Reports - Mississippi Renewal

Reports - Mississippi Renewal

Reports - Mississippi Renewal

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

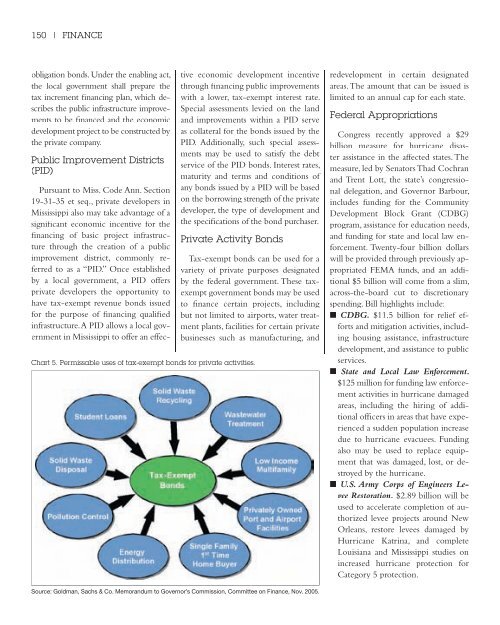

150 | FINANCEobligation bonds. Under the enabling act,the local government shall prepare thetax increment financing plan, which describesthe public infrastructure improvementsto be financed and the economicdevelopment project to be constructed bythe private company.Public Improvement Districts(PID)Pursuant to Miss. Code Ann. Section19-31-35 et seq., private developers in<strong>Mississippi</strong> also may take advantage of asignificant economic incentive for thefinancing of basic project infrastructurethrough the creation of a publicimprovement district, commonly referredto as a “PID.” Once establishedby a local government, a PID offersprivate developers the opportunity tohave tax-exempt revenue bonds issuedfor the purpose of financing qualifiedinfrastructure. A PID allows a local governmentin <strong>Mississippi</strong> to offer an effectiveeconomic development incentivethrough financing public improvementswith a lower, tax-exempt interest rate.Special assessments levied on the landand improvements within a PID serveas collateral for the bonds issued by thePID. Additionally, such special assessmentsmay be used to satisfy the debtservice of the PID bonds. Interest rates,maturity and terms and conditions ofany bonds issued by a PID will be basedon the borrowing strength of the privatedeveloper, the type of development andthe specifications of the bond purchaser.Private Activity BondsTax-exempt bonds can be used for avariety of private purposes designatedby the federal government. These taxexemptgovernment bonds may be usedto finance certain projects, includingbut not limited to airports, water treatmentplants, facilities for certain privatebusinesses such as manufacturing, andChart 5. Permissable uses of tax-exempt bonds for private activities.redevelopment in certain designatedareas. The amount that can be issued islimited to an annual cap for each state.Federal AppropriationsCongress recently approved a $29billion measure for hurricane disasterassistance in the affected states. Themeasure, led by Senators Thad Cochranand Trent Lott, the state’s congressionaldelegation, and Governor Barbour,includes funding for the CommunityDevelopment Block Grant (CDBG)program, assistance for education needs,and funding for state and local law enforcement.Twenty-four billion dollarswill be provided through previously appropriatedFEMA funds, and an additional$5 billion will come from a slim,across-the-board cut to discretionaryspending. Bill highlights include:■ CDBG. $11.5 billion for relief effortsand mitigation activities, includinghousing assistance, infrastructuredevelopment, and assistance to publicservices.■ State and Local Law Enforcement.$125 million for funding law enforcementactivities in hurricane damagedareas, including the hiring of additionalofficers in areas that have experienceda sudden population increasedue to hurricane evacuees. Fundingalso may be used to replace equipmentthat was damaged, lost, or destroyedby the hurricane.■ U.S. Army Corps of Engineers LeveeRestoration. $2.89 billion will beused to accelerate completion of authorizedlevee projects around NewOrleans, restore levees damaged byHurricane Katrina, and completeLouisiana and <strong>Mississippi</strong> studies onincreased hurricane protection forCategory 5 protection.Source: Goldman, Sachs & Co. Memorandum to Governor’s Commission, Committee on Finance, Nov. 2005.