annual-and-sustainability-report-2014

annual-and-sustainability-report-2014

annual-and-sustainability-report-2014

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

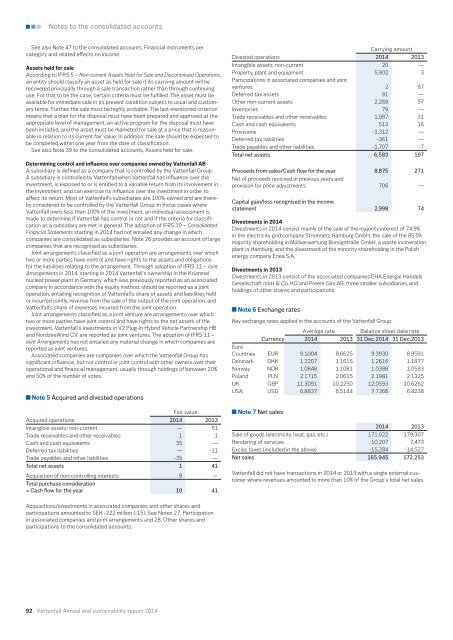

Notes to the consolidated accountsSee also Note 47 to the consolidated accounts, Financial instruments percategory <strong>and</strong> related effects on income.Assets held for saleAccording to IFRS 5 – Non-current Assets Held for Sale <strong>and</strong> Discontinued Operations,an entity should classify an asset as held for sale if its carrying amount will berecovered principally through a sale transaction rather than through continuinguse. For that to be the case, certain criteria must be fulfilled. The asset must beavailable for immediate sale in its present condition subject to usual <strong>and</strong> customaryterms. Further, the sale must be highly probable. The last-mentioned criterionmeans that a plan for the disposal must have been prepared <strong>and</strong> approved at theappropriate level of management, an active program for the disposal must havebeen initiated, <strong>and</strong> the asset must be marketed for sale at a price that is reasonablein relation to its current fair value. In addition, the sale should be expected tobe completed within one year from the date of classification.See also Note 39 to the consolidated accounts, Assets held for sale.Determining control <strong>and</strong> influence over companies owned by Vattenfall ABA subsidiary is defined as a company that is controlled by the Vattenfall Group.A subsidiary is controlled by Vattenfall when Vattenfall has influence over theinvestment, is exposed to or is entitled to a variable return from its involvement inthe investment, <strong>and</strong> can exercise its influence over the investment in order toaffect its return. Most of Vattenfall’s subsidiaries are 100%-owned <strong>and</strong> are therebyconsidered to be controlled by the Vattenfall Group. In those cases whereVattenfall owns less than 100% of the investment, an individual assessment ismade to determine if Vattenfall has control or not <strong>and</strong> if the criteria for classificationas a subsidiary are met in general. The adoption of IFRS 10 – ConsolidatedFinancial Statements starting in <strong>2014</strong> had not entailed any change in whichcompanies are consolidated as subsidiaries. Note 26 provides an account of largecompanies that are recognised as subsidiaries.Joint arrangements classified as a joint operation are arrangements over whichtwo or more parties have control <strong>and</strong> have rights to the assets <strong>and</strong> obligationsfor the liabilities relating to the arrangement. Through adoption of IFRS 11 – JointArrangements in <strong>2014</strong>, starting in <strong>2014</strong> Vattenfall’s ownership in the Krümmelnuclear power plant in Germany, which was previously <strong>report</strong>ed as an associatedcompany in accordance with the equity method, should be <strong>report</strong>ed as a jointoperation, entailing recognition of Vattenfall’s share of assets <strong>and</strong> liabilities heldor incurred jointly, revenue from the sale of the output of the joint operation, <strong>and</strong>Vattenfall’s share of expenses incurred from the joint operation.Joint arrangements classified as a joint venture are arrangements over whichtwo or more parties have joint control <strong>and</strong> have rights to the net assets of theinvestment. Vattenfall’s investments in V2 Plug-In Hybrid Vehicle Partnership HB<strong>and</strong> NordzeeWind C.V. are <strong>report</strong>ed as joint ventures. The