annual-and-sustainability-report-2014

annual-and-sustainability-report-2014

annual-and-sustainability-report-2014

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

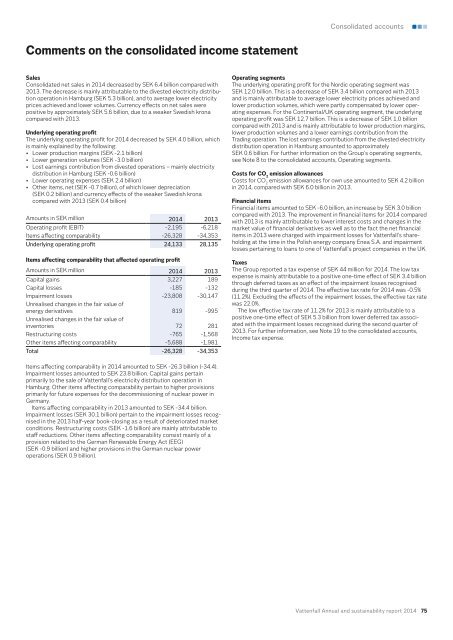

Consolidated accountsComments on the consolidated income statementSalesConsolidated net sales in <strong>2014</strong> decreased by SEK 6.4 billion compared with2013. The decrease is mainly attributable to the divested electricity distributionoperation in Hamburg (SEK 5.3 billion), <strong>and</strong> to average lower electricityprices achieved <strong>and</strong> lower volumes. Currency effects on net sales werepositive by approximately SEK 5.6 billion, due to a weaker Swedish kronacompared with 2013.Underlying operating profitThe underlying operating profit for <strong>2014</strong> decreased by SEK 4.0 billion, whichis mainly explained by the following:• Lower production margins (SEK -2.1 billion)• Lower generation volumes (SEK -3.0 billion)• Lost earnings contribution from divested operations – mainly electricitydistribution in Hamburg (SEK -0.6 billion)• Lower operating expenses (SEK 2.4 billion)• Other items, net (SEK -0.7 billion), of which lower depreciation(SEK 0.2 billion) <strong>and</strong> currency effects of the weaker Swedish kronacompared with 2013 (SEK 0.4 billion)Amounts in SEK million <strong>2014</strong> 2013Operating profit (EBIT) -2,195 -6,218Items affecting comparability -26,328 -34,353Underlying operating profit 24,133 28,135Items affecting comparability that affected operating profitAmounts in SEK million <strong>2014</strong> 2013Capital gains 3,227 189Capital losses -185 -132Impairment losses -23,808 -30,147Unrealised changes in the fair value ofenergy derivatives 819 -995Unrealised changes in the fair value ofinventories 72 281Restructuring costs -765 -1,568Other items affecting comparability -5,688 -1,981Total -26,328 -34,353Operating segmentsThe underlying operating profit for the Nordic operating segment wasSEK 12.0 billion. This is a decrease of SEK 3.4 billion compared with 2013<strong>and</strong> is mainly attributable to average lower electricity prices achieved <strong>and</strong>lower production volumes, which were partly compensated by lower operatingexpenses. For the Continental/UK operating segment, the underlyingoperating profit was SEK 12.7 billion. This is a decrease of SEK 1.0 billioncompared with 2013 <strong>and</strong> is mainly attributable to lower production margins,lower production volumes <strong>and</strong> a lower earnings contribution from theTrading operation. The lost earnings contribution from the divested electricitydistribution operation in Hamburg amounted to approximatelySEK 0.6 billion. For further information on the Group’s operating segments,see Note 8 to the consolidated accounts, Operating segments.Costs for CO 2emission allowancesCosts for CO 2emission allowances for own use amounted to SEK 4.2 billionin <strong>2014</strong>, compared with SEK 6.0 billion in 2013.Financial itemsFinancial items amounted to SEK -6.0 billion, an increase by SEK 3.0 billioncompared with 2013. The improvement in financial items for <strong>2014</strong> comparedwith 2013 is mainly attributable to lower interest costs <strong>and</strong> changes in themarket value of financial derivatives as well as to the fact the net financialitems in 2013 were charged with impairment losses for Vattenfall’s shareholdingat the time in the Polish energy company Enea S.A. <strong>and</strong> impairmentlosses pertaining to loans to one of Vattenfall’s project companies in the UK.TaxesThe Group <strong>report</strong>ed a tax expense of SEK 44 million for <strong>2014</strong>. The low taxexpense is mainly attributable to a positive one-time effect of SEK 3.4 billionthrough deferred taxes as an effect of the impairment losses recognisedduring the third quarter of <strong>2014</strong>. The effective tax rate for <strong>2014</strong> was -0.5%(11.2%). Excluding the effects of the impairment losses, the effective tax ratewas 22.0%.The low effective tax rate of 11.2% for 2013 is mainly attributable to apositive one-time effect of SEK 5.3 billion from lower deferred tax associatedwith the impairment losses recognised during the second quarter of2013. For further information, see Note 19 to the consolidated accounts,Income tax expense.Items affecting comparability in <strong>2014</strong> amounted to SEK -26.3 billion (-34.4).Impairment losses amounted to SEK 23.8 billion. Capital gains pertainprimarily to the sale of Vattenfall’s electricity distribution operation inHamburg. Other items affecting comparability pertain to higher provisionsprimarily for future expenses for the decommissioning of nuclear power inGermany.Items affecting comparability in 2013 amounted to SEK -34.4 billion.Impairment losses (SEK 30.1 billion) pertain to the impairment losses recognisedin the 2013 half-year book-closing as a result of deteriorated marketconditions. Restructuring costs (SEK -1.6 billion) are mainly attributable tostaff reductions. Other items affecting comparability consist mainly of aprovision related to the German Renewable Energy Act (EEG)(SEK -0.9 billion) <strong>and</strong> higher provisions in the German nuclear poweroperations (SEK 0.9 billion).Vattenfall Annual <strong>and</strong> <strong>sustainability</strong> <strong>report</strong> <strong>2014</strong> 75