Notes to the consolidated fi nancial statementsManagement <strong>report</strong>Consolidatedfinancial statements<strong>Annual</strong> financial statementsAdditional informationparameters (such as equity prices) resulted in a significantshift in the fair value;• For some financial assets, mainly bonds, liquidity riskbecame a more important factor in the determination of thefair value and therefore led to a classification into level 3;• Most of <strong>com</strong>plex derivatives were reclassified into level 3due to the definition published by the amended IFRS 7. Notethat <strong>com</strong>plex products are mostly back-to-back structures.Evolution of level 3 instruments during <strong>2009</strong> can be explainedas follows:• Some markets recovered during <strong>2009</strong>, such as for Germanand French covered bonds and some bank securities,so those instruments moved in the fair value hierarchy fromlevel 3 to level 2;• The column “Total gains/losses in P/L” can not be analysedon a stand alone basis, as some assets/liabilities classified inamortised cost or in level 1 or 2 may be hedged by derivativesclassified in level 3. We refer to the note 11.4. – Resultof hedge accounting – to have an economic view on the P/Limpact;• Improvement in internal model as well as increasing theback-testing resulted in a transfer between levels; mainlyfrom level 3 to level 2;• During its review of classification in levels in <strong>2009</strong>, <strong>Dexia</strong>identified that some senior banks bonds, classified as liquidand therefore level 2, became illiquid. By consequence, theywere transferred to level 3;• High sales and low purchases of financial instruments aremainly explained by management decision to:(i) stop proprietary trading activities; and(ii) decrease <strong>Dexia</strong>’s bond portfolio.However, impact in P&L is rather limited due to the fact thatstructured financial instruments are fully hedged: not onlythe interest-rate risk but also the risks attached to the structurevia back-to-back derivatives.E. SENSITIVITY OF LEVEL 3 VALUATIONS TOALTERNATIVE ASSUMPTIONSFor its Mark-to-Model price, <strong>Dexia</strong> uses a discount cash-flowmodel. The sensitivity measures the impact on fair value ofalternative assumptions used for unobservable parameters atclosing date.When using its models, <strong>Dexia</strong> decided to elaborate alternativeassumptions on the unobservable parameters, mainly:• credit spreads; depending on availability of credit spreadsfor the same counterparty, or credit spreads based on similarcounterparties, similar sectors or by using credit risk indexedon liquid CDS indexes;• liquidity premiums; that are mainly used in the context ofcalculating the fair value for bonds and mainly depend onthe ability of qualifying as eligible for the refinancing at CentralBanks;• illiquidity of the financial instrument, depending on theliquidity of the market for the same instrument, similar products,including the analysis of the difference between bid andask prices for real transactions.Tests have been performed on all financial instruments classifiedin level 3. The main impacts are the following:• For level 3 bonds in AFS, the sensitivity of the AFS reserve toalternative assumptions is estimated between a positive impact ofEUR +377 million and a negative impact of EUR -189 million.• Negative Basis Trades are considered as one single producton the market, and are therefore tested for the bond andits related CDS together. The main assumption having animpact on their fair value is the unwinding (bid-ask spread)impact. Based on the important number of unwinds performedby <strong>Dexia</strong> in <strong>2009</strong>, and taking into account the stockof remaining NBT transactions, the positive impact (medianunwind premium of <strong>2009</strong>) is EUR +5 million whereas thenegative impact (highest unwind premium of <strong>2009</strong>) gives animpact of EUR -18 million.