adoption of IFRS 11 –Joint Arrangements has not entailed any material change in which companies are<strong>report</strong>ed as joint ventures.Associated companies are companies over which the Vattenfall Group hassignificant influence, but not control or joint control with other owners over theiroperational <strong>and</strong> financial management, usually through holdings of between 20%<strong>and</strong> 50% of the number of votes.Note 5 Acquired <strong>and</strong> divested operationsFair valueAcquired operations <strong>2014</strong> 2013Intangible assets: non-current — 51Trade receivables <strong>and</strong> other receivables 1 1Cash <strong>and</strong> cash equivalents 35 —Deferred tax liabilities — -11Trade payables <strong>and</strong> other liabilities -35 —Total net assets 1 41Acquisition of non-controlling interests 9 —Total purchase consideration= Cash flow for the year 10 41Carrying amountDivested operations <strong>2014</strong> 2013Intangible assets: non-current 20 —Property, plant <strong>and</strong> equipment 5,902 3Participations in associated companies <strong>and</strong> jointventures 2 97Deferred tax assets 91 —Other non-current assets 2,269 57Inventories 79 —Trade receivables <strong>and</strong> other receivables 1,087 31Cash <strong>and</strong> cash equivalents 513 16Provisions -1,312 —Deferred tax liabilities -361 —Trade payables <strong>and</strong> other liabilities -1,707 -7Total net assets 6,583 197Proceeds from sales/Cash flow for the year 8,875 271Net of proceeds received in previous years <strong>and</strong>provision for price adjustments 706 —Capital gain/loss recognised in the incomestatement 2,998 74Divestments in <strong>2014</strong>Divestments in <strong>2014</strong> consist mainly of the sale of the majority interest of 74.9%in the electricity grid company Stromnetz Hamburg GmbH, the sale of the 85.5%majority shareholding in Müllverwertung Borsigstraße GmbH, a waste incinerationplant in Hamburg, <strong>and</strong> the divestment of the minority shareholding in the Polishenergy company Enea S.A.Divestments in 2013Divestments in 2013 consist of the associated companies EHA Energie H<strong>and</strong>elsGesellschaft mbH & Co. KG <strong>and</strong> Preem Gas AB, three smaller subsidiaries, <strong>and</strong>holdings of other shares <strong>and</strong> participations.Note 6 Exchange ratesKey exchange rates applied in the accounts of the Vattenfall Group:Average rate Balance sheet date rateCurrency <strong>2014</strong> 2013 31 Dec.<strong>2014</strong> 31 Dec.2013EuroCountries EUR 9.1004 8.6625 9.3930 8.8591Denmark DKK 1.2207 1.1615 1.2616 1.1877Norway NOK 1.0848 1.1081 1.0388 1.0593Pol<strong>and</strong> PLN 2.1715 2.0615 2.1981 2.1325UK GBP 11.3091 10.2250 12.0593 10.6262USA USD 6.8837 6.5144 7.7366 6.4238Note 7 Net sales<strong>2014</strong> 2013Sale of goods (electricity, heat, gas, etc.) 171,022 179,307Rendering of services 10,207 7,473Excise taxes (included in the above) -15,284 -14,527Net sales 165,945 172,253Vattenfall did not have transactions in <strong>2014</strong> or 2013 with a single external customerwhere revenues amounted to more than 10% of the Group’s total net sales.Acquisitions/investments in associated companies <strong>and</strong> other shares <strong>and</strong>participations amounted to SEK -222 million (-15). See Notes 27, Participationin associated companies <strong>and</strong> joint arrangements <strong>and</strong> 28, Other shares <strong>and</strong>participations to the consolidated accounts.92 Vattenfall Annual <strong>and</strong> <strong>sustainability</strong> <strong>report</strong> <strong>2014</strong>