Reports - Mississippi Renewal

Reports - Mississippi Renewal

Reports - Mississippi Renewal

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

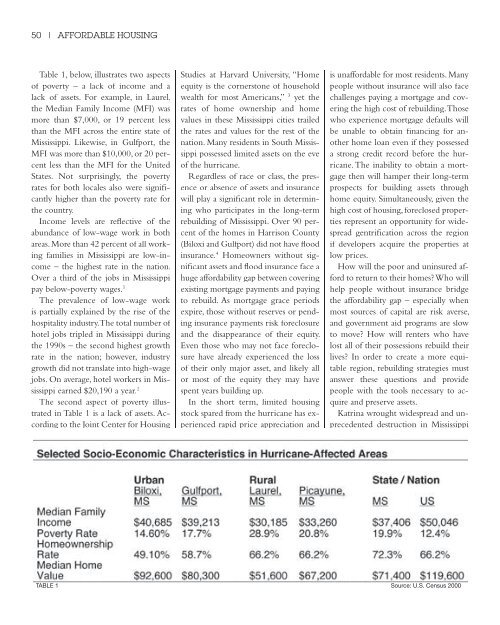

50 | AFFORDABLE HOUSINGTable 1, below, illustrates two aspectsof poverty – a lack of income and alack of assets. For example, in Laurel,the Median Family Income (MFI) wasmore than $7,000, or 19 percent lessthan the MFI across the entire state of<strong>Mississippi</strong>. Likewise, in Gulfport, theMFI was more than $10,000, or 20 percentless than the MFI for the UnitedStates. Not surprisingly, the povertyrates for both locales also were significantlyhigher than the poverty rate forthe country.Income levels are reflective of theabundance of low-wage work in bothareas. More than 42 percent of all workingfamilies in <strong>Mississippi</strong> are low-income– the highest rate in the nation.Over a third of the jobs in <strong>Mississippi</strong>pay below-poverty wages. 1The prevalence of low-wage workis partially explained by the rise of thehospitality industry. The total number ofhotel jobs tripled in <strong>Mississippi</strong> duringthe 1990s – the second highest growthrate in the nation; however, industrygrowth did not translate into high-wagejobs. On average, hotel workers in <strong>Mississippi</strong>earned $20,190 a year. 2The second aspect of poverty illustratedin Table 1 is a lack of assets. Accordingto the Joint Center for HousingStudies at Harvard University, “Homeequity is the cornerstone of householdwealth for most Americans,” 3 yet therates of home ownership and homevalues in these <strong>Mississippi</strong> cities trailedthe rates and values for the rest of thenation. Many residents in South <strong>Mississippi</strong>possessed limited assets on the eveof the hurricane.Regardless of race or class, the presenceor absence of assets and insurancewill play a significant role in determiningwho participates in the long-termrebuilding of <strong>Mississippi</strong>. Over 90 percentof the homes in Harrison County(Biloxi and Gulfport) did not have floodinsurance. 4 Homeowners without significantassets and flood insurance face ahuge affordability gap between coveringexisting mortgage payments and payingto rebuild. As mortgage grace periodsexpire, those without reserves or pendinginsurance payments risk foreclosureand the disappearance of their equity.Even those who may not face foreclosurehave already experienced the lossof their only major asset, and likely allor most of the equity they may havespent years building up.In the short term, limited housingstock spared from the hurricane has experiencedrapid price appreciation andis unaffordable for most residents. Manypeople without insurance will also facechallenges paying a mortgage and coveringthe high cost of rebuilding. Thosewho experience mortgage defaults willbe unable to obtain financing for anotherhome loan even if they possesseda strong credit record before the hurricane.The inability to obtain a mortgagethen will hamper their long-termprospects for building assets throughhome equity. Simultaneously, given thehigh cost of housing, foreclosed propertiesrepresent an opportunity for widespreadgentrification across the regionif developers acquire the properties atlow prices.How will the poor and uninsured affordto return to their homes? Who willhelp people without insurance bridgethe affordability gap – especially whenmost sources of capital are risk averse,and government aid programs are slowto move? How will renters who havelost all of their possessions rebuild theirlives? In order to create a more equitableregion, rebuilding strategies mustanswer these questions and providepeople with the tools necessary to acquireand preserve assets.Katrina wrought widespread and unprecedenteddestruction in <strong>Mississippi</strong>TABLE 1 Source: U.S. Census 2000