Notes to the consolidated fi nancial statementsManagement <strong>report</strong>Consolidatedfinancial statements<strong>Annual</strong> financial statementsAdditional informationC. ASSETS AND LIABILITIES INCLUDEDIN DISPOSAL GROUPS HELD FOR SALEYear 2008The Insurance activity of FSA Holdings has been recorded asa group held for sale as from 1 October 2008 (signed on14 november).The Share Purchase Agreement with Assured Guaranty stipulateda purchase price consisting of a 50/50 payment in cash(USD 361 mio) and stock (44.6 mio shares).At the date of signing both cash and stock portion equalledUSD 361 mio (stock portion being 44.6 mio shares at a priceof USD 8.1, the Assured Guaranty share price at the date ofsigning).At closing, Assured Guaranty had the option to substituteUSD 8.1 in cash per share for up to 22.3 mio of the 44.6 mioshares.As the number of shares and the value of shares at closingwere uncertain, the signing value of USD 8.1 has been usedfor accounting purposes.The assets of this activity have been summarised in one line inthe assets, the liabilities as well, and the difference betweenthe sold equity and the sale’s price has been recorded in “Netin<strong>com</strong>e on investments”.The 4Q 2008 result has been consolidated line by line, as inprevious quarters, as <strong>Dexia</strong> still had a control on this activity,but the economic result as from 1 October 2008 was forAssured Guaranty, as the price was based on the equity at30 September 2008, except in some exceptional conditions.Details and figures are <strong>report</strong>ed in <strong>Dexia</strong>’s annual <strong>report</strong>2008, note 9.6.C.Year <strong>2009</strong>As required by IFRS 5, the assets and liabilities of <strong>Dexia</strong>Epargne Pension (DEP) have been recorded as a group heldfor sale as from 31 December <strong>2009</strong>.As at 9 December <strong>2009</strong>, <strong>Dexia</strong> signed an agreement relatingto the sale of <strong>Dexia</strong> Epargne Pension to BNP ParibasAssurance.The transaction is expected to be finalised during the firsthalf of 2010.The assets and liabilities included in the group held for sale are as follows: <strong>2009</strong>DEPCash and cash equivalents 126Loans and advances due from banks 2Loans and advances to customers 377Financial assets measured at fair value through profit and loss 1,658Financial investments 2,066Other assets 66Non current assets held for sale 4,295Due to banks (109)Subordinated debts (108)Technical provisions of insurance <strong>com</strong>panies (4,072)Other liabilities (43)Liabilities included in disposal groups held for sale (4,332)NET ASSETS (37)9.6. EquityBy category of share 2008 <strong>2009</strong>Number of shares authorised and not issued 352,542,645 1,760,513,402Number of shares issued and fully paid 1,762,478,783 1,762,478,783Number of shares issued and not fully paid 0 0Value per share no nominal value no nominal valueOutstanding as at 1 Jan. 1,178,576,763 1,762,478,783Number of shares issued 606,160,256 0Number of shares cancelled (22,258,236) 0Outstanding as at 31 Dec. 1,762,478,783 1,762,478,783Rights, preferences and restrictions, including restrictions on the distributionof dividends and the repayment of capital 0 0Number of treasury shares 293,570 293,570Number of shares reserved for issue under stock options and contractsfor the sale of share 293,570 293,570See note 9.4.C. Warrants granted to the Belgian and the French States.See note 9.7. Stock option plan.170<strong>Dexia</strong> <strong>Annual</strong> <strong>report</strong> <strong>2009</strong>