<strong>Dexia</strong> tested the impact of different unobservable parametersfor its derivatives, like exotic currencies, interest-rate volatility(unobservable vega and smile) and correlation, model uncertainties,extrapolation for long-term periods, equities’ sensitivities(unobservable vega, dividend volatility, correlation,etc). The main impacts relate to correlation on CMS-spreadoptions, estimated at EUR +8 million (positive scenario) orEUR -8 million (negative scenario), and to credit spread onCDS, where the impact is estimated at EUR +32 million(positive scenario) versus EUR -28 million (negative scenario)before tax.F. DISCLOSURE OF DIFFERENCE BETWEENTRANSACTION PRICES AND MODELED VALUES(DEFERRED DAY ONE PROFIT)No significant amounts are recognised as deferred Day OneProfit (DOP) as at 31 December 2008 nor as at 31 December<strong>2009</strong>.DOP is recognised up-front on simple products like Interest-Rate Swaps (IRS) or <strong>com</strong>plex products (like structured transactions)that are backed-to-back.Day one profit taken up-front amounted respectively toEUR 45 million and EUR 23 million as at 31 December 2008and as at 31 December <strong>2009</strong>. The amounts are recognised inNet trading in<strong>com</strong>e (disclosure 11.4.).190<strong>Dexia</strong> <strong>Annual</strong> <strong>report</strong> <strong>2009</strong>

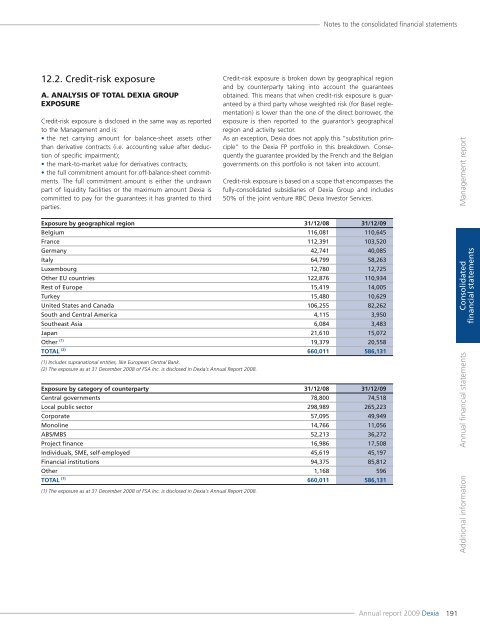

Notes to the consolidated fi nancial statements12.2. Credit-risk exposureA. ANALYSIS OF TOTAL DEXIA GROUPEXPOSURECredit-risk exposure is disclosed in the same way as <strong>report</strong>edto the Management and is:• the net carrying amount for balance-sheet assets otherthan derivative contracts (i.e. accounting value after deductionof specific impairment);• the mark-to-market value for derivatives contracts;• the full <strong>com</strong>mitment amount for off-balance-sheet <strong>com</strong>mitments.The full <strong>com</strong>mitment amount is either the undrawnpart of liquidity facilities or the maximum amount <strong>Dexia</strong> is<strong>com</strong>mitted to pay for the guarantees it has granted to thirdparties.Credit-risk exposure is broken down by geographical regionand by counterparty taking into account the guaranteesobtained. This means that when credit-risk exposure is guaranteedby a third party whose weighted risk (for Basel reglementation)is lower than the one of the direct borrower, theexposure is then <strong>report</strong>ed to the guarantor’s geographicalregion and activity sector.As an exception, <strong>Dexia</strong> does not apply this “substitution principle”to the <strong>Dexia</strong> FP portfolio in this breakdown. Consequentlythe guarantee provided by the French and the Belgiangovernments on this portfolio is not taken into account.Credit-risk exposure is based on a scope that en<strong>com</strong>passes thefully-consolidated subsidiaries of <strong>Dexia</strong> Group and includes50% of the joint venture RBC <strong>Dexia</strong> Investor Services.Management <strong>report</strong>Exposure by geographical region 31/12/08 31/12/09Belgium 116,081 110,645France 112,391 103,520Germany 42,741 40,085Italy 64,799 58,263Luxembourg 12,780 12,725Other EU countries 122,876 110,934Rest of Europe 15,419 14,005Turkey 15,480 10,629United States and Canada 106,255 82,262South and Central America 4,115 3,950Southeast Asia 6,084 3,483Japan 21,610 15,072Other (1) 19,379 20,558TOTAL (2) 660,011 586,131(1) Includes supranational entities, like European Central Bank.(2) The exposure as at 31 December 2008 of FSA Inc. is disclosed in <strong>Dexia</strong>’s <strong>Annual</strong> Report 2008.Exposure by category of counterparty 31/12/08 31/12/09Central governments 78,800 74,518Local public sector 298,989 265,223Corporate 57,095 49,949Monoline 14,766 11,056ABS/MBS 52,213 36,272Project finance 16,986 17,508Individuals, SME, self-employed 45,619 45,197Financial institutions 94,375 85,812Other 1,168 596TOTAL (1) 660,011 586,131(1) The exposure as at 31 December 2008 of FSA Inc. is disclosed in <strong>Dexia</strong>’s <strong>Annual</strong> Report 2008.Consolidatedfinancial statements<strong>Annual</strong> financial statementsAdditional information<strong>Annual</strong> <strong>report</strong> <strong>2009</strong> <strong>Dexia</strong> 191