- Page 1 and 2:

VOLUME IANNUAL REPORT2013

- Page 3 and 4:

VOLUME IANNUAL REPORT2013

- Page 5 and 6:

Pretoria·············

- Page 7 and 8:

I International Federation The Inte

- Page 9 and 10:

ABBREVIATIONS AND DEFINITIONS | 7

- Page 11 and 12:

Societies and the ICRC as part of t

- Page 13 and 14:

..organization and processes: organ

- Page 15 and 16:

• Policy and guidelines/Research

- Page 17:

As a neutral and independent humani

- Page 21 and 22:

OPERATIONS WORLDWIDEAFRICAASIA AND

- Page 23 and 24:

ard reporting procedures have to be

- Page 25 and 26:

In addition, for more than a decade

- Page 27 and 28:

to management. Since 2007, this app

- Page 29 and 30:

The ways of measuring progress towa

- Page 31 and 32:

ASSISTANCEGeneric indicators based

- Page 33 and 34:

PROTECTIONThe Protection Policy (da

- Page 35 and 36:

Major assistance, protection, finan

- Page 37 and 38:

a four-year commitment (2013-16), t

- Page 39 and 40:

midwives also play a decisive role

- Page 41 and 42:

violence are coordinated with other

- Page 43 and 44:

DEFINITIONS USED BY THE ICRCA child

- Page 45 and 46:

AssistanceEconomic security - emerg

- Page 47 and 48:

prevention of hand-to-mouth contami

- Page 49 and 50:

ANNEX 4:THE ICRC’S OPERATIONAL AP

- Page 51 and 52:

to prevent the displacement of civi

- Page 53 and 54:

who are affected by the presence of

- Page 55 and 56:

..Where inadequate legislation exis

- Page 57 and 58:

ICRC GOVERNING ANDCONTROLLING BODIE

- Page 59 and 60:

in 11 countries, recording positive

- Page 61 and 62:

PLANNING, MONITORING AND EVALUATION

- Page 63 and 64:

The unit also contributed to the in

- Page 65 and 66:

system for all units, with dedicate

- Page 67 and 68:

INTERNATIONAL LAW AND COOPERATIONTh

- Page 69 and 70:

The Advisory Service provided input

- Page 71 and 72:

followed by a second high-level mee

- Page 73 and 74:

COMMUNICATION ANDINFORMATION MANAGE

- Page 75 and 76:

ent Health Care in Danger project e

- Page 77 and 78:

• the completion of RADAR (Reliab

- Page 79 and 80:

of the new mobile recruits, while t

- Page 81 and 82:

FINANCIAL RESOURCES AND LOGISTICSTh

- Page 83 and 84:

The table below shows the contribut

- Page 85 and 86:

Swiss Reinsurance Company, Vontobel

- Page 87:

FINANCIAL RESOURCES ICRC ANNUAL AND

- Page 90 and 91:

THE ICRC AROUND THE WORLDAFRICAASIA

- Page 92 and 93:

OPERATIONAL HIGHLIGHTSrecruitment a

- Page 94 and 95:

South Sudan ended the year in the m

- Page 96 and 97:

of the children and their relatives

- Page 98 and 99:

The ICRC organized, or contributed

- Page 100 and 101:

USER GUIDE:YEARLY RESULTSThe ICRC a

- Page 102 and 103:

Tracing requests closed positivelyt

- Page 104 and 105:

ECONOMIC SECURITYBENEFICIARIESNote:

- Page 106 and 107:

AFRICAKEY RESULTS/CONSTRAINTSIn 201

- Page 108 and 109:

Pedram YAZDI / ICRCAFRICAIn 2013, t

- Page 110 and 111:

The ICRC backed government and comm

- Page 112 and 113:

PROTECTION MAIN FIGURES AND INDICAT

- Page 114 and 115:

ASSISTANCE MAIN FIGURES AND INDICAT

- Page 116 and 117:

ALGERIAThe ICRC has been working in

- Page 118 and 119:

The ICRC remained ready to share it

- Page 120 and 121:

BURUNDIThe ICRC has been present in

- Page 122 and 123:

With the ICRC’s help, the Nationa

- Page 124 and 125:

MAIN FIGURES AND INDICATORS: PROTEC

- Page 126 and 127:

CONTEXTIn the Central African Repub

- Page 128 and 129:

PEOPLE DEPRIVED OF THEIR FREEDOMDia

- Page 130 and 131:

MAIN FIGURES AND INDICATORS: ASSIST

- Page 132 and 133:

CONTEXTChad remained relatively cal

- Page 134 and 135:

tasks, such as the management of be

- Page 136:

