REGISTRATION DOCUMENT - Bourbon

REGISTRATION DOCUMENT - Bourbon

REGISTRATION DOCUMENT - Bourbon

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

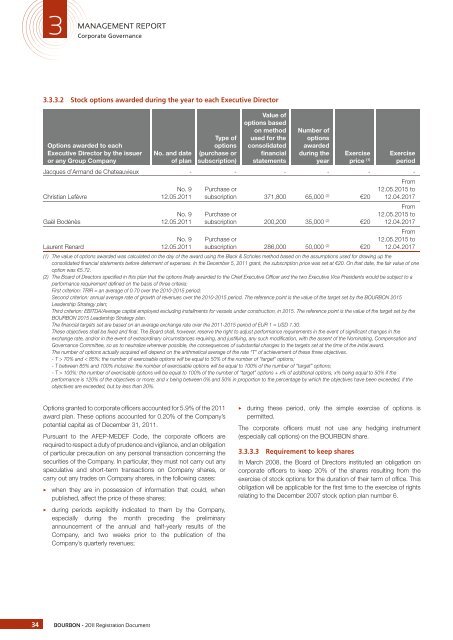

3CorporateMANAGEMENT REPORTGovernance3.3.3.2 Stock options awarded during the year to each Executive DirectorOptions awarded to eachExecutive Director by the issueror any Group CompanyNo. and dateof planType ofoptions(purchase orsubscription)Value ofoptions basedon methodused for theconsolidatedfinancialstatementsNumber ofoptionsawardedduring theyearExerciseprice (1)ExerciseperiodJacques d’Armand de Chateauvieux - - - - - -Christian LefèvreGaël BodénèsLaurent RenardNo. 912.05.2011No. 912.05.2011No. 912.05.2011Purchase orsubscription 371,800 65,000 (2) €20Purchase orsubscription 200,200 35,000 (2) €20Purchase orsubscription 286,000 50,000 (2) €20From12.05.2015 to12.04.2017From12.05.2015 to12.04.2017From12.05.2015 to12.04.2017(1) The value of options awarded was calculated on the day of the award using the Black & Scholes method based on the assumptions used for drawing up theconsolidated fi nancial statements before deferment of expenses. In the December 5, 2011 grant, the subscription price was set at €20. On that date, the fair value of oneoption was €5.72.(2) The Board of Directors specifi ed in this plan that the options fi nally awarded to the Chief Executive Offi cer and the two Executive Vice Presidents would be subject to aperformance requirement defi ned on the basis of three criteria:First criterion: TRIR = an average of 0.70 over the 2010-2015 period;Second criterion: annual average rate of growth of revenues over the 2010-2015 period. The reference point is the value of the target set by the BOURBON 2015Leadership Strategy plan;Third criterion: EBITDA/Average capital employed excluding installments for vessels under construction, in 2015. The reference point is the value of the target set by theBOURBON 2015 Leadership Strategy plan.The fi nancial targets set are based on an average exchange rate over the 2011-2015 period of EUR 1 = USD 1.30.These objectives shall be fi xed and fi nal. The Board shall, however, reserve the right to adjust performance requirements in the event of signifi cant changes in theexchange rate, and/or in the event of extraordinary circumstances requiring, and justifying, any such modifi cation, with the assent of the Nominating, Compensation andGovernance Committee, so as to neutralize wherever possible, the consequences of substantial changes to the targets set at the time of the initial award.The number of options actually acquired will depend on the arithmetical average of the rate “T” of achievement of these three objectives.- T > 70% and < 85%: the number of exercisable options will be equal to 50% of the number of “target” options;- T between 85% and 100% inclusive: the number of exercisable options will be equal to 100% of the number of “target” options;- T > 100%: the number of exercisable options will be equal to 100% of the number of “target” options + x% of additional options, x% being equal to 50% if theperformance is 120% of the objectives or more; and x being between 0% and 50% in proportion to the percentage by which the objectives have been exceeded, if theobjectives are exceeded, but by less than 20%.Options granted to corporate offi cers accounted for 5.9% of the 2011award plan. These options accounted for 0.20% of the Company’spotential capital as of December 31, 2011.Pursuant to the AFEP-MEDEF Code, the corporate offi cers arerequired to respect a duty of prudence and vigilance, and an obligationof particular precaution on any personal transaction concerning thesecurities of the Company. In particular, they must not carry out anyspeculative and short-term transactions on Company shares, orcarry out any trades on Company shares, in the following cases:3 when they are in possession of information that could, whenpublished, affect the price of these shares;3 during periods explicitly indicated to them by the Company,especially during the month preceding the preliminaryannouncement of the annual and half-yearly results of theCompany, and two weeks prior to the publication of theCompany’s quarterly revenues;3 during these period, only the simple exercise of options ispermitted.The corporate offi cers must not use any hedging instrument(especially call options) on the BOURBON share.3.3.3.3 Requirement to keep sharesIn March 2008, the Board of Directors instituted an obligation oncorporate offi cers to keep 20% of the shares resulting from theexercise of stock options for the duration of their term of offi ce. Thisobligation will be applicable for the fi rst time to the exercise of rightsrelating to the December 2007 stock option plan number 6.34BOURBON - 2011 Registration Document