4NotesCONSOLIDATED FINANCIAL STATEMENTSto the consolidated financial statementsfor net operating debts (NOD = net debts excluding prepayment onorders of vessels under construction) to EBITDA and net debt toequity. These two multilateral borrowing lines were secured throughcollateral, replacing the mortgage commitments granted when theloans on certain vessels in the BOURBON fl eet were contracted (seenote 5.1).Similarly, the syndicate for the €318 million loan contracted in 2009removed the restriction on the net operating debts (NOD = net debtsexcluding prepayment on orders of vessels under construction) toEBITDA ratio. The ratio of net debt to equity below 1.90 continuesto apply. This multilateral borrowing line is also secured throughcollateral replacing mortgage commitments granted when the loanson certain vessels in the BOURBON fl eet were contracted (seenote 5.1).For some of the bilateral fi nancings, mainly tax-based leasingfi nancing, of which the total amount outstanding at the end of2011 was €111.7 million, the provisions of the tax-based leasingcontracts specify a net debt to equity ratio of below 1.90 and a “NetOperating Debt to EBITDA” ratio that must be below 5.0 for fi scalyears 2011 and 2012, below 4.5 for fi scal years 2013 and 2014, and4.0 thereafter.There was no acceleration of maturity on any of our fi nancialcommitments as of December 31, 2011. Similarly, there were nocross defaults among the Group’s entities. In addition, no loancontracts were terminated early, for example, owing to a terminationevent related to a change of control at the debtor as of December 31,2011.As of December 31, 2011, BOURBON was in compliance with itsfi nancial covenants, i.e., its fi nancial commitments relating to thefi nancing contracts.Short-term lines of creditThe Group has unused short-term credit lines totaling around€44 million as of December 31, 2011. The Group had cash assets of€230 million as of December 31, 2011.Cash management is coordinated at the Group’s operatingheadquarters. Financière <strong>Bourbon</strong>, a partnership organized as a cashclearing house, offers its services to most of the Group’s operatingsubsidiaries. These entities, under a cash agreement with Financière<strong>Bourbon</strong>, receive active support in the management of their cashfl ow, their foreign currency and interest rate risks, their operatingrisks and their short and medium-term debt, in accordance with thevarious laws in force locally.BOURBON does not have a fi nancial rating from a specialist agency.3.19.3 Market risksMarket risks include the Group’s exposure to interest rate risks,foreign exchange risks, risks on equities and risks on supplies.Interest rate riskThe Group’s exposure to the risk of interest rate fl uctuations isrelated to the Group’s medium- and long-term variable rate fi nancialdebt. BOURBON regularly monitors its exposure to interest raterisk. This is coordinated and controlled centrally. It comes underthe responsibility of the Vice President-Finance who reports to theExecutive Vice President, Chief Financial Offi cer.The Group’s policy consists of managing its interest rate expenseby using a combination of fi xed-rate and variable-rate borrowing.In order to optimize the overall fi nancing cost, the Group sets upinterest rate swaps under which it exchanges, at pre-determinedintervals, the difference between the amount of fi xed-rate interestand the amount of variable-rate interest calculated on a pre-defi nednominal amount of borrowing.These swaps are assigned to hedge the borrowings. As ofDecember 31, 2011, after taking account of interest rate swaps,approximately 50% of the Group’s medium or long-term debt wascontracted at a fi xed interest rate.As of December 31, 2011, the rate swap contracts were on theGroup’s borrowings, transforming variable rates into fi xed rates.96BOURBON - 2011 Registration Document

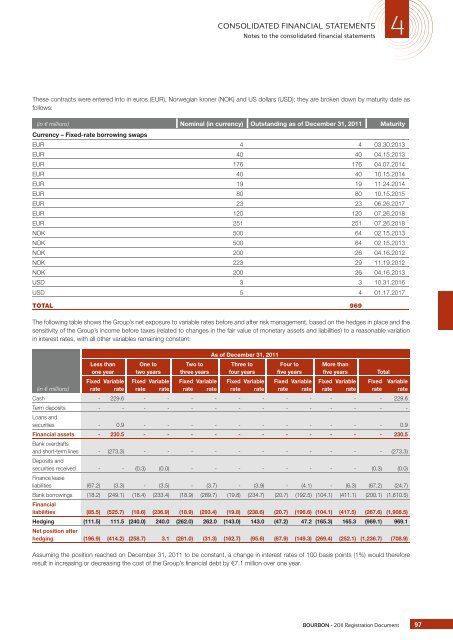

CONSOLIDATED FINANCIAL STATEMENTS4Notes to the consolidated financial statementsThese contracts were entered into in euros (EUR), Norwegian kroner (NOK) and US dollars (USD); they are broken down by maturity date asfollows:(in € millions) Nominal (in currency) Outstanding as of December 31, 2011 MaturityCurrency – Fixed-rate borrowing swapsEUR 4 4 03.30.2013EUR 40 40 04.15.2013EUR 176 176 04.07.2014EUR 40 40 10.15.2014EUR 19 19 11.24.2014EUR 80 80 10.15.2015EUR 23 23 06.26.2017EUR 120 120 07.26.2018EUR 251 251 07.26.2018NOK 500 64 02.15.2013NOK 500 64 02.15.2013NOK 200 26 04.16.2012NOK 223 29 11.19.2012NOK 200 26 04.16.2013USD 3 3 10.31.2016USD 5 4 01.17.2017TOTAL 969The following table shows the Group’s net exposure to variable rates before and after risk management, based on the hedges in place and thesensitivity of the Group’s income before taxes (related to changes in the fair value of monetary assets and liabilities) to a reasonable variationin interest rates, with all other variables remaining constant:Less thanone yearOne totwo yearsTwo tothree yearsAs of December 31, 2011Three tofour yearsFour tofive yearsMore thanfive yearsFixed Variable Fixed Variable Fixed Variable Fixed Variable Fixed Variable Fixed Variable Fixed Variable(in € millions) rate rate rate rate rate rate rate rate rate rate rate rate rate rateCash - 229.6 - - - - - - - - - - - 229.6Term deposits - - - - - - - - - - - - - -Loans andsecurities - 0.9 - - - - - - - - - - - 0.9Financial assets - 230.5 - - - - - - - - - - - 230.5Bank overdraftsand short-term lines - (273.3) - - - - - - - - - - - (273.3)Deposits andsecurities received - - (0.3) (0.0) - - - - - - - - (0.3) (0.0)Finance leaseliabilities (67.2) (3.3) - (3.5) - (3.7) - (3.9) - (4.1) - (6.3) (67.2) (24.7)Bank borrowings (18.2) (249.1) (18.4) (233.4) (18.9) (289.7) (19.8) (234.7) (20.7) (192.5) (104.1) (411.1) (200.1) (1,610.5)Financialliabilities (85.5) (525.7) (18.6) (236.9) (18.9) (293.4) (19.8) (238.6) (20.7) (196.6) (104.1) (417.5) (267.6) (1,908.5)Hedging (111.5) 111.5 (240.0) 240.0 (262.0) 262.0 (143.0) 143.0 (47.2) 47.2 (165.3) 165.3 (969.1) 969.1Net position afterhedging (196.9) (414.2) (258.7) 3.1 (281.0) (31.3) (162.7) (95.6) (67.9) (149.3) (269.4) (252.1) (1,236.7) (708.9)Assuming the position reached on December 31, 2011 to be constant, a change in interest rates of 100 basis points (1%) would thereforeresult in increasing or decreasing the cost of the Group’s fi nancial debt by €7.1 million over one year.TotalBOURBON - 2011 Registration Document 97