MAIN FIGURES AND INDICATORS: ASSIST

- Page 139 and 140:

(sometimes partial) essential house

- Page 141 and 142:

Hospitals in Bukavu and Goma benefi

- Page 144 and 145:

ERITREAThe ICRC opened a delegation

- Page 146 and 147:

Households access clean water from

- Page 148 and 149:

ETHIOPIAContinuously present in Eth

- Page 150 and 151:

process and contributing to the rep

- Page 152 and 153:

organization of first-aid training

- Page 154 and 155:

CONTEXTThe African Union (AU) conti

- Page 156 and 157:

GUINEACOVERING: Guinea, Sierra Leon

- Page 158 and 159:

Five others, including two who had

- Page 160 and 161:

company to facilitate the sending o

- Page 162 and 163:

CONTEXTLiberia was largely peaceful

- Page 164 and 165:

AUTHORITIES, ARMED FORCES AND OTHER

- Page 166 and 167:

LIBYAThe ICRC opened a delegation i

- Page 168 and 169:

- working alongside ICRC delegates

- Page 170 and 171:

Possibilities were explored with po

- Page 172 and 173:

MALIICRC operations in Mali are bud

- Page 174 and 175:

Families reconnect with displaced o

- Page 176 and 177:

AUTHORITIES, ARMED FORCES AND OTHER

- Page 178 and 179:

MAIN FIGURES AND INDICATORS: ASSIST

- Page 180 and 181:

CONTEXTMauritania felt the effects

- Page 182 and 183:

AUTHORITIES, ARMED FORCES AND OTHER

- Page 184 and 185:

NIGERIAActive in Nigeria during the

- Page 186 and 187:

following distributions of emergenc

- Page 188 and 189:

MAIN FIGURES AND INDICATORS: PROTEC

- Page 190 and 191:

CONTEXTWhen the conflict in the Nor

- Page 192 and 193:

WOUNDED AND SICKAt the request of t

- Page 194 and 195:

SOMALIAThe ICRC has maintained a pr

- Page 196 and 197:

y al-Shabaab in southern and centra

- Page 198 and 199:

Ad hoc delivery of supplies to hosp

- Page 200 and 201:

MAIN FIGURES AND INDICATORS: ASSIST

- Page 202 and 203:

CONTEXTThe production/export of oil

- Page 204 and 205:

governing detention and about the I

- Page 206 and 207:

MAIN FIGURES AND INDICATORS: PROTEC

- Page 208 and 209:

SUDANThe ICRC opened an office in K

- Page 210 and 211:

the local authorities’ consent. T

- Page 212 and 213:

Briefings/training for weapon beare

- Page 214 and 215:

UGANDAThe ICRC has been present in

- Page 216 and 217:

implementation or completion of pro

- Page 218 and 219:

MAIN FIGURES AND INDICATORS: PROTEC

- Page 220 and 221:

CONTEXTSupported by the internation

- Page 222 and 223:

Nearly 53,300 patients - of whom pr

- Page 224 and 225:

MAIN FIGURES AND INDICATORS: PROTEC

- Page 226 and 227:

CONTEXTThe political crisis in Mada

- Page 228 and 229:

TB management in the Antanimora and

- Page 230 and 231:

DAKAR (regional)COVERING: Cabo Verd

- Page 232 and 233:

Over 24,000 people, including pregn

- Page 234 and 235:

Local associations of disabled peop

- Page 236 and 237:

MAIN FIGURES AND INDICATORS: ASSIST

- Page 238 and 239:

CONTEXTZimbabwe was largely peacefu

- Page 240 and 241:

ICRC. Technical support through fie

- Page 242 and 243:

NAIROBI (regional)COVERING: Djibout

- Page 244 and 245:

ainwater catchments in 22 schools,

- Page 246 and 247:

and obstacles to applying IHL, at c

- Page 248 and 249:

NIAMEY (regional)COVERING: Mali (se

- Page 250 and 251:

situation. Some National Society br

- Page 252 and 253:

RED CROSS AND RED CRESCENT MOVEMENT

- Page 254 and 255:

PRETORIA (regional)COVERING: Botswa

- Page 256 and 257:

Migrants held in South Africa and d

- Page 258 and 259:

TUNIS (regional)COVERING: Morocco/W

- Page 260 and 261:

concerns during first-aid courses a

- Page 262 and 263:

Forty-two students from Tunisia and

- Page 264 and 265:

CONTEXTThe region remained generall

- Page 266 and 267:

After its resumption in 2012, stren

- Page 268 and 269:

MAIN FIGURES AND INDICATORS: PROTEC

- Page 270 and 271:

