3RiskMANAGEMENT REPORTfactorsMarine riskMaritime piracy has been a major concern for all marine operatorsfor several years now and BOURBON has very rapidly put in placea number of measures and collaborative arrangements in order toassess this risk in its vessels’ operating and transit regions, all underthe control of the Group’s Safety Manager.For vessels in operation, BOURBON applies a set of safety proceduresadapted to each oilfi eld, coordinating with the oil companies andrelevant authorities. In the Niger delta area, particularly Nigeria andCameroon, a dedicated reinforced strengthened safety mechanismhas been set up in order to ensure the best safety conditions foremployees and vessels.For vessel transits in high-risk regions, BOURBON totally adheres tothe recommendations of the International Maritime Organization andsystematically adopts dedicated security measures such as “Piracy– Best Management Practices” and adapts is methods according tothe particular transit region.Thus, in the rare cases of its vessels transiting the Gulf of Aden region,the area where it is currently most exposed to risk, BOURBON hasthe support of the appropriate protection forces.BOURBON cannot, however, guarantee that the preventive measurestaken and its recourse to these protection forces will be suffi cient, inthe future, to guarantee the safety of its activities and its employees,which could have a negative impact on its business and its image.BOURBON’s development is partly conducted in emergingcountries where the risks associated with the operation ofactivities may include political, economic, social or financialinstability. BOURBON may encounter difficulties in theexercise of its activities in such countries, which could havean impact on its results.Some of BOURBON’s international growth is taking place inemerging countries (the coasts of Africa, Asia, South America, etc.)where the risks associated with operating activities may includepolitical, economic, social or fi nancial instability. It operates primarilyvia joint ventures with local partners, with a view to sharing expertiseand assets, while having a general concern to maximize the localcontribution. In particular, it is via actions in the sphere of humanresources that BOURBON is in a position to recruit, train and promotepersonal career development programs for all its employees andassociates recruited locally.Through an approach that is specifi c for each country, and withhelp from local partners, BOURBON is thus able to claim to be alocal entity, minimizing the risks associated with the operation ofits activities and enabling a better appreciation of the local contextand risks.BOURBON cannot, however, guarantee that it will be able to developand apply procedures, policies and practices enabling it to anticipateand control all these risks or to ensure that they are managedeffectively. If not, its business, fi nancial position, results or outlookmay be affected.4.3 LEGAL RISKSApart from disputes for which provisions have already been madein the accounts and/or those whose disclosure would be contraryto its legitimate interests, there is no other governmental, judicial orarbitration procedure (including any procedure to the Company’sknowledge that is pending or with which it is threatened) likely tohave or to have had in the last 12 months any material effect on theGroup’s fi nancial situation or profi tability.For each signifi cant dispute, a provision has been establishedto meet the estimated risk if the probability of occurrence of thatrisk is considered to be high. Otherwise, no provision has beenestablished. In 2011, provisions were constituted to cover risks inBrazil and Angola in the main. No individual item is signifi cant. Theseare operating risks related to the international environment in the oilservices sector, some of which generate litigation. These risks areclosely monitored by the Group and its legal advisors.4.4 FINANCIAL RISK MANAGEMENTOBJECTIVES AND POLICYThe main risks to which the Group is exposed are credit/counterpartyrisks, liquidity risks and market risks. The Board of Directors hasreviewed and approved the management policies of each of theserisks. The policies are summarized below.4.4.1 Credit/counterparty riskThe Group’s policy is to verify the fi nancial health of all customersseeking credit payment terms. Furthermore, the Group continuallymonitors client balances. The fi nancial soundness of its clients enablesBOURBON to avoid the use of COFACE-type credit insurance.Supermajor, major, national and independent oil companies accountfor nearly 80% of revenues. The Group has not therefore taken outthis type of credit insurance agreement.The volume of business conducted with the top fi ve clientsrepresented €459 million (45.5% of revenues) while the top tenclients accounted for nearly 63.7% (€642 million).A statement of anteriority of credits and other debtors is presented innote 3.20.5. of the Notes to the Consolidated Financial Statements.In 2011, BOURBON did not conduct any contracts with national oilcompanies in countries with a high political risk such as Venezuela,Iran, Iraq or Myanmar. Our main client accounts for 20% of thecompany’ s total revenues (41% in 2003).42BOURBON - 2011 Registration Document

