REGISTRATION DOCUMENT - Bourbon

REGISTRATION DOCUMENT - Bourbon

REGISTRATION DOCUMENT - Bourbon

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

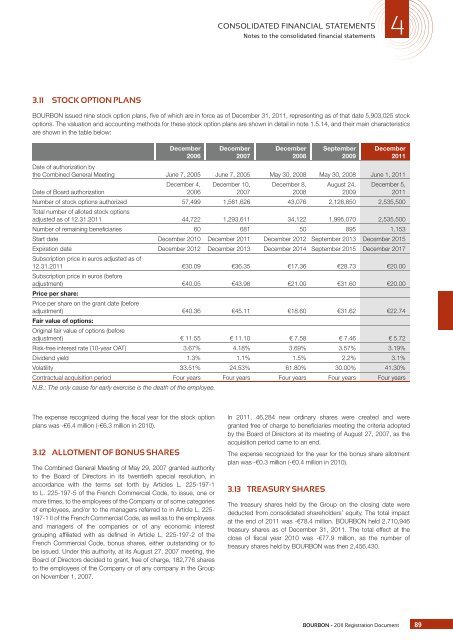

CONSOLIDATED FINANCIAL STATEMENTS4Notes to the consolidated financial statements3.11 STOCK OPTION PLANSBOURBON issued nine stock option plans, fi ve of which are in force as of December 31, 2011, representing as of that date 5,903,025 stockoptions. The valuation and accounting methods for these stock option plans are shown in detail in note 1.5.14, and their main characteristicsare shown in the table below:December2006December2007December2008September2009December2011Date of authorization bythe Combined General Meeting June 7, 2005 June 7, 2005 May 30, 2008 May 30, 2008 June 1, 2011Date of Board authorizationDecember 4,2006December 10,2007December 8,2008August 24,2009December 5,2011Number of stock options authorized 57,499 1,561,626 43,076 2,126,850 2,535,500Total number of alloted stock optionsadjusted as of 12.31.2011 44,722 1,293,611 34,122 1,995,070 2,535,500Number of remaining benefi ciaries 60 681 50 895 1,153Start date December 2010 December 2011 December 2012 September 2013 December 2015Expiration date December 2012 December 2013 December 2014 September 2015 December 2017Subscription price in euros adjusted as of12.31.2011 €30.09 €36.35 €17.36 €28.73 €20.00Subscription price in euros (beforeadjustment) €40.05 €43.98 €21.00 €31.60 €20.00Price per share:Price per share on the grant date (beforeadjustment) €40.36 €45.11 €18.60 €31.62 €22.74Fair value of options:Original fair value of options (beforeadjustment) € 11.55 € 11.10 € 7.58 € 7.46 € 5.72Risk-free interest rate (10-year OAT) 3.67% 4.18% 3.69% 3.57% 3.19%Dividend yield 1.3% 1.1% 1.5% 2.2% 3.1%Volatility 33.51% 24.53% 61.80% 30.00% 41.30%Contractual acquisition period Four years Four years Four years Four years Four yearsN.B.: The only cause for early exercise is the death of the employee.The expense recognized during the fi scal year for the stock optionplans was -€6.4 million (-€6.3 million in 2010).3.12 ALLOTMENT OF BONUS SHARESThe Combined General Meeting of May 29, 2007 granted authorityto the Board of Directors in its twentieth special resolution, inaccordance with the terms set forth by Articles L. 225-197-1to L. 225-197-5 of the French Commercial Code, to issue, one ormore times, to the employees of the Company or of some categoriesof employees, and/or to the managers referred to in Article L. 225-197-1 II of the French Commercial Code, as well as to the employeesand managers of the companies or of any economic interestgrouping affi liated with as defi ned in Article L. 225-197-2 of theFrench Commercial Code, bonus shares, either outstanding or tobe issued. Under this authority, at its August 27, 2007 meeting, theBoard of Directors decided to grant, free of charge, 182,776 sharesto the employees of the Company or of any company in the Groupon November 1, 2007.In 2011, 46,284 new ordinary shares were created and weregranted free of charge to benefi ciaries meeting the criteria adoptedby the Board of Directors at its meeting of August 27, 2007, as theacquisition period came to an end.The expense recognized for the year for the bonus share allotmentplan was -€0.3 million (-€0.4 million in 2010).3.13 TREASURY SHARESThe treasury shares held by the Group on the closing date werededucted from consolidated shareholders’ equity. The total impactat the end of 2011 was -€78.4 million. BOURBON held 2,710,946treasury shares as of December 31, 2011. The total effect at theclose of fi scal year 2010 was -€77.9 million, as the number oftreasury shares held by BOURBON was then 2,456,430.BOURBON - 2011 Registration Document 89