ASIA AND THE PACIFICKEY RESULTS/CON

- Page 272 and 273:

Brecht GORIS / ICRCASIA AND THE PAC

- Page 274 and 275:

in prisons and rehabilitation centr

- Page 276 and 277:

PROTECTION MAIN FIGURES AND INDICAT

- Page 278 and 279:

ASSISTANCE MAIN FIGURES AND INDICAT

- Page 280 and 281:

AFGHANISTANHaving assisted victims

- Page 282 and 283:

strengthened capacities, the Nation

- Page 284 and 285:

Prompted by a 2012 security inciden

- Page 286 and 287:

MAIN FIGURES AND INDICATORS: ASSIST

- Page 288 and 289:

CONTEXTTensions, unrest and strikes

- Page 290 and 291:

and publications in the local langu

- Page 292 and 293:

MYANMARThe ICRC began working in My

- Page 294 and 295:

Muslim and Rakhinese residents and

- Page 296 and 297:

IHL and the Movement, and learnt ho

- Page 298 and 299:

CONTEXTThe absorption of former mem

- Page 300 and 301:

the misuse of ambulances and obstac

- Page 302 and 303:

PAKISTANThe ICRC began working in P

- Page 304 and 305:

The National Society, with the ICRC

- Page 306 and 307:

MAIN FIGURES AND INDICATORS: PROTEC

- Page 308 and 309:

CONTEXTNational/local midterm elect

- Page 310 and 311:

training of health staff and midwiv

- Page 312 and 313:

RED CROSS AND RED CRESCENT MOVEMENT

- Page 314 and 315:

CONTEXTWith macro-economic growth a

- Page 316 and 317:

WOUNDED AND SICKICRC-supported cent

- Page 318 and 319:

BANGKOK (regional)COVERING: Cambodi

- Page 320 and 321:

Mine/ERW victims in the Lao PDR and

- Page 322 and 323:

AUTHORITIES, ARMED FORCES AND OTHER

- Page 324 and 325:

BEIJING (regional)COVERING: China,

- Page 326 and 327:

Chinese Red Cross personnel were be

- Page 328 and 329:

humanitarian issues at ICRC briefin

- Page 330 and 331:

CONTEXTIndonesia continued to play

- Page 332 and 333:

In the framework of the Health Care

- Page 334 and 335:

KUALA LUMPUR (regional)COVERING: Br

- Page 336 and 337:

No requests were made for travel do

- Page 338 and 339:

All four National Societies worked

- Page 340 and 341:

CONTEXTIn Jammu and Kashmir, India,

- Page 342 and 343:

visited by relatives from refugee c

- Page 344 and 345:

MAIN FIGURES AND INDICATORS: ASSIST

- Page 346 and 347:

CONTEXTNatural disasters, fragile n

- Page 348 and 349:

institutions and five police statio

- Page 350 and 351:

MAIN FIGURES AND INDICATORS: PROTEC

- Page 352 and 353:

International Committee of the Red

- Page 354 and 355:

This report is primarily an account

- Page 356 and 357:

CONTENTSVOLUME IAbbreviations and d

- Page 358 and 359:

EUROPE ANDTHE AMERICASKEY RESULTS/C

- Page 360 and 361:

Rodrigo ABD / ICRCEUROPE AND THE AM

- Page 362 and 363:

with US government representatives

- Page 364 and 365:

PROTECTION MAIN FIGURES AND INDICAT

- Page 366 and 367:

ASSISTANCE MAIN FIGURES AND INDICAT

- Page 368 and 369:

ARMENIAThe ICRC has been working in

- Page 370 and 371:

At the request of local leaders, th

- Page 372 and 373:

MAIN FIGURES AND INDICATORS: PROTEC

- Page 374 and 375:

CONTEXTTensions remained high along

- Page 376 and 377:

procedures continued apace, with th

- Page 378 and 379:

MAIN FIGURES AND INDICATORS: PROTEC

- Page 380 and 381:

CONTEXTCivilians continued to feel

- Page 382 and 383:

Imereti, 48 displaced families (150

- Page 384 and 385:

MAIN FIGURES AND INDICATORS: PROTEC

- Page 386 and 387:

CONTEXTKyrgyzstan remained relative

- Page 388 and 389:

Authorities pursue efforts to strea

- Page 390 and 391:

EUROPE (regional)COVERING: Denmark,

- Page 392 and 393:

Movement efforts enable migrants to

- Page 394 and 395:

RED CROSS AND RED CRESCENT MOVEMENT

- Page 396 and 397:

CONTEXTAfter its presidential elect

- Page 398 and 399:

AUTHORITIES, ARMED FORCES AND OTHER

- Page 400 and 401:

