Annual report 2009 - Dexia.com

Annual report 2009 - Dexia.com

Annual report 2009 - Dexia.com

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

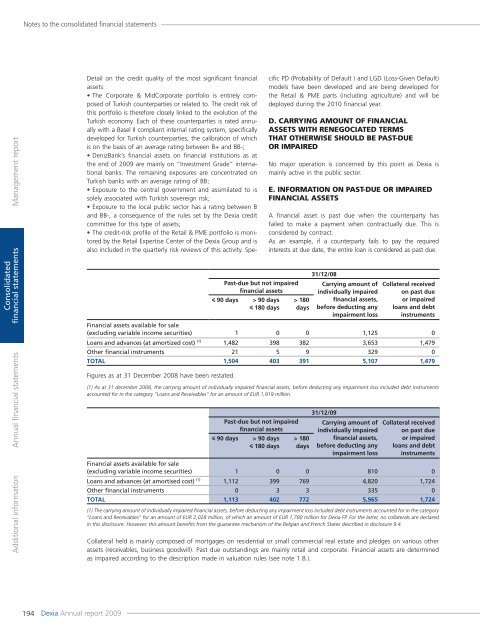

Notes to the consolidated fi nancial statementsManagement <strong>report</strong>Consolidatedfinancial statements<strong>Annual</strong> financial statementsAdditional informationPast-due but not impairedfinancial assets90 days > 90 days180 days> 180days31/12/08Carrying amount ofindividually impairedfinancial assets,before deducting anyimpairment lossCollateral receivedon past dueor impairedloans and debtinstrumentsFinancial assets available for sale(excluding variable in<strong>com</strong>e securities) 1 0 0 1,125 0Loans and advances (at amortized cost) (1) 1,482 398 382 3,653 1,479Other financial instruments 21 5 9 329 0TOTAL 1,504 403 391 5,107 1,479Figures as at 31 December 2008 have been restated.(1) As at 31 december 2008, the carrying amount of individually impaired financial assets, before deducting any impairment loss included debt instrumentsaccounted for in the category “Loans and Receivables” for an amount of EUR 1,919 million.Past-due but not impairedfinancial assets90 days > 90 days180 daysDetail on the credit quality of the most significant financialassets:• The Corporate & MidCorporate portfolio is entirely <strong>com</strong>posedof Turkish counterparties or related to. The credit risk ofthis portfolio is therefore closely linked to the evolution of theTurkish economy. Each of these counterparties is rated annuallywith a Basel II <strong>com</strong>pliant internal rating system, specificallydeveloped for Turkish counterparties, the calibration of whichis on the basis of an average rating between B+ and BB-;• DenizBank’s financial assets on financial institutions as atthe end of <strong>2009</strong> are mainly on “Investment Grade” internationalbanks. The remaining exposures are concentrated onTurkish banks with an average rating of BB;• Exposure to the central government and assimilated to issolely associated with Turkish sovereign risk;• Exposure to the local public sector has a rating between Band BB-, a consequence of the rules set by the <strong>Dexia</strong> credit<strong>com</strong>mittee for this type of assets;• The credit-risk profile of the Retail & PME portfolio is monitoredby the Retail Expertise Center of the <strong>Dexia</strong> Group and isalso included in the quarterly risk reviews of this activity. SpecificPD (Probability of Default ) and LGD (Loss-Given Default)models have been developed and are being developed forthe Retail & PME parts (including agriculture) and will bedeployed during the 2010 financial year.D. CARRYING AMOUNT OF FINANCIALASSETS WITH RENEGOCIATED TERMSTHAT OTHERWISE SHOULD BE PAST-DUEOR IMPAIREDNo major operation is concerned by this point as <strong>Dexia</strong> ismainly active in the public sector.E. INFORMATION ON PAST-DUE OR IMPAIREDFINANCIAL ASSETSA financial asset is past due when the counterparty hasfailed to make a payment when contractually due. This isconsidered by contract.As an example, if a counterparty fails to pay the requiredinterests at due date, the entire loan is considered as past due.> 180days31/12/09Carrying amount ofindividually impairedfinancial assets,before deducting anyimpairment lossCollateral receivedon past dueor impairedloans and debtinstrumentsFinancial assets available for sale(excluding variable in<strong>com</strong>e securities) 1 0 0 810 0Loans and advances (at amortised cost) (1) 1,112 399 769 4,820 1,724Other financial instruments 0 3 3 335 0TOTAL 1,113 402 772 5,965 1,724(1) The carrying amount of individually impaired financial assets, before deducting any impairment loss included debt instruments accounted for in the category“Loans and Receivables” for an amount of EUR 2,028 million, of which an amount of EUR 1,780 million for <strong>Dexia</strong> FP. For the latter, no collaterals are declaredin this disclosure. However, this amount benefits from the guarantee mechanism of the Belgian and French States described in disclosure 9.4.Collateral held is mainly <strong>com</strong>posed of mortgages on residential or small <strong>com</strong>mercial real estate and pledges on various otherassets (receivables, business goodwill). Past due outstandings are mainly retail and corporate. Financial assets are determinedas impaired according to the description made in valuation rules (see note 1.8.).194<strong>Dexia</strong> <strong>Annual</strong> <strong>report</strong> <strong>2009</strong>