PDF Download Link (best for mobile devices) - Oceaneering

PDF Download Link (best for mobile devices) - Oceaneering

PDF Download Link (best for mobile devices) - Oceaneering

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

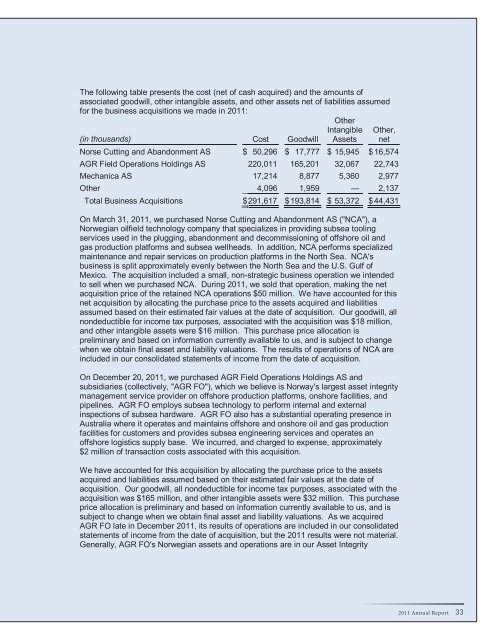

The following table presents the cost (net of cash acquired) and the amounts ofassociated goodwill, other intangible assets, and other assets net of liabilities assumed<strong>for</strong> the business acquisitions we made in 2011:(in thousands) Cost GoodwillOtherIntangibleAssetsOther,netNorse Cutting and Abandonment AS $ 50,296 $ 17,777 $ 15,945 $ 16,574AGR Field Operations Holdings AS 220,011 165,201 32,067 22,743Mechanica AS 17,214 8,877 5,360 2,977Other 4,096 1,959 — 2,137Total Business Acquisitions $ 291,617 $ 193,814 $ 53,372 $ 44,431On March 31, 2011, we purchased Norse Cutting and Abandonment AS ("NCA"), aNorwegian oilfield technology company that specializes in providing subsea toolingservices used in the plugging, abandonment and decommissioning of offshore oil andgas production plat<strong>for</strong>ms and subsea wellheads. In addition, NCA per<strong>for</strong>ms specializedmaintenance and repair services on production plat<strong>for</strong>ms in the North Sea. NCA'sbusiness is split approximately evenly between the North Sea and the U.S. Gulf ofMexico. The acquisition included a small, non-strategic business operation we intendedto sell when we purchased NCA. During 2011, we sold that operation, making the netacquisition price of the retained NCA operations $50 million. We have accounted <strong>for</strong> thisnet acquisition by allocating the purchase price to the assets acquired and liabilitiesassumed based on their estimated fair values at the date of acquisition. Our goodwill, allnondeductible <strong>for</strong> income tax purposes, associated with the acquisition was $18 million,and other intangible assets were $16 million. This purchase price allocation ispreliminary and based on in<strong>for</strong>mation currently available to us, and is subject to changewhen we obtain final asset and liability valuations. The results of operations of NCA areincluded in our consolidated statements of income from the date of acquisition.On December 20, 2011, we purchased AGR Field Operations Holdings AS andsubsidiaries (collectively, "AGR FO"), which we believe is Norway's largest asset integritymanagement service provider on offshore production plat<strong>for</strong>ms, onshore facilities, andpipelines. AGR FO employs subsea technology to per<strong>for</strong>m internal and externalinspections of subsea hardware. AGR FO also has a substantial operating presence inAustralia where it operates and maintains offshore and onshore oil and gas productionfacilities <strong>for</strong> customers and provides subsea engineering services and operates anoffshore logistics supply base. We incurred, and charged to expense, approximately$2 million of transaction costs associated with this acquisition.We have accounted <strong>for</strong> this acquisition by allocating the purchase price to the assetsacquired and liabilities assumed based on their estimated fair values at the date ofacquisition. Our goodwill, all nondeductible <strong>for</strong> income tax purposes, associated with theacquisition was $165 million, and other intangible assets were $32 million. This purchaseprice allocation is preliminary and based on in<strong>for</strong>mation currently available to us, and issubject to change when we obtain final asset and liability valuations. As we acquiredAGR FO late in December 2011, its results of operations are included in our consolidatedstatements of income from the date of acquisition, but the 2011 results were not material.Generally, AGR FO's Norwegian assets and operations are in our Asset Integrity2011 Annual Report 33