3BOURBONMANAGEMENT REPORTSA and its shareholders6.3 COMPANY TRANSACTIONS ON ITS OWN STOCK6.3.1 Stock buyback programPortion of the capital held by the Company and breakdown by objective for holding the Company’s treasury sharesAs of December 31, 2011, the Company held 2,710,946 treasury shares, representing 4.00% of the capital.Objective for holding treasury sharesNumber ofshares held atthe year-endValue atpurchase price(in € thousands)Par value(in € thousands)Stimulation of the market by an investment service provider 17,541 371 11Hedging stock options or other employee shareholding systems 2,693,405 75,772 1,711External expansion operations None - -Hedging securities giving access to share capital None - -Cancellation None - -TOTAL 2,710,946 76,143 1,722Transactions made by the Company on treasury sharesduring the year, by acquisition, disposal or transferAll the acquisitions and disposals in 2011 were made via CM CICSecurities, an investment service provider responsible for marketstimulation under the AMAFI charter, in the context of its managementof the liquidity contract.During the year, 1,714,111 shares were thus acquired at an averagepurchase price of €27.29 while 1,709,111 shares were sold at anaverage sale price of €27.09. These transactions did not incur anydealing costs. It is also noted that no derivative products were usedto conduct these transactions and that no put or call position wasopen as of December 31, 2011.Please note that no treasury shares were reallocated or used in 2011.Description of the share buyback program proposed tothe Combined General Meeting on June 1, 2012At the Combined General Meeting on June 1, 2012, BOURBON willpropose the renewal of the share buyback program with a view to:3 market-making or providing share liquidity through an investmentservice provider, operating wholly independently within the scopeof a liquidity contract under AMAFI rules of professional conductapproved by the French Financial Services Authority;3 holding them for later use as payment or exchange within thescope of acquisitions initiated by the Company;3 allotting shares to employees and authorized agents of theCompany or its Group to cover bonus share or stock optionallotment plans or as part of their benefi cial participation in theexpansion of the Company or within the scope of a shareholdingplan or an employee savings plan;3 handing over stock upon exercise of rights attached to securitieswhich, by way of conversion, exercise, repayment or exchange,entitle the exerciser to allotment of Company shares within thebounds of stock market regulations;3 canceling shares as part of a capital reduction as prescribed bylaw.Subject to the approval of the Ordinary General Meeting on June 1,2012, this program will be authorized for a period ending at the nextGeneral Meeting called to approve the fi nancial statements for theyear ending December 31, 2012, but not exceeding a period of18 months, i.e. November 30, 2013.The shares likely to be repurchased under this program are ordinaryshares.The maximum purchase price per share cannot exceed €50,excluding charges.The maximum percentage of BOURBON’s capital that may beacquired is 10% (i.e. 6,778,153 shares based on the share capitalas of December 31, 2011 comprising 67,781,535 shares); giventhat this limit is assessed on the repurchase date so as to allowfor possible capital increases or reductions during the course of theprogram. The number of shares taken into consideration in order tocalculate this limit corresponds to the number or shares purchased,less the number of shares resold for liquidity purposes during thecourse of the program.The Company is bound to retain a fl oat of at least 10% of its capitaland, in accordance with the law, not hold more than 10% of itscapital, directly or indirectly.It should be noted that, by law, the maximum buyback percentageof shares acquired by the Company in order to hold them forsubsequent delivery in payment or exchange for a merger, split-off orcontribution is limited to 5%.52BOURBON - 2011 Registration Document

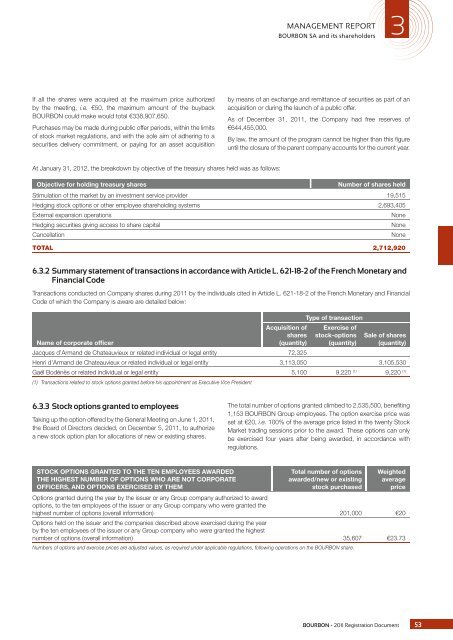

MANAGEMENT REPORT3BOURBON SA and its shareholdersIf all the shares were acquired at the maximum price authorizedby the meeting, i.e. €50, the maximum amount of the buybackBOURBON could make would total €338,907,650.Purchases may be made during public offer periods, within the limitsof stock market regulations, and with the sole aim of adhering to asecurities delivery commitment, or paying for an asset acquisitionby means of an exchange and remittance of securities as part of anacquisition or during the launch of a public offer.As of December 31, 2011, the Company had free reserves of€644,455,000.By law, the amount of the program cannot be higher than this fi gureuntil the closure of the parent company accounts for the current year.At January 31, 2012, the breakdown by objective of the treasury shares held was as follows:Objective for holding treasury sharesNumber of shares heldStimulation of the market by an investment service provider 19,515Hedging stock options or other employee shareholding systems 2,693,405External expansion operationsNoneHedging securities giving access to share capitalNoneCancellationNoneTOTAL 2,712,9206.3.2 Summary statement of transactions in accordance with Article L. 621-18-2 of the French Monetary andFinancial CodeTransactions conducted on Company shares during 2011 by the individuals cited in Article L. 621-18-2 of the French Monetary and FinancialCode of which the Company is aware are detailed below:Type of transactionName of corporate officerAcquisition ofshares(quantity)Exercise ofstock-options(quantity)Sale of shares(quantity)Jacques d’Armand de Chateauvieux or related individual or legal entity 72,325Henri d’Armand de Chateauvieux or related individual or legal entity 3,113,050 3,105,530Gaël Bodénès or related individual or legal entity 5,100 9,220 (1) 9,220 (1)(1) Transactions related to stock options granted before his appointment as Executive Vice President6.3.3 Stock options granted to employeesTaking up the option offered by the General Meeting on June 1, 2011,the Board of Directors decided, on December 5, 2011, to authorizea new stock option plan for allocations of new or existing shares.The total number of options granted climbed to 2,535,500, benefi ting1,153 BOURBON Group employees. The option exercise price wasset at €20, i.e. 100% of the average price listed in the twenty StockMarket trading sessions prior to the award. These options can onlybe exercised four years after being awarded, in accordance withregulations.STOCK OPTIONS GRANTED TO THE TEN EMPLOYEES AWARDEDTHE HIGHEST NUMBER OF OPTIONS WHO ARE NOT CORPORATEOFFICERS, AND OPTIONS EXERCISED BY THEMTotal number of optionsawarded/new or existingstock purchasedWeightedaveragepriceOptions granted during the year by the issuer or any Group company authorized to awardoptions, to the ten employees of the issuer or any Group company who were granted thehighest number of options (overall information) 201,000 €20Options held on the issuer and the companies described above exercised during the yearby the ten employees of the issuer or any Group company who were granted the highestnumber of options (overall information) 35,607 €23.73Numbers of options and exercise prices are adjusted values, as required under applicable regulations, following operations on the BOURBON share.BOURBON - 2011 Registration Document 53