Reports - Mississippi Renewal

Reports - Mississippi Renewal

Reports - Mississippi Renewal

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

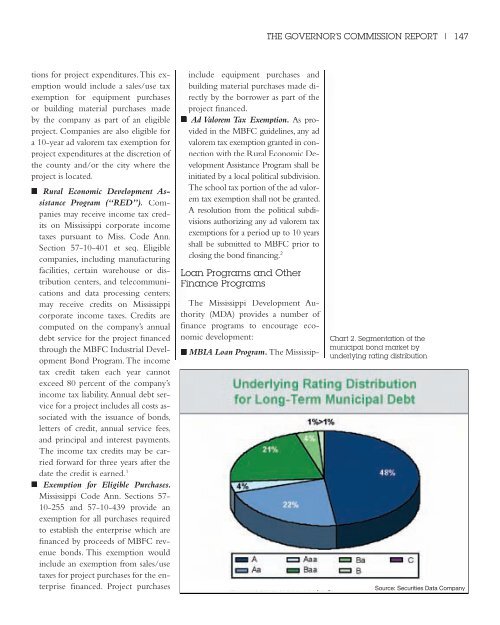

THE GOVERNOR’S COMMISSION REPORT | 147tions for project expenditures. This exemptionwould include a sales/use taxexemption for equipment purchasesor building material purchases madeby the company as part of an eligibleproject. Companies are also eligible fora 10-year ad valorem tax exemption forproject expenditures at the discretion ofthe county and/or the city where theproject is located.■ Rural Economic Development AssistanceProgram (“RED”). Companiesmay receive income tax creditson <strong>Mississippi</strong> corporate incometaxes pursuant to Miss. Code Ann.Section 57-10-401 et seq. Eligiblecompanies, including manufacturingfacilities, certain warehouse or distributioncenters, and telecommunicationsand data processing centers;may receive credits on <strong>Mississippi</strong>corporate income taxes. Credits arecomputed on the company’s annualdebt service for the project financedthrough the MBFC Industrial DevelopmentBond Program. The incometax credit taken each year cannotexceed 80 percent of the company’sincome tax liability. Annual debt servicefor a project includes all costs associatedwith the issuance of bonds,letters of credit, annual service fees,and principal and interest payments.The income tax credits may be carriedforward for three years after thedate the credit is earned. 1■ Exemption for Eligible Purchases.<strong>Mississippi</strong> Code Ann. Sections 57-10-255 and 57-10-439 provide anexemption for all purchases requiredto establish the enterprise which arefinanced by proceeds of MBFC revenuebonds. This exemption wouldinclude an exemption from sales/usetaxes for project purchases for the enterprisefinanced. Project purchasesinclude equipment purchases andbuilding material purchases made directlyby the borrower as part of theproject financed.■ Ad Valorem Tax Exemption. As providedin the MBFC guidelines, any advalorem tax exemption granted in connectionwith the Rural Economic DevelopmentAssistance Program shall beinitiated by a local political subdivision.The school tax portion of the ad valoremtax exemption shall not be granted.A resolution from the political subdivisionsauthorizing any ad valorem taxexemptions for a period up to 10 yearsshall be submitted to MBFC prior toclosing the bond financing. 2Loan Programs and OtherFinance ProgramsThe <strong>Mississippi</strong> Development Au-thority (MDA) provides a number offinance programs to encourage eco-nomic development:■ MBIA Loan Program. The Mississip-Chart 2. Segmentation of themunicipal bond market byunderlying rating distribution.Source: Securities Data Company