December 31,(in thousands) 2011 2010 2009Medusa Spar LLCCondensed Balance SheetsASSETSCash and cash equivalents $ 2,904 $ 217 $ 949Other current assets 5,302 3,189 4,116Property and Equipment, net 91,073 100,551 110,028Total Assets $ 99,279 $ 103,957 $ 115,093LIABILITIES AND MEMBERS’ EQUITYCurrent Liabilities $ 18 $ 18 $ 17Members’ Equity 99,261 103,939 115,076Total Liabilities and Members’ Equity $ 99,279 $ 103,957 $ 115,093Condensed Statements of OperationsRevenue $ 17,536 $ 13,816 $ 16,143Depreciation (9,478) (9,478) (9,478)General and Administrative (72) (71) (70)Net Income $ 7,986