REGISTRATION DOCUMENT - Bourbon

REGISTRATION DOCUMENT - Bourbon

REGISTRATION DOCUMENT - Bourbon

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

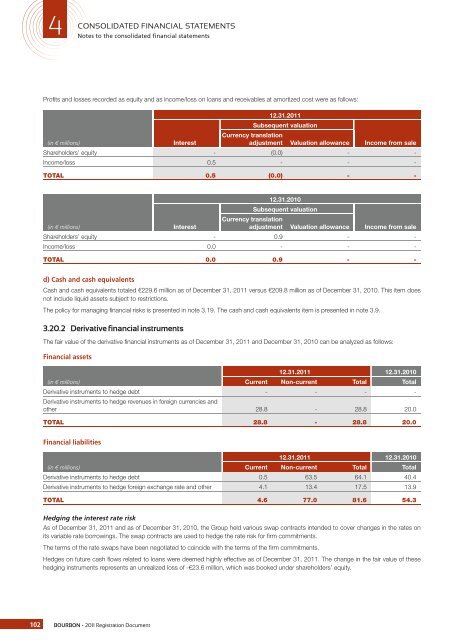

4NotesCONSOLIDATED FINANCIAL STATEMENTSto the consolidated financial statementsProfi ts and losses recorded as equity and as income/loss on loans and receivables at amortized cost were as follows:12.31.2011Subsequent valuationCurrency translation(in € millions)Interestadjustment Valuation allowance Income from saleShareholders’ equity - (0.0) - -Income/loss 0.5 - - -TOTAL 0.5 (0.0) - -12.31.2010Subsequent valuationCurrency translation(in € millions)Interestadjustment Valuation allowance Income from saleShareholders’ equity - 0.9 - -Income/loss 0.0 - - -TOTAL 0.0 0.9 - -d) Cash and cash equivalentsCash and cash equivalents totaled €229.6 million as of December 31, 2011 versus €209.8 million as of December 31, 2010. This item doesnot include liquid assets subject to restrictions.The policy for managing fi nancial risks is presented in note 3.19. The cash and cash equivalents item is presented in note 3.9.3.20.2 Derivative financial instrumentsThe fair value of the derivative fi nancial instruments as of December 31, 2011 and December 31, 2010 can be analyzed as follows:Financial assets12.31.2011 12.31.2010(in € millions)Current Non-current Total TotalDerivative instruments to hedge debt - - - -Derivative instruments to hedge revenues in foreign currencies andother 28.8 - 28.8 20.0TOTAL 28.8 - 28.8 20.0Financial liabilities12.31.2011 12.31.2010(in € millions)Current Non-current Total TotalDerivative instruments to hedge debt 0.5 63.5 64.1 40.4Derivative instruments to hedge foreign exchange rate and other 4.1 13.4 17.5 13.9TOTAL 4.6 77.0 81.6 54.3Hedging the interest rate riskAs of December 31, 2011 and as of December 31, 2010, the Group held various swap contracts intended to cover changes in the rates onits variable rate borrowings. The swap contracts are used to hedge the rate risk for fi rm commitments.The terms of the rate swaps have been negotiated to coincide with the terms of the fi rm commitments.Hedges on future cash fl ows related to loans were deemed highly effective as of December 31, 2011. The change in the fair value of thesehedging instruments represents an unrealized loss of -€23.6 million, which was booked under shareholders’ equity.102BOURBON - 2011 Registration Document