Download - FEAS

Download - FEAS

Download - FEAS

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

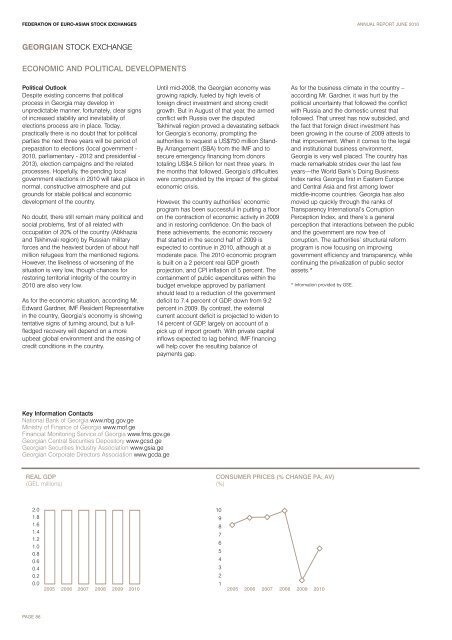

FEDERATION OF EURO-ASIAN STOCK EXCHANGES ANNUAL REPORT JUNE 2010GEORGIAN STOCK EXCHANGEECONOMIC AND POLITICAL DEVELOPMENTSPolitical OutlookDespite existing concerns that politicalprocess in Georgia may develop inunpredictable manner, fortunately, clear signsof increased stability and inevitability ofelections process are in place. Today,practically there is no doubt that for politicalparties the next three years will be period ofpreparation to elections (local government -2010, parliamentary - 2012 and presidential -2013), election campaigns and the relatedprocesses. Hopefully, the pending localgovernment elections in 2010 will take place innormal, constructive atmosphere and putgrounds for stable political and economicdevelopment of the country.No doubt, there still remain many political andsocial problems, first of all related withoccupation of 20% of the country (Abkhaziaand Tskhinvali region) by Russian militaryforces and the heaviest burden of about halfmillion refugees from the mentioned regions.However, the likeliness of worsening of thesituation is very low, though chances forrestoring territorial integrity of the country in2010 are also very low.As for the economic situation, according Mr.Edward Gardner, IMF Resident Representativein the country, Georgia’s economy is showingtentative signs of turning around, but a fullfledgedrecovery will depend on a moreupbeat global environment and the easing ofcredit conditions in the country.Until mid-2008, the Georgian economy wasgrowing rapidly, fueled by high levels offoreign direct investment and strong creditgrowth. But in August of that year, the armedconflict with Russia over the disputedTskhinvali region proved a devastating setbackfor Georgia’s economy, prompting theauthorities to request a US$750 million Stand-By Arrangement (SBA) from the IMF and tosecure emergency financing from donorstotaling US$4.5 billion for next three years. Inthe months that followed, Georgia’s difficultieswere compounded by the impact of the globaleconomic crisis.However, the country authorities’ economicprogram has been successful in putting a flooron the contraction of economic activity in 2009and in restoring confidence. On the back ofthese achievements, the economic recoverythat started in the second half of 2009 isexpected to continue in 2010, although at amoderate pace. The 2010 economic programis built on a 2 percent real GDP growthprojection, and CPI inflation of 5 percent. Thecontainment of public expenditures within thebudget envelope approved by parliamentshould lead to a reduction of the governmentdeficit to 7.4 percent of GDP, down from 9.2percent in 2009. By contrast, the externalcurrent account deficit is projected to widen to14 percent of GDP, largely on account of apick up of import growth. With private capitalinflows expected to lag behind, IMF financingwill help cover the resulting balance ofpayments gap.As for the business climate in the country –according Mr. Gardner, it was hurt by thepolitical uncertainty that followed the conflictwith Russia and the domestic unrest thatfollowed. That unrest has now subsided, andthe fact that foreign direct investment hasbeen growing in the course of 2009 attests tothat improvement. When it comes to the legaland institutional business environment,Georgia is very well placed. The country hasmade remarkable strides over the last fewyears—the World Bank’s Doing BusinessIndex ranks Georgia first in Eastern Europeand Central Asia and first among lowermiddle-income countries. Georgia has alsomoved up quickly through the ranks ofTransparency International’s CorruptionPerception Index, and there’s a generalperception that interactions between the publicand the government are now free ofcorruption. The authorities’ structural reformprogram is now focusing on improvinggovernment efficiency and transparency, whilecontinuing the privatization of public sectorassets.** Information provided by GSE.Key Information ContactsNational Bank of Georgia www.nbg.gov.geMinistry of Finance of Georgia www.mof.geFinancial Monitoring Service of Georgia www.fms.gov.geGeorgian Central Securities Depository www.gcsd.geGeorgian Securities Industry Association www.gsia.geGeorgian Corporate Directors Association www.gcda.geREAL GDP(GEL millions)CONSUMER PRICES (% CHANGE PA; AV)(%)2.01.81.61.41.21.00.80.60.40.20.0109876543212005 2006 2007 2008 2009 2010 2005 2006 2007 2008 2009 2010PAGE 86