REGISTRATION DOCUMENT - Bourbon

REGISTRATION DOCUMENT - Bourbon

REGISTRATION DOCUMENT - Bourbon

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

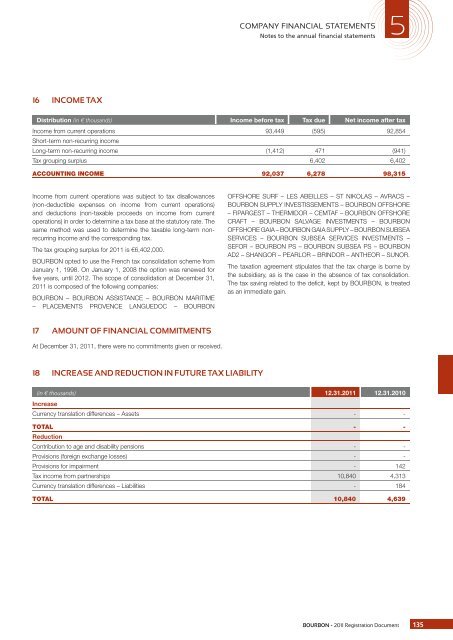

COMPANY FINANCIAL STATEMENTS5Notes to the annual financial statements16 INCOME TAXDistribution (in € thousands) Income before tax Tax due Net income after taxIncome from current operations 93,449 (595) 92,854Short-term non-recurring incomeLong-term non-recurring income (1,412) 471 (941)Tax grouping surplus 6,402 6,402ACCOUNTING INCOME 92,037 6,278 98,315Income from current operations was subject to tax disallowances(non-deductible expenses on income from current operations)and deductions (non-taxable proceeds on income from currentoperations) in order to determine a tax base at the statutory rate. Thesame method was used to determine the taxable long-term nonrecurringincome and the corresponding tax.The tax grouping surplus for 2011 is €6,402,000.BOURBON opted to use the French tax consolidation scheme fromJanuary 1, 1998. On January 1, 2008 the option was renewed forfi ve years, until 2012. The scope of consolidation at December 31,2011 is composed of the following companies:BOURBON – BOURBON ASSISTANCE – BOURBON MARITIME– PLACEMENTS PROVENCE LANGUEDOC – BOURBONOFFSHORE SURF – LES ABEILLES – ST NIKOLAS – AVRACS –BOURBON SUPPLY INVESTISSEMENTS – BOURBON OFFSHORE– FIPARGEST – THERMIDOR – CEMTAF – BOURBON OFFSHORECRAFT – BOURBON SALVAGE INVESTMENTS – BOURBONOFFSHORE GAIA – BOURBON GAIA SUPPLY – BOURBON SUBSEASERVICES – BOURBON SUBSEA SERVICES INVESTMENTS –SEFOR – BOURBON PS – BOURBON SUBSEA PS – BOURBONAD2 – SHANGOR – PEARLOR – BRINDOR – ANTHEOR – SUNOR.The taxation agreement stipulates that the tax charge is borne bythe subsidiary, as is the case in the absence of tax consolidation.The tax saving related to the defi cit, kept by BOURBON, is treatedas an immediate gain.17 AMOUNT OF FINANCIAL COMMITMENTSAt December 31, 2011, there were no commitments given or received.18 INCREASE AND REDUCTION IN FUTURE TAX LIABILITY(in € thousands) 12.31.2011 12.31.2010IncreaseCurrency translation differences – Assets - -TOTAL - -ReductionContribution to age and disability pensions - -Provisions (foreign exchange losses) - -Provisions for impairment - 142Tax income from partnerships 10,840 4,313Currency translation differences – Liabilities - 184TOTAL 10,840 4,639BOURBON - 2011 Registration Document 135