TASHKENT (regional)COVERING: Kazakh

- Page 402 and 403:

Three especially vulnerable people

- Page 404 and 405:

Military/police personnel learn to

- Page 406 and 407:

WESTERN BALKANS (regional)COVERING:

- Page 408 and 409:

Local stakeholders bolster capaciti

- Page 410 and 411:

support, the National Societies of

- Page 412 and 413:

BRUSSELSCOVERING: Institutions of t

- Page 414 and 415:

Discussions centred on the humanita

- Page 416 and 417:

LONDONCOVERING: Ireland, United Kin

- Page 418 and 419:

exchange of any information that ma

- Page 420 and 421:

PARISCOVERING: France, MonacoThe Pa

- Page 422 and 423:

AUTHORITIES, ARMED FORCES AND OTHER

- Page 424 and 425:

COLOMBIAIn Colombia since 1969, the

- Page 426 and 427:

In violence-prone urban areas such

- Page 428 and 429:

Human Rights and IHL System, and ex

- Page 430 and 431:

HAITICOVERING: Dominican Republic,

- Page 432 and 433:

to medical services, and learnt mor

- Page 434 and 435:

MAIN FIGURES AND INDICATORS: PROTEC

- Page 436 and 437:

CONTEXTIn Chile, tensions over land

- Page 438 and 439:

PEOPLE DEPRIVED OF THEIR FREEDOMNew

- Page 440 and 441:

MAIN FIGURES AND INDICATORS: PROTEC

- Page 442 and 443:

CONTEXTPresident Hugo Chávez was r

- Page 444 and 445:

action, including through social me

- Page 446 and 447:

CONTEXTIn Peru, armed clashes betwe

- Page 448 and 449:

In Peru, 846 relatives of missing p

- Page 450 and 451:

ICRC presentations and the provisio

- Page 452 and 453:

CONTEXTViolence persisted throughou

- Page 454 and 455:

Facilitating a coherent response on

- Page 456 and 457:

and navy personnel acquired greater

- Page 458 and 459:

WASHINGTON (regional)COVERING: Cana

- Page 460 and 461:

expand their response accordingly.

- Page 462 and 463:

MAIN FIGURES AND INDICATORS: PROTEC

- Page 464 and 465:

CONTEXTThe UN and the diplomatic co

- Page 466 and 467:

MIDDLE EASTKEY RESULTS/CONSTRAINTSI

- Page 468 and 469:

Jessica BARRY / ICRCMIDDLE EASTIn 2

- Page 470 and 471:

guarantees and health in detention,

- Page 472 and 473:

PROTECTION MAIN FIGURES AND INDICAT

- Page 474 and 475:

ASSISTANCE MAIN FIGURES AND INDICAT

- Page 476 and 477:

EGYPTCOVERING: Egypt, League of Ara

- Page 478 and 479:

handle influxes of patients after a

- Page 480 and 481:

IRAN, ISLAMIC REPUBLIC OFThe ICRC h

- Page 482 and 483:

and identification of human remains

- Page 484 and 485:

IRAQThe ICRC has been present in Ir

- Page 486 and 487:

Displaced people receive food and h

- Page 488 and 489:

Helping boost local capacities, 14

- Page 490 and 491:

ISRAEL AND THE OCCUPIED TERRITORIES

- Page 492 and 493:

..ensure that the situation of the

- Page 494 and 495:

Disabled patients access specialize

- Page 496 and 497:

MAIN FIGURES AND INDICATORS: ASSIST

- Page 498 and 499:

CONTEXTJordan remained stable despi

- Page 500 and 501:

level to obtain their proactive com

- Page 502 and 503:

MAIN FIGURES AND INDICATORS: ASSIST

- Page 504 and 505:

CONTEXTThe armed conflict in the Sy

- Page 506 and 507:

wounded Syrians underwent ICRC-spon

- Page 508 and 509:

MAIN FIGURES AND INDICATORS: ASSIST

- Page 510 and 511:

CONTEXTThe armed conflict in the Sy

- Page 512 and 513:

