REGISTRATION DOCUMENT - Bourbon

REGISTRATION DOCUMENT - Bourbon

REGISTRATION DOCUMENT - Bourbon

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

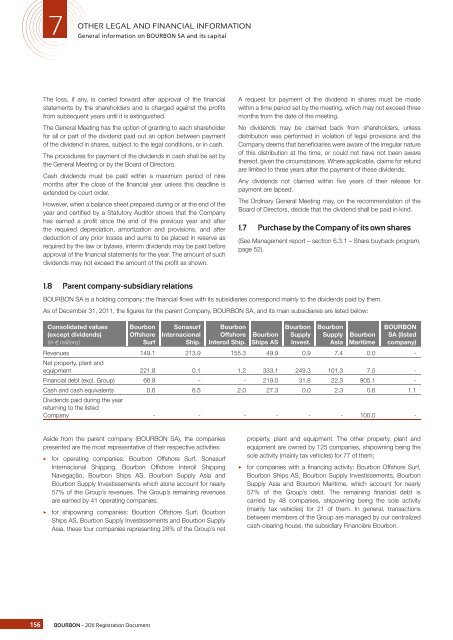

7GeneralOTHER LEGAL AND FINANCIAL INFORMATIONinformation on BOURBON SA and its capitalThe loss, if any, is carried forward after approval of the fi nancialstatements by the shareholders and is charged against the profi tsfrom subsequent years until it is extinguished.The General Meeting has the option of granting to each shareholderfor all or part of the dividend paid out an option between paymentof the dividend in shares, subject to the legal conditions, or in cash.The procedures for payment of the dividends in cash shall be set bythe General Meeting or by the Board of Directors.Cash dividends must be paid within a maximum period of ninemonths after the close of the fi nancial year unless this deadline isextended by court order.However, when a balance sheet prepared during or at the end of theyear and certifi ed by a Statutory Auditor shows that the Companyhas earned a profi t since the end of the previous year and afterthe required depreciation, amortization and provisions, and afterdeduction of any prior losses and sums to be placed in reserve asrequired by the law or bylaws, interim dividends may be paid beforeapproval of the fi nancial statements for the year. The amount of suchdividends may not exceed the amount of the profi t as shown.A request for payment of the dividend in shares must be madewithin a time period set by the meeting, which may not exceed threemonths from the date of the meeting.No dividends may be claimed back from shareholders, unlessdistribution was performed in violation of legal provisions and theCompany deems that benefi ciaries were aware of the irregular natureof this distribution at the time, or could not have not been awarethereof, given the circumstances. Where applicable, claims for refundare limited to three years after the payment of these dividends.Any dividends not claimed within fi ve years of their release forpayment are lapsed.The Ordinary General Meeting may, on the recommendation of theBoard of Directors, decide that the dividend shall be paid in kind.1.7 Purchase by the Company of its own shares(See Management report – section 6.3.1 – Share buyback program,page 52).1.8 Parent company-subsidiary relationsBOURBON SA is a holding company; the fi nancial fl ows with its subsidiaries correspond mainly to the dividends paid by them.As of December 31, 2011, the fi gures for the parent Company, BOURBON SA, and its main subsidiaries are listed below:Consolidated values(except dividends)(in € millions)<strong>Bourbon</strong>OffshoreSurfSonasurfInternacionalShip.<strong>Bourbon</strong>OffshoreInteroil Ship.<strong>Bourbon</strong>Ships AS<strong>Bourbon</strong>SupplyInvest.<strong>Bourbon</strong>SupplyAsia<strong>Bourbon</strong>MaritimeBOURBONSA (listedcompany)Revenues 149.1 213.9 155.3 49.9 0.9 7.4 0.0 -Net property, plant andequipment 221.8 0.1 1.2 333.1 249.3 101.3 7.5 -Financial debt (excl. Group) 66.8 - - 219.0 31.8 22.3 905.1 -Cash and cash equivalents 0.6 6.5 2.0 27.3 0.0 2.3 0.6 1.1Dividends paid during the yearreturning to the listedCompany - - - - - - 100.0 -Aside from the parent company (BOURBON SA), the companiespresented are the most representative of their respective activities:3 for operating companies: <strong>Bourbon</strong> Offshore Surf, SonasurfInternacional Shipping, <strong>Bourbon</strong> Offshore Interoil ShippingNavegação, <strong>Bourbon</strong> Ships AS, <strong>Bourbon</strong> Supply Asia and<strong>Bourbon</strong> Supply Investissements which alone account for nearly57% of the Group’s revenues. The Group’s remaining revenuesare earned by 41 operating companies;3 for shipowning companies: <strong>Bourbon</strong> Offshore Surf, <strong>Bourbon</strong>Ships AS, <strong>Bourbon</strong> Supply Investissements and <strong>Bourbon</strong> SupplyAsia, these four companies representing 28% of the Group’s netproperty, plant and equipment. The other property, plant andequipment are owned by 125 companies, shipowning being thesole activity (mainly tax vehicles) for 77 of them;3 for companies with a fi nancing activity: <strong>Bourbon</strong> Offshore Surf,<strong>Bourbon</strong> Ships AS, <strong>Bourbon</strong> Supply Investissements, <strong>Bourbon</strong>Supply Asia and <strong>Bourbon</strong> Maritime, which account for nearly57% of the Group’s debt. The remaining fi nancial debt iscarried by 48 companies, shipowning being the sole activity(mainly tax vehicles) for 21 of them. In general, transactionsbetween members of the Group are managed by our centralizedcash-clearing house, the subsidiary Financière <strong>Bourbon</strong>.156BOURBON - 2011 Registration Document