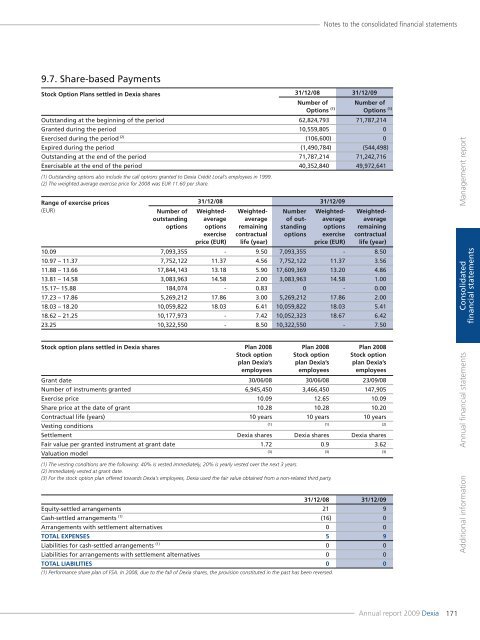

Notes to the consolidated fi nancial statements9.7. Share-based PaymentsStock Option Plans settled in <strong>Dexia</strong> shares 31/12/08 31/12/09Number ofOptions (1)Number ofOptions (1)Outstanding at the beginning of the period 62,824,793 71,787,214Granted during the period 10,559,805 0Exercised during the period (2) (106,600) 0Expired during the period (1,490,784) (544,498)Outstanding at the end of the period 71,787,214 71,242,716Exercisable at the end of the period 40,352,840 49,972,641(1) Outstanding options also include the call options granted to <strong>Dexia</strong> Crédit Local’s employees in 1999.(2) The weighted average exercise price for 2008 was EUR 11.60 per share.Range of exercise prices(EUR)Number ofoutstandingoptions31/12/08 31/12/09Weightedaverageoptionsexerciseprice (EUR)Weightedaverageremainingcontractuallife (year)Numberof outstandingoptionsWeightedaverageoptionsexerciseprice (EUR)Weightedaverageremainingcontractuallife (year)10.09 7,093,355 - 9.50 7,093,355 - 8.5010.97 – 11.37 7,752,122 11.37 4.56 7,752,122 11.37 3.5611.88 – 13.66 17,844,143 13.18 5.90 17,609,369 13.20 4.8613.81 – 14.58 3,083,963 14.58 2.00 3,083,963 14.58 1.0015.17– 15.88 184,074 - 0.83 0 - 0.0017.23 – 17.86 5,269,212 17.86 3.00 5,269,212 17.86 2.0018.03 – 18.20 10,059,822 18.03 6.41 10,059,822 18.03 5.4118.62 – 21.25 10,177,973 - 7.42 10,052,323 18.67 6.4223.25 10,322,550 - 8.50 10,322,550 - 7.50Management <strong>report</strong>Consolidatedfinancial statementsStock option plans settled in <strong>Dexia</strong> shares Plan 2008Stock optionplan <strong>Dexia</strong>’semployeesPlan 2008Stock optionplan <strong>Dexia</strong>’semployeesPlan 2008Stock optionplan <strong>Dexia</strong>’semployeesGrant date 30/06/08 30/06/08 23/09/08Number of instruments granted 6,945,450 3,466,450 147,905Exercise price 10.09 12.65 10.09Share price at the date of grant 10.28 10.28 10.20Contractual life (years) 10 years 10 years 10 yearsVesting conditions(1) (1) (2)Settlement <strong>Dexia</strong> shares <strong>Dexia</strong> shares <strong>Dexia</strong> sharesFair value per granted instrument at grant date 1.72 0.9 3.62Valuation model(3) (3) (3)(1) The vesting conditions are the following: 40% is vested immediately, 20% is yearly vested over the next 3 years.(2) Immediately vested at grant date.(3) For the stock option plan offered towards <strong>Dexia</strong>’s employees, <strong>Dexia</strong> used the fair value obtained from a non-related third party.31/12/08 31/12/09Equity-settled arrangements 21 9Cash-settled arrangements (1) (16) 0Arrangements with settlement alternatives 0 0TOTAL EXPENSES 5 9Liabilities for cash-settled arrangements (1) 0 0Liabilities for arrangements with settlement alternatives 0 0TOTAL LIABILITIES 0 0(1) Performance share plan of FSA. In 2008, due to the fall of <strong>Dexia</strong> shares, the provision constituted in the past has been reversed.<strong>Annual</strong> financial statementsAdditional information<strong>Annual</strong> <strong>report</strong> <strong>2009</strong> <strong>Dexia</strong> 171