REGISTRATION DOCUMENT - Bourbon

REGISTRATION DOCUMENT - Bourbon

REGISTRATION DOCUMENT - Bourbon

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

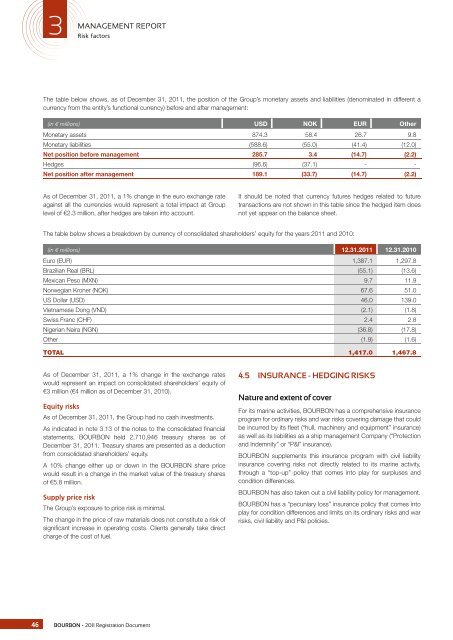

3RiskMANAGEMENT REPORTfactorsThe table below shows, as of December 31, 2011, the position of the Group’s monetary assets and liabilities (denominated in different acurrency from the entity’s functional currency) before and after management:(in € millions) USD NOK EUR OtherMonetary assets 874.3 58.4 26.7 9.8Monetary liabilities (588.6) (55.0) (41.4) (12.0)Net position before management 285.7 3.4 (14.7) (2.2)Hedges (96.6) (37.1) - -Net position after management 189.1 (33.7) (14.7) (2.2)As of December 31, 2011, a 1% change in the euro exchange rateagainst all the currencies would represent a total impact at Grouplevel of €2.3 million, after hedges are taken into account.It should be noted that currency futures hedges related to futuretransactions are not shown in this table since the hedged item doesnot yet appear on the balance sheet.The table below shows a breakdown by currency of consolidated shareholders’ equity for the years 2011 and 2010:(in € millions) 12.31.2011 12.31.2010Euro (EUR) 1,387.1 1,297.8Brazilian Real (BRL) (55.1) (13.6)Mexican Peso (MXN) 9.7 11.9Norwegian Kroner (NOK) 67.6 51.0US Dollar (USD) 46.0 139.0Vietnamese Dong (VND) (2.1) (1.8)Swiss Franc (CHF) 2.4 2.8Nigerian Naira (NGN) (36.8) (17.8)Other (1.9) (1.6)TOTAL 1,417.0 1,467.8As of December 31, 2011, a 1% change in the exchange rateswould represent an impact on consolidated shareholders’ equity of€3 million (€4 million as of December 31, 2010).Equity risksAs of December 31, 2011, the Group had no cash investments.As indicated in note 3.13 of the notes to the consolidated fi nancialstatements, BOURBON held 2,710,946 treasury shares as ofDecember 31, 2011. Treasury shares are presented as a deductionfrom consolidated shareholders’ equity.A 10% change either up or down in the BOURBON share pricewould result in a change in the market value of the treasury sharesof €5.8 million.Supply price riskThe Group’s exposure to price risk is minimal.The change in the price of raw materials does not constitute a risk ofsignifi cant increase in operating costs. Clients generally take directcharge of the cost of fuel.4.5 INSURANCE - HEDGING RISKSNature and extent of coverFor its marine activities, BOURBON has a comprehensive insuranceprogram for ordinary risks and war risks covering damage that couldbe incurred by its fl eet (“hull, machinery and equipment” insurance)as well as its liabilities as a ship management Company (“Protectionand Indemnity” or “P&I” insurance).BOURBON supplements this insurance program with civil liabilityinsurance covering risks not directly related to its marine activity,through a “top-up” policy that comes into play for surpluses andcondition differences.BOURBON has also taken out a civil liability policy for management.BOURBON has a “pecuniary loss” insurance policy that comes intoplay for condition differences and limits on its ordinary risks and warrisks, civil liability and P&I policies.46BOURBON - 2011 Registration Document