ANNUAL FINANCIAL REPORT 2010 2010 - TiGenix

ANNUAL FINANCIAL REPORT 2010 2010 - TiGenix

ANNUAL FINANCIAL REPORT 2010 2010 - TiGenix

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

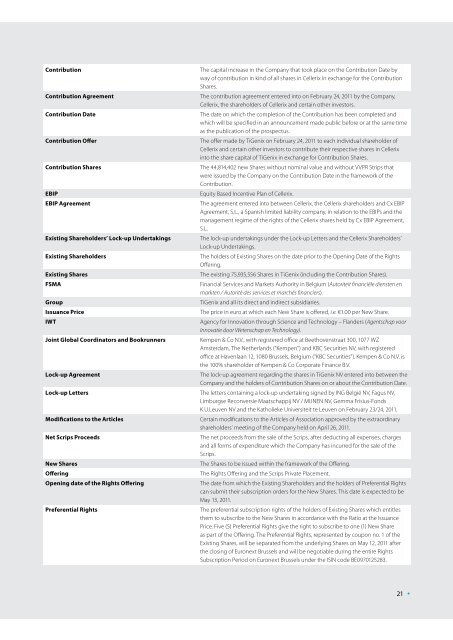

ContributionContribution AgreementContribution DateContribution OfferContribution SharesEBIPEBIP AgreementExisting Shareholders’ Lock-up UndertakingsExisting ShareholdersExisting SharesFSMAGroupIssuance PriceIWTJoint Global Coordinators and BookrunnersLock-up AgreementLock-up LettersModifications to the ArticlesNet Scrips ProceedsNew SharesOfferingOpening date of the Rights OfferingPreferential RightsThe capital increase in the Company that took place on the Contribution Date byway of contribution in kind of all shares in Cellerix in exchange for the ContributionShares.The contribution agreement entered into on February 24, 2011 by the Company,Cellerix, the shareholders of Cellerix and certain other investors.The date on which the completion of the Contribution has been completed andwhich will be specified in an announcement made public before or at the same timeas the publication of the prospectus.The offer made by <strong>TiGenix</strong> on February 24, 2011 to each individual shareholder ofCellerix and certain other investors to contribute their respective shares in Cellerixinto the share capital of <strong>TiGenix</strong> in exchange for Contribution Shares.The 44,814,402 new Shares without nominal value and without VVPR Strips thatwere issued by the Company on the Contribution Date in the framework of theContribution.Equity Based Incentive Plan of Cellerix.The agreement entered into between Cellerix, the Cellerix shareholders and Cx EBIPAgreement, S.L., a Spanish limited liability company, in relation to the EBIPs and themanagement regime of the rights of the Cellerix shares held by Cx EBIP Agreement,S.L.The lock-up undertakings under the Lock-up Letters and the Cellerix Shareholders’Lock-up Undertakings.The holders of Existing Shares on the date prior to the Opening Date of the RightsOffering.The existing 75,935,556 Shares in <strong>TiGenix</strong> (including the Contribution Shares).Financial Services and Markets Authority in Belgium (Autoriteit financiële diensten enmarkten / Autorité des services et marchés financiers).<strong>TiGenix</strong> and all its direct and indirect subsidiaries.The price in euro at which each New Share is offered, i.e. €1.00 per New Share.Agency for Innovation through Science and Technology – Flanders (Agentschap voorInnovatie door Wetenschap en Technology).Kempen & Co N.V., with registered office at Beethovenstraat 300, 1077 WZAmsterdam, The Netherlands (“Kempen”) and KBC Securities NV, with registeredoffice at Havenlaan 12, 1080 Brussels, Belgium (“KBC Securities”). Kempen & Co N.V. isthe 100% shareholder of Kempen & Co Corporate Finance B.V.The lock-up agreement regarding the shares in <strong>TiGenix</strong> NV entered into between theCompany and the holders of Contribution Shares on or about the Contribution Date.The letters containing a lock-up undertaking signed by ING België NV, Fagus NV,Limburgse Reconversie Maatschappij NV / MIJNEN NV, Gemma Frisius-FondsK.U.Leuven NV and the Katholieke Universiteit te Leuven on February 23/24, 2011.Certain modifications to the Articles of Association approved by the extraordinaryshareholders’ meeting of the Company held on April 26, 2011.The net proceeds from the sale of the Scrips, after deducting all expenses, chargesand all forms of expenditure which the Company has incurred for the sale of theScrips.The Shares to be issued within the framework of the Offering.The Rights Offering and the Scrips Private Placement.The date from which the Existing Shareholders and the holders of Preferential Rightscan submit their subscription orders for the New Shares. This date is expected to beMay 13, 2011.The preferential subscription rights of the holders of Existing Shares which entitlesthem to subscribe to the New Shares in accordance with the Ratio at the IssuancePrice. Five (5) Preferential Rights give the right to subscribe to one (1) New Shareas part of the Offering. The Preferential Rights, represented by coupon no. 1 of theExisting Shares, will be separated from the underlying Shares on May 12, 2011 afterthe closing of Euronext Brussels and will be negotiable during the entire RightsSubscription Period on Euronext Brussels under the ISIN code BE0970125283.21 •