REGISTRATION DOCUMENT - Bourbon

REGISTRATION DOCUMENT - Bourbon

REGISTRATION DOCUMENT - Bourbon

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

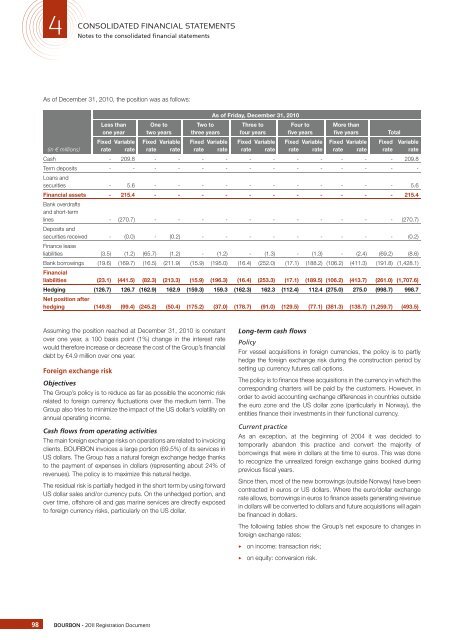

4NotesCONSOLIDATED FINANCIAL STATEMENTSto the consolidated financial statementsAs of December 31, 2010, the position was as follows:Less thanone yearOne totwo yearsTwo tothree yearsAs of Friday, December 31, 2010Three tofour yearsFour tofive yearsMore thanfive yearsFixed Variable Fixed Variable Fixed Variable Fixed Variable Fixed Variable Fixed Variable Fixed Variable(in € millions) rate rate rate rate rate rate rate rate rate rate rate rate rate rateCash - 209.8 - - - - - - - - - - - 209.8Term deposits - - - - - - - - - - - - - -Loans andsecurities - 5.6 - - - - - - - - - - - 5.6Financial assets - 215.4 - - - - - - - - - - - 215.4Bank overdraftsand short-termlines - (270.7) - - - - - - - - - - - (270.7)Deposits andsecurities received - (0.0) - (0.2) - - - - - - - - - (0.2)Finance leaseliabilities (3.5) (1.2) (65.7) (1.2) - (1.2) - (1.3) - (1.3) - (2.4) (69.2) (8.6)Bank borrowings (19.6) (169.7) (16.5) (211.9) (15.9) (195.0) (16.4) (252.0) (17.1) (188.2) (106.2) (411.3) (191.8) (1,428.1)Financialliabilities (23.1) (441.5) (82.3) (213.3) (15.9) (196.3) (16.4) (253.3) (17.1) (189.5) (106.2) (413.7) (261.0) (1,707.6)Hedging (126.7) 126.7 (162.9) 162.9 (159.3) 159.3 (162.3) 162.3 (112.4) 112.4 (275.0) 275.0 (998.7) 998.7Net position afterhedging (149.8) (99.4) (245.2) (50.4) (175.2) (37.0) (178.7) (91.0) (129.5) (77.1) (381.3) (138.7) (1,259.7) (493.5)TotalAssuming the position reached at December 31, 2010 is constantover one year, a 100 basis point (1%) change in the interest ratewould therefore increase or decrease the cost of the Group’s fi nancialdebt by €4.9 million over one year.Foreign exchange riskObjectivesThe Group’s policy is to reduce as far as possible the economic riskrelated to foreign currency fl uctuations over the medium term. TheGroup also tries to minimize the impact of the US dollar’s volatility onannual operating income.Cash flows from operating activitiesThe main foreign exchange risks on operations are related to invoicingclients. BOURBON invoices a large portion (69.5%) of its services inUS dollars. The Group has a natural foreign exchange hedge thanksto the payment of expenses in dollars (representing about 24% ofrevenues). The policy is to maximize this natural hedge.The residual risk is partially hedged in the short term by using forwardUS dollar sales and/or currency puts. On the unhedged portion, andover time, offshore oil and gas marine services are directly exposedto foreign currency risks, particularly on the US dollar.Long-term cash flowsPolicyFor vessel acquisitions in foreign currencies, the policy is to partlyhedge the foreign exchange risk during the construction period bysetting up currency futures call options.The policy is to fi nance these acquisitions in the currency in which thecorresponding charters will be paid by the customers. However, inorder to avoid accounting exchange differences in countries outsidethe euro zone and the US dollar zone (particularly in Norway), theentities fi nance their investments in their functional currency.Current practiceAs an exception, at the beginning of 2004 it was decided totemporarily abandon this practice and convert the majority ofborrowings that were in dollars at the time to euros. This was doneto recognize the unrealized foreign exchange gains booked duringprevious fi scal years.Since then, most of the new borrowings (outside Norway) have beencontracted in euros or US dollars. Where the euro/dollar exchangerate allows, borrowings in euros to fi nance assets generating revenuein dollars will be converted to dollars and future acquisitions will againbe fi nanced in dollars.The following tables show the Group’s net exposure to changes inforeign exchange rates:3 on income: transaction risk;3 on equity: conversion risk.98BOURBON - 2011 Registration Document