During discussions with representat

- Page 514 and 515: YEMENThe ICRC has been working in Y

- Page 516 and 517: Approximately 9,900 residents in Sa

- Page 518 and 519: Serious security incidents in May (

- Page 520 and 521: KUWAIT (regional)COVERING: member S

- Page 522 and 523: situation monitored and assessed by

- Page 524 and 525: and the Restoring Family Links Stra

- Page 527 and 528: MAIN FIGURESAND INDICATORSMAIN ICRC

- Page 529 and 530: WORLD AFRICA ASIA &THE PACIFICEUROP

- Page 531 and 532: WORLD 1 AFRICA ASIA &THE PACIFICEUR

- Page 533 and 534: WORLD 1 AFRICA ASIA &THE PACIFICEUR

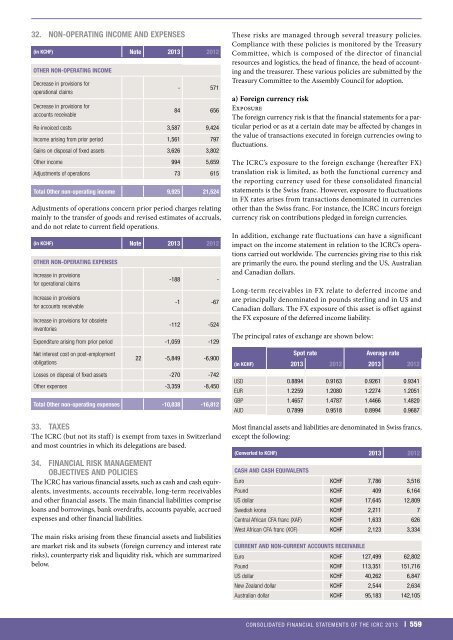

- Page 535 and 536: FINANCE ANDADMINISTRATIONFINANCE AN

- Page 537 and 538: CONSOLIDATED FINANCIAL STATEMENTSOF

- Page 539 and 540: CONSOLIDATED STATEMENT OF COMPREHEN

- Page 541 and 542: CONSOLIDATED STATEMENT OF CHANGES I

- Page 543 and 544: 3.3 InvestmentsIn accordance with i

- Page 545 and 546: If, in a subsequent year, the amoun

- Page 547 and 548: Donors’ restricted contributions

- Page 549 and 550: g) Pension and other post-employmen

- Page 551 and 552: ) Pledges denominated in foreign cu

- Page 553 and 554: 15. INTANGIBLE ASSETS(in KCHF)Book

- Page 555 and 556: 2. The early retirement defined ben

- Page 557 and 558: NET BENEFIT (ASSETS)/LIABILITIES RE

- Page 559 and 560: For the end-of-service plan, these

- Page 561 and 562: 25. UNRESTRICTED RESERVES DESIGNATE

- Page 563: 28. OVERHEAD AND ADMINISTRATIVE COS

- Page 567 and 568: To limit this market exposure, the

- Page 569 and 570: 2013(in KCHF)NoteCarryingAmountFair

- Page 571 and 572: Ernst & Young LtdRoute de Chancy 59

- Page 573 and 574: FINANCIAL AND STATISTICAL TABLESA.

- Page 575 and 576: INCOME(Cash, kind, services and ass

- Page 577 and 578: INCOME(Cash, kind, services and ass

- Page 579 and 580: INCOME(Cash, kind, services and ass

- Page 581 and 582: 1. GOVERNMENTS (CONT.) (in CHF)Head

- Page 583 and 584: 5. NATIONAL SOCIETIES (CONT.) (in C

- Page 585 and 586: 7. PRIVATE SOURCES (in CHF)Headquar

- Page 587 and 588: D. CONTRIBUTIONS IN KIND, IN SERVIC

- Page 589 and 590: RECEIPT OF ASSISTANCE ITEMS BY CONT

- Page 591 and 592: ContextGIFTS IN KIND AND CASH FOR K

- Page 593 and 594: Zimbabwe 371,291 537,614 176,996 30

- Page 595 and 596: FOUNDATION FOR THE INTERNATIONAL CO

- Page 597 and 598: CLARE BENEDICT FUND (in CHF)BALANCE

- Page 599 and 600: JEAN PICTET FUND (in CHF)BALANCE SH

- Page 601 and 602: OMAR EL MUKHTAR FUND (in CHF)BALANC

- Page 603 and 604: ICRC SPECIAL FUND FOR THE DISABLED

- Page 605: ICRC SPECIAL FUND FOR THE DISABLED

- Page 608 and 609: ICRC ORGANIZATIONAL CHARTAssembly C

- Page 610 and 611: Mr Rolf Soiron, PhD from Harvard Bu

- Page 612 and 613: impartial and independent humanitar

- Page 614 and 615:

THE ICRC AND ITS WORK WITH OTHER CO

- Page 616 and 617:

STATES PARTY TO THE GENEVA CONVENTI

- Page 618 and 619:

ABBREVIATIONSR/A/SRatification: a t

- Page 620 and 621:

STATES PARTY TO THE GENEVA CONVENTI

- Page 622 and 623:

STATES PARTY TO THE GENEVA CONVENTI

- Page 624:

International Committee of the Red