annual-and-sustainability-report-2014

annual-and-sustainability-report-2014

annual-and-sustainability-report-2014

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

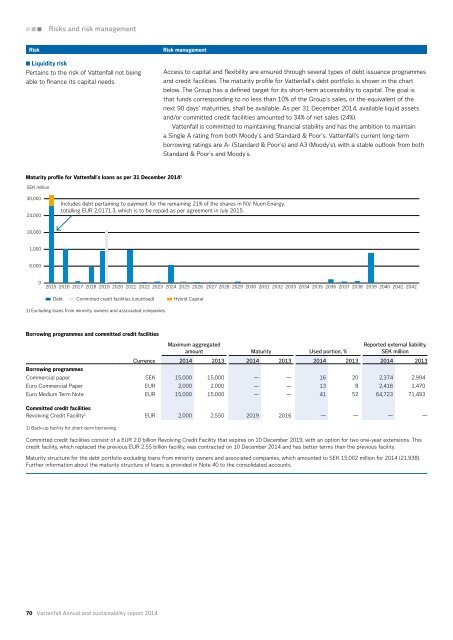

Risks <strong>and</strong> risk managementRiskLiquidity riskPertains to the risk of Vattenfall not beingable to finance its capital needs.Risk managementAccess to capital <strong>and</strong> flexibility are ensured through several types of debt issuance programmes<strong>and</strong> credit facilities. The maturity profile for Vattenfall’s debt portfolio is shown in the chartbelow. The Group has a defined target for its short-term accessibility to capital. The goal isthat funds corresponding to no less than 10% of the Group’s sales, or the equivalent of thenext 90 days’ maturities, shall be available. As per 31 December <strong>2014</strong>, available liquid assets<strong>and</strong>/or committed credit facilities amounted to 34% of net sales (24%).Vattenfall is committed to maintaining financial stability <strong>and</strong> has the ambition to maintaina Single A rating from both Moody’s <strong>and</strong> St<strong>and</strong>ard & Poor’s. Vattenfall’s current long-termborrowing ratings are A- (St<strong>and</strong>ard & Poor’s) <strong>and</strong> A3 (Moody’s), with a stable outlook from bothSt<strong>and</strong>ard & Poor’s <strong>and</strong> Moody’s.Maturity profile for Vattenfall’s loans as per 31 December <strong>2014</strong> 1SEK million30,00024,000Includes debt pertaining to payment for the remaining 21% of the shares in N.V. Nuon Energy,totalling EUR 2,0171.3, which is to be repaid as per agreement in July 2015.18,0001,0006,00002015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 20382039 2040 2041 2042Debt Committed credit facilities (unutilised) Hybrid Capital1) Excluding loans from minority owners <strong>and</strong> associated companies.Borrowing programmes <strong>and</strong> committed credit facilitiesMaximum aggregatedamount Maturity Used portion, %Reported external liability,SEK millionCurrency <strong>2014</strong> 2013 <strong>2014</strong> 2013 <strong>2014</strong> 2013 <strong>2014</strong> 2013Borrowing programmesCommercial paper SEK 15,000 15,000 — — 16 20 2,374 2,994Euro Commercial Paper EUR 2,000 2,000 — — 13 8 2,418 1,470Euro Medium Term Note EUR 15,000 15,000 — — 41 52 64,723 71,493Committed credit facilitiesRevolving Credit Facility 1 EUR 2,000 2,550 2019 2016 — — — —1) Back-up facility for short-term borrowing.Committed credit facilities consist of a EUR 2.0 billion Revolving Credit Facility that expires on 10 December 2019, with an option for two one-year extensions. Thiscredit facility, which replaced the previous EUR 2.55 billion facility, was contracted on 10 December <strong>2014</strong> <strong>and</strong> has better terms than the previous facility.Maturity structure for the debt portfolio excluding loans from minority owners <strong>and</strong> associated companies, which amounted to SEK 15,002 million for <strong>2014</strong> (21,938).Further information about the maturity structure of loans is provided in Note 40 to the consolidated accounts.70 Vattenfall Annual <strong>and</strong> <strong>sustainability</strong> <strong>report</strong> <strong>2014</strong>