ICT and e-Business Impact in the Retail Industry - empirica

ICT and e-Business Impact in the Retail Industry - empirica

ICT and e-Business Impact in the Retail Industry - empirica

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

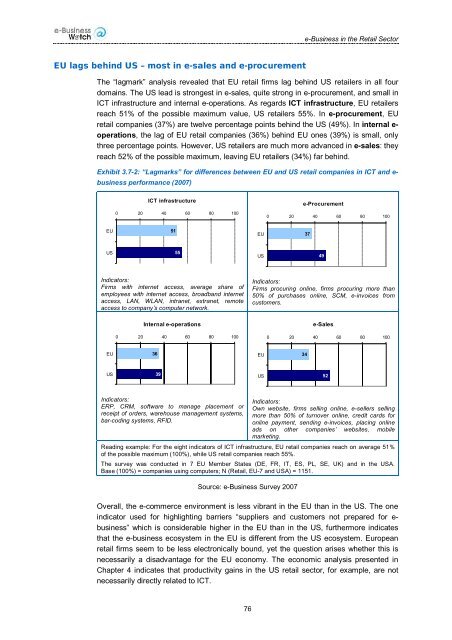

e-<strong>Bus<strong>in</strong>ess</strong> <strong>in</strong> <strong>the</strong> <strong>Retail</strong> SectorEU lags beh<strong>in</strong>d US – most <strong>in</strong> e-sales <strong>and</strong> e-procurementThe “lagmark” analysis revealed that EU retail firms lag beh<strong>in</strong>d US retailers <strong>in</strong> all fourdoma<strong>in</strong>s. The US lead is strongest <strong>in</strong> e-sales, quite strong <strong>in</strong> e-procurement, <strong>and</strong> small <strong>in</strong><strong>ICT</strong> <strong>in</strong>frastructure <strong>and</strong> <strong>in</strong>ternal e-operations. As regards <strong>ICT</strong> <strong>in</strong>frastructure, EU retailersreach 51% of <strong>the</strong> possible maximum value, US retailers 55%. In e-procurement, EUretail companies (37%) are twelve percentage po<strong>in</strong>ts beh<strong>in</strong>d <strong>the</strong> US (49%). In <strong>in</strong>ternal e-operations, <strong>the</strong> lag of EU retail companies (36%) beh<strong>in</strong>d EU ones (39%) is small, onlythree percentage po<strong>in</strong>ts. However, US retailers are much more advanced <strong>in</strong> e-sales: <strong>the</strong>yreach 52% of <strong>the</strong> possible maximum, leav<strong>in</strong>g EU retailers (34%) far beh<strong>in</strong>d.Exhibit 3.7-2: “Lagmarks” for differences between EU <strong>and</strong> US retail companies <strong>in</strong> <strong>ICT</strong> <strong>and</strong> e-bus<strong>in</strong>ess performance (2007)<strong>ICT</strong> <strong>in</strong>frastructuree-Procurement0 20 40 60 80 1000 20 40 60 80 100EU51EU37US55US49Indicators:Firms with <strong>in</strong>ternet access, average share ofemployees with <strong>in</strong>ternet access, broadb<strong>and</strong> <strong>in</strong>ternetaccess, LAN, WLAN, <strong>in</strong>tranet, extranet, remoteaccess to company’s computer network.Indicators:Firms procur<strong>in</strong>g onl<strong>in</strong>e, firms procur<strong>in</strong>g more than50% of purchases onl<strong>in</strong>e, SCM, e-<strong>in</strong>voices fromcustomers.Internal e-operations0 20 40 60 80 100e-Sales0 20 40 60 80 100EU36EU34US39US52Indicators:ERP, CRM, software to manage placement orreceipt of orders, warehouse management systems,bar-cod<strong>in</strong>g systems, RFID.Indicators:Own website, firms sell<strong>in</strong>g onl<strong>in</strong>e, e-sellers sell<strong>in</strong>gmore than 50% of turnover onl<strong>in</strong>e, credit cards foronl<strong>in</strong>e payment, send<strong>in</strong>g e-<strong>in</strong>voices, plac<strong>in</strong>g onl<strong>in</strong>eads on o<strong>the</strong>r companies’ websites, mobilemarket<strong>in</strong>g.Read<strong>in</strong>g example: For <strong>the</strong> eight <strong>in</strong>dicators of <strong>ICT</strong> <strong>in</strong>frastructure, EU retail companies reach on average 51%of <strong>the</strong> possible maximum (100%), while US retail companies reach 55%.The survey was conducted <strong>in</strong> 7 EU Member States (DE, FR, IT, ES, PL, SE, UK) <strong>and</strong> <strong>in</strong> <strong>the</strong> USA.Base (100%) = companies us<strong>in</strong>g computers; N (<strong>Retail</strong>, EU-7 <strong>and</strong> USA) = 1151.Source: e-<strong>Bus<strong>in</strong>ess</strong> Survey 2007Overall, <strong>the</strong> e-commerce environment is less vibrant <strong>in</strong> <strong>the</strong> EU than <strong>in</strong> <strong>the</strong> US. The one<strong>in</strong>dicator used for highlight<strong>in</strong>g barriers “suppliers <strong>and</strong> customers not prepared for e-bus<strong>in</strong>ess” which is considerable higher <strong>in</strong> <strong>the</strong> EU than <strong>in</strong> <strong>the</strong> US, fur<strong>the</strong>rmore <strong>in</strong>dicatesthat <strong>the</strong> e-bus<strong>in</strong>ess ecosystem <strong>in</strong> <strong>the</strong> EU is different from <strong>the</strong> US ecosystem. Europeanretail firms seem to be less electronically bound, yet <strong>the</strong> question arises whe<strong>the</strong>r this isnecessarily a disadvantage for <strong>the</strong> EU economy. The economic analysis presented <strong>in</strong>Chapter 4 <strong>in</strong>dicates that productivity ga<strong>in</strong>s <strong>in</strong> <strong>the</strong> US retail sector, for example, are notnecessarily directly related to <strong>ICT</strong>.76