REGISTRATION DOCUMENT - Bourbon

REGISTRATION DOCUMENT - Bourbon

REGISTRATION DOCUMENT - Bourbon

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

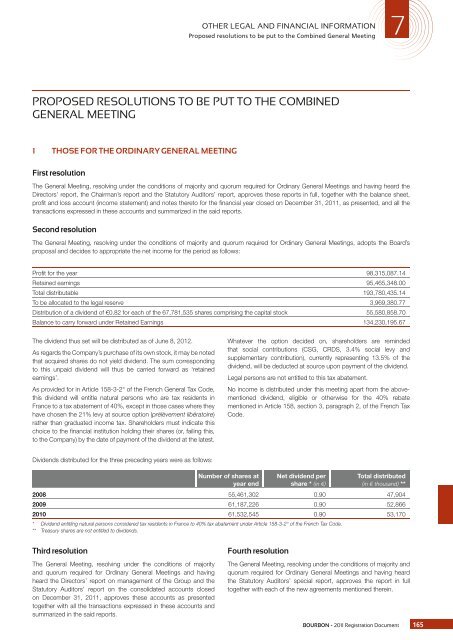

OTHER LEGAL AND FINANCIAL INFORMATION7Proposed resolutions to be put to the Combined General MeetingPROPOSED RESOLUTIONS TO BE PUT TO THE COMBINEDGENERAL MEETING1 THOSE FOR THE ORDINARY GENERAL MEETINGFirst resolutionThe General Meeting, resolving under the conditions of majority and quorum required for Ordinary General Meetings and having heard theDirectors’ report, the Chairman’s report and the Statutory Auditors’ report, approves these reports in full, together with the balance sheet,profi t and loss account (income statement) and notes thereto for the fi nancial year closed on December 31, 2011, as presented, and all thetransactions expressed in these accounts and summarized in the said reports.Second resolutionThe General Meeting, resolving under the conditions of majority and quorum required for Ordinary General Meetings, adopts the Board’sproposal and decides to appropriate the net income for the period as follows:Profi t for the year 98,315,087.14Retained earnings 95,465,348.00Total distributable 193,780,435.14To be allocated to the legal reserve 3,969,380.77Distribution of a dividend of €0.82 for each of the 67,781,535 shares comprising the capital stock 55,580,858.70Balance to carry forward under Retained Earnings 134,230,195.67The dividend thus set will be distributed as of June 8, 2012.As regards the Company’s purchase of its own stock, it may be notedthat acquired shares do not yield dividend. The sum correspondingto this unpaid dividend will thus be carried forward as ‘retainedearnings’.As provided for in Article 158-3-2° of the French General Tax Code,this dividend will entitle natural persons who are tax residents inFrance to a tax abatement of 40%, except in those cases where theyhave chosen the 21% levy at source option (prélèvement libératoire)rather than graduated income tax. Shareholders must indicate thischoice to the fi nancial institution holding their shares (or, failing this,to the Company) by the date of payment of the dividend at the latest.Whatever the option decided on, shareholders are remindedthat social contributions (CSG, CRDS, 3.4% social levy andsupplementary contribution), currently representing 13.5% of thedividend, will be deducted at source upon payment of the dividend.Legal persons are not entitled to this tax abatement.No income is distributed under this meeting apart from the abovementioneddividend, eligible or otherwise for the 40% rebatementioned in Article 158, section 3, paragraph 2, of the French TaxCode.Dividends distributed for the three preceding years were as follows:Number of shares atyear endNet dividend pershare * (in €)Total distributed(in € thousand) **2008 55,461,302 0.90 47,9042009 61,187,226 0.90 52,8662010 61,532,545 0.90 53,170* Dividend entitling natural persons considered tax residents in France to 40% tax abatement under Article 158-3-2° of the French Tax Code.** Treasury shares are not entitled to dividends.Third resolutionThe General Meeting, resolving under the conditions of majorityand quorum required for Ordinary General Meetings and havingheard the Directors’ report on management of the Group and theStatutory Auditors’ report on the consolidated accounts closedon December 31, 2011, approves these accounts as presentedtogether with all the transactions expressed in these accounts andsummarized in the said reports.Fourth resolutionThe General Meeting, resolving under the conditions of majority andquorum required for Ordinary General Meetings and having heardthe Statutory Auditors’ special report, approves the report in fulltogether with each of the new agreements mentioned therein.BOURBON - 2011 Registration Document 165