Reports - Mississippi Renewal

Reports - Mississippi Renewal

Reports - Mississippi Renewal

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

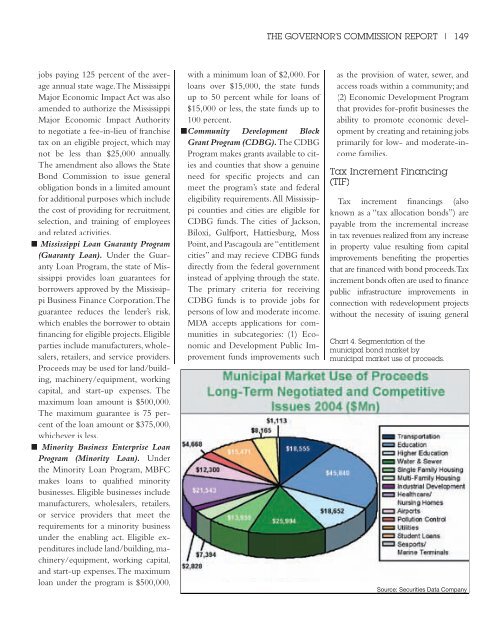

THE GOVERNOR’S COMMISSION REPORT | 149jobs paying 125 percent of the averageannual state wage. The <strong>Mississippi</strong>Major Economic Impact Act was alsoamended to authorize the <strong>Mississippi</strong>Major Economic Impact Authorityto negotiate a fee-in-lieu of franchisetax on an eligible project, which maynot be less than $25,000 annually.The amendment also allows the StateBond Commission to issue generalobligation bonds in a limited amountfor additional purposes which includethe cost of providing for recruitment,selection, and training of employeesand related activities.■ <strong>Mississippi</strong> Loan Guaranty Program(Guaranty Loan). Under the GuarantyLoan Program, the state of <strong>Mississippi</strong>provides loan guarantees forborrowers approved by the <strong>Mississippi</strong>Business Finance Corporation. Theguarantee reduces the lender’s risk,which enables the borrower to obtainfinancing for eligible projects. Eligibleparties include manufacturers, wholesalers,retailers, and service providers.Proceeds may be used for land/building,machinery/equipment, workingcapital, and start-up expenses. Themaximum loan amount is $500,000.The maximum guarantee is 75 percentof the loan amount or $375,000,whichever is less.■ Minority Business Enterprise LoanProgram (Minority Loan). Underthe Minority Loan Program, MBFCmakes loans to qualified minoritybusinesses. Eligible businesses includemanufacturers, wholesalers, retailers,or service providers that meet therequirements for a minority businessunder the enabling act. Eligible expendituresinclude land/building, machinery/equipment,working capital,and start-up expenses. The maximumloan under the program is $500,000,with a minimum loan of $2,000. Forloans over $15,000, the state fundsup to 50 percent while for loans of$15,000 or less, the state funds up to100 percent.■Community Development BlockGrant Program (CDBG). The CDBGProgram makes grants available to citiesand counties that show a genuineneed for specific projects and canmeet the program’s state and federaleligibility requirements. All <strong>Mississippi</strong>counties and cities are eligible forCDBG funds. The cities of Jackson,Biloxi, Gulfport, Hattiesburg, MossPoint, and Pascagoula are “entitlementcities” and may recieve CDBG fundsdirectly from the federal governmentinstead of applying through the state.The primary criteria for receivingCDBG funds is to provide jobs forpersons of low and moderate income.MDA accepts applications for communitiesin subcategories: (1) Economicand Development Public Improvementfunds improvements suchas the provision of water, sewer, andaccess roads within a community; and(2) Economic Development Programthat provides for-profit businesses theability to promote economic developmentby creating and retaining jobsprimarily for low- and moderate-incomefamilies.Tax Increment Financing(TIF)Tax increment financings (alsoknown as a “tax allocation bonds”) arepayable from the incremental increasein tax revenues realized from any increasein property value resulting from capitalimprovements benefiting the propertiesthat are financed with bond proceeds. Taxincrement bonds often are used to financepublic infrastructure improvements inconnection with redevelopment projectswithout the necessity of issuing generalChart 4. Segmentation of themunicipal bond market bymunicipal market use of proceeds.Source: Securities Data Company