Annual report 2009 - Dexia.com

Annual report 2009 - Dexia.com

Annual report 2009 - Dexia.com

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

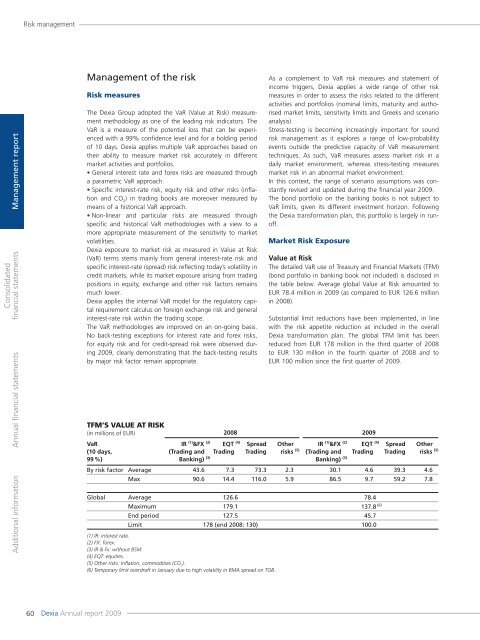

Risk managementManagement <strong>report</strong>Consolidatedfinancial statements<strong>Annual</strong> financial statementsAdditional informationManagement of the riskRisk measuresThe <strong>Dexia</strong> Group adopted the VaR (Value at Risk) measurementmethodology as one of the leading risk indicators. TheVaR is a measure of the potential loss that can be experiencedwith a 99% confidence level and for a holding periodof 10 days. <strong>Dexia</strong> applies multiple VaR approaches based ontheir ability to measure market risk accurately in differentmarket activities and portfolios.• General interest rate and forex risks are measured througha parametric VaR approach.• Specific interest-rate risk, equity risk and other risks (inflationand CO 2) in trading books are moreover measured bymeans of a historical VaR approach.• Non-linear and particular risks are measured throughspecific and historical VaR methodologies with a view to amore appropriate measurement of the sensitivity to marketvolatilities.<strong>Dexia</strong> exposure to market risk as measured in Value at Risk(VaR) terms stems mainly from general interest-rate risk andspecific interest-rate (spread) risk reflecting today’s volatility incredit markets, while its market exposure arising from tradingpositions in equity, exchange and other risk factors remainsmuch lower.<strong>Dexia</strong> applies the internal VaR model for the regulatory capitalrequirement calculus on foreign exchange risk and generalinterest-rate risk within the trading scope.The VaR methodologies are improved on an on-going basis.No back-testing exceptions for interest rate and forex risks,for equity risk and for credit-spread risk were observed during<strong>2009</strong>, clearly demonstrating that the back-testing resultsby major risk factor remain appropriate.As a <strong>com</strong>plement to VaR risk measures and statement ofin<strong>com</strong>e triggers, <strong>Dexia</strong> applies a wide range of other riskmeasures in order to assess the risks related to the differentactivities and portfolios (nominal limits, maturity and authorisedmarket limits, sensitivity limits and Greeks and scenarioanalysis).Stress-testing is be<strong>com</strong>ing increasingly important for soundrisk management as it explores a range of low-probabilityevents outside the predictive capacity of VaR measurementtechniques. As such, VaR measures assess market risk in adaily market environment, whereas stress-testing measuresmarket risk in an abnormal market environment.In this context, the range of scenario assumptions was constantlyrevised and updated during the financial year <strong>2009</strong>.The bond portfolio on the banking books is not subject toVaR limits, given its different investment horizon. Followingthe <strong>Dexia</strong> transformation plan, this portfolio is largely in runoff.Market Risk ExposureValue at RiskThe detailed VaR use of Treasury and Financial Markets (TFM)(bond portfolio in banking book not included) is disclosed inthe table below. Average global Value at Risk amounted toEUR 78.4 million in <strong>2009</strong> (as <strong>com</strong>pared to EUR 126.6 millionin 2008).Substantial limit reductions have been implemented, in linewith the risk appetite reduction as included in the overall<strong>Dexia</strong> transformation plan. The global TFM limit has beenreduced from EUR 178 million in the third quarter of 2008to EUR 130 million in the fourth quarter of 2008 and toEUR 100 million since the first quarter of <strong>2009</strong>.TFM’S VALUE AT RISK(in millions of EUR) 2008 <strong>2009</strong>EQT (4)IR (1) &FX (2) EQT (4)VaRIR (1) &FX (2)Spread OtherSpread Other99 %)Banking) (3) Banking) (3)(10 days,(Trading and Trading Trading risks (5) (Trading and Trading Trading risks (5)By risk factor Average 43.6 7.3 73.3 2.3 30.1 4.6 39.3 4.6Max 90.6 14.4 116.0 5.9 86.5 9.7 59.2 7.8Global Average 126.6 78.4Maximum 179.1 137.8 (6)End period 127.5 45.7Limit 178 (end 2008: 130) 100.0(1) IR: interest rate.(2) FX: forex.(3) IR & Fx: without BSM.(4) EQT: equities.(5) Other risks: Inflation, <strong>com</strong>modities (CO 2).(6) Temporary limit overdraft in January due to high volatility in BMA spread on TOB.60<strong>Dexia</strong> <strong>Annual</strong> <strong>report</strong> <strong>2009</strong>