Reports - Mississippi Renewal

Reports - Mississippi Renewal

Reports - Mississippi Renewal

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

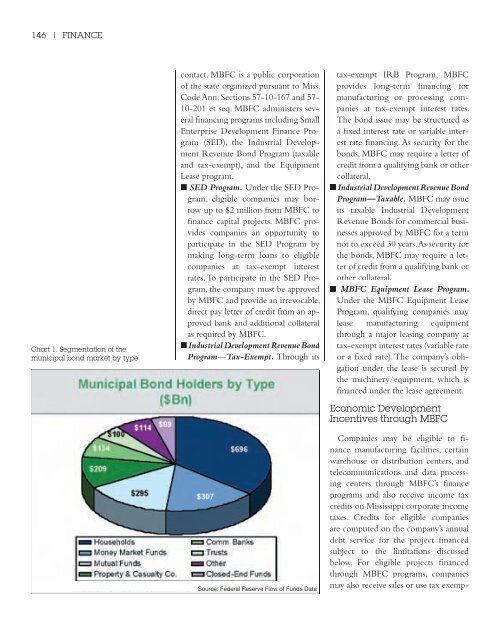

146 | FINANCEChart 1. Segmentation of themunicipal bond market by type.contact. MBFC is a public corporationof the state organized pursuant to Miss.Code Ann. Sections 57-10-167 and 57-10-201 et seq. MBFC administers severalfinancing programs including SmallEnterprise Development Finance Program(SED), the Industrial DevelopmentRevenue Bond Program (taxableand tax-exempt), and the EquipmentLease program.■ SED Program. Under the SED Program,eligible companies may borrowup to $2 million from MBFC tofinance capital projects. MBFC providescompanies an opportunity toparticipate in the SED Program bymaking long-term loans to eligiblecompanies at tax-exempt interestrates. To participate in the SED Program,the company must be approvedby MBFC and provide an irrevocable,direct pay letter of credit from an approvedbank and additional collateralas required by MBFC.■ Industrial Development Revenue BondProgram—Tax-Exempt. Through itsSource: Federal Reserve Flow of Funds Datatax-exempt IRB Program, MBFCprovides long-term financing formanufacturing or processing companiesat tax-exempt interest rates.The bond issue may be structured asa fixed interest rate or variable interestrate financing. As security for thebonds, MBFC may require a letter ofcredit from a qualifying bank or othercollateral.■ Industrial Development Revenue BondProgram—Taxable. MBFC may issueits taxable Industrial DevelopmentRevenue Bonds for commercial businessesapproved by MBFC for a termnot to exceed 30 years. As security forthe bonds, MBFC may require a letterof credit from a qualifying bank orother collateral.■ MBFC Equipment Lease Program.Under the MBFC Equipment LeaseProgram, qualifying companies maylease manufacturing equipmentthrough a major leasing company attax-exempt interest rates (variable rateor a fixed rate). The company’s obligationunder the lease is secured bythe machinery/equipment, which isfinanced under the lease agreement.Economic DevelopmentIncentives through MBFCCompanies may be eligible to financemanufacturing facilities, certainwarehouse or distribution centers, andtelecommunications and data processingcenters through MBFC’s financeprograms and also receive income taxcredits on <strong>Mississippi</strong> corporate incometaxes. Credits for eligible companiesare computed on the company’s annualdebt service for the project financedsubject to the limitations discussedbelow. For eligible projects financedthrough MBFC programs, companiesmay also receive sales or use tax exemp-