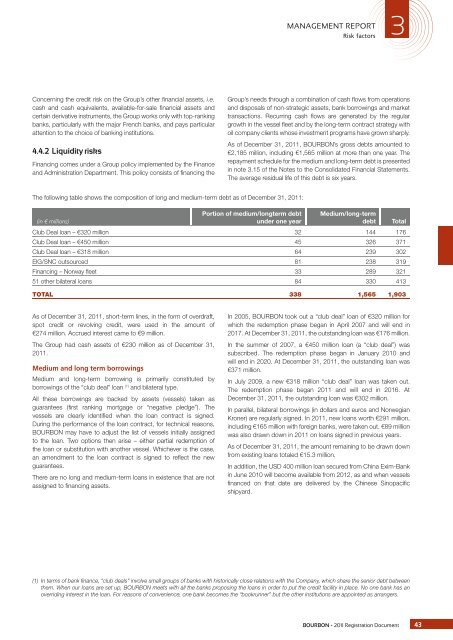

MANAGEMENT REPORT3Risk factorsConcerning the credit risk on the Group’s other fi nancial assets, i.e.cash and cash equivalents, available-for-sale fi nancial assets andcertain derivative instruments, the Group works only with top-rankingbanks, particularly with the major French banks, and pays particularattention to the choice of banking institutions.4.4.2 Liquidity risksFinancing comes under a Group policy implemented by the Financeand Administration Department. This policy consists of fi nancing theGroup’s needs through a combination of cash fl ows from operationsand disposals of non-strategic assets, bank borrowings and markettransactions. Recurring cash fl ows are generated by the regulargrowth in the vessel fl eet and by the long-term contract strategy withoil company clients whose investment programs have grown sharply.As of December 31, 2011, BOURBON’s gross debts amounted to€2,185 million, including €1,565 million at more than one year. Therepayment schedule for the medium and long-term debt is presentedin note 3.15 of the Notes to the Consolidated Financial Statements.The average residual life of this debt is six years.The following table shows the composition of long and medium-term debt as of December 31, 2011:Portion of medium/longterm debtunder one yearMedium/long-termdebt(in € millions)TotalClub Deal loan – €320 million 32 144 176Club Deal loan – €450 million 45 326 371Club Deal loan – €318 million 64 239 302EIG/SNC outsourced 81 238 319Financing – Norway fl eet 33 289 32151 other bilateral loans 84 330 413TOTAL 338 1,565 1,903As of December 31, 2011, short-term lines, in the form of overdraft,spot credit or revolving credit, were used in the amount of€274 million. Accrued interest came to €9 million.The Group had cash assets of €230 million as of December 31,2011.Medium and long term borrowingsMedium and long-term borrowing is primarily constituted byborrowings of the “club deal” loan (1) and bilateral type.All these borrowings are backed by assets (vessels) taken asguarantees (fi rst ranking mortgage or “negative pledge”). Thevessels are clearly identifi ed when the loan contract is signed.During the performance of the loan contract, for technical reasons,BOURBON may have to adjust the list of vessels initially assignedto the loan. Two options then arise – either partial redemption ofthe loan or substitution with another vessel. Whichever is the case,an amendment to the loan contract is signed to refl ect the newguarantees.There are no long and medium-term loans in existence that are notassigned to fi nancing assets.In 2005, BOURBON took out a “club deal” loan of €320 million forwhich the redemption phase began in April 2007 and will end in2017. At December 31, 2011, the outstanding loan was €176 million.In the summer of 2007, a €450 million loan (a “club deal”) wassubscribed. The redemption phase began in January 2010 andwill end in 2020. At December 31, 2011, the outstanding loan was€371 million.In July 2009, a new €318 million “club deal” loan was taken out.The redemption phase began 2011 and will end in 2016. AtDecember 31, 2011, the outstanding loan was €302 million.In parallel, bilateral borrowings (in dollars and euros and NorwegianKroner) are regularly signed. In 2011, new loans worth €291 million,including €165 million with foreign banks, were taken out. €89 millionwas also drawn down in 2011 on loans signed in previous years.As of December 31, 2011, the amount remaining to be drawn downfrom existing loans totaled €15.3 million.In addition, the USD 400 million loan secured from China Exim-Bankin June 2010 will become available from 2012, as and when vesselsfi nanced on that date are delivered by the Chinese Sinopacifi cshipyard.(1) In terms of bank fi nance, “club deals” involve small groups of banks with historically close relations with the Company, which share the senior debt betweenthem. When our loans are set up, BOURBON meets with all the banks proposing the loans in order to put the credit facility in place. No one bank has anoverriding interest in the loan. For reasons of convenience, one bank becomes the “bookrunner” but the other institutions are appointed as arrangers.BOURBON - 2011 Registration Document 43