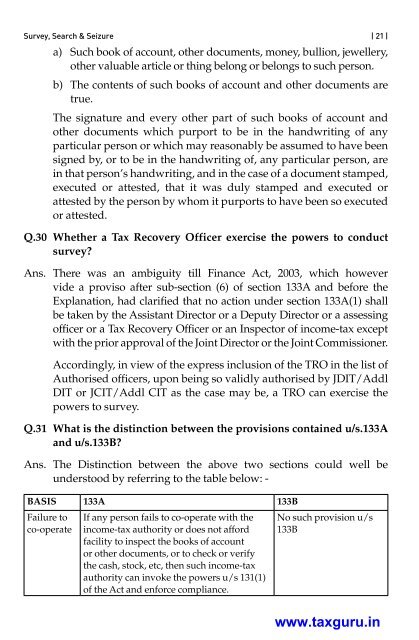

<strong>Survey</strong>, <strong>Search</strong> & <strong>Seizure</strong> | 21 |a) Such book of account, other documents, m<strong>on</strong>ey, bulli<strong>on</strong>, jewellery,other valuable article or thing bel<strong>on</strong>g or bel<strong>on</strong>gs to such pers<strong>on</strong>.b) The c<strong>on</strong>tents of such books of account and other documents aretrue.The signature and every other part of such books of account andother documents which purport to be in the handwriting of anyparticular pers<strong>on</strong> or which may reas<strong>on</strong>ably be assumed to have beensigned by, or to be in the handwriting of, any particular pers<strong>on</strong>, arein that pers<strong>on</strong>’s handwriting, and in the case of a document stamped,executed or attested, that it was duly stamped and executed orattested by the pers<strong>on</strong> by whom it purports to have been so executedor attested.Q.30 Whether a Tax Recovery Officer exercise the powers to c<strong>on</strong>ductsurvey?Ans. There was an ambiguity till Finance Act, 2003, which howevervide a proviso after sub-secti<strong>on</strong> (6) of secti<strong>on</strong> 133A and before theExplanati<strong>on</strong>, had clarified that no acti<strong>on</strong> <strong>under</strong> secti<strong>on</strong> 133A(1) shallbe taken by the Assistant Director or a Deputy Director or a assessingofficer or a Tax Recovery Officer or an Inspector of income-tax exceptwith the prior approval of the Joint Director or the Joint Commissi<strong>on</strong>er.Accordingly, in view of the express inclusi<strong>on</strong> of the TRO in the list ofAuthorised officers, up<strong>on</strong> being so validly authorised by JDIT/AddlDIT or JCIT/Addl CIT as the case may be, a TRO can exercise thepowers to survey.Q.31 What is the distincti<strong>on</strong> between the provisi<strong>on</strong>s c<strong>on</strong>tained u/s.133Aand u/s.133b?Ans. The Distincti<strong>on</strong> between the above two secti<strong>on</strong>s could well be<strong>under</strong>stood by referring to the table below: -BASIS 133A 133BFailure toco-operateIf any pers<strong>on</strong> fails to co-operate with theincome-tax authority or does not affordfacility to inspect the books of accountor other documents, or to check or verifythe cash, stock, etc, then such income-taxauthority can invoke the powers u/s 131(1)of the Act and enforce compliance.No such provisi<strong>on</strong> u/s133Bwww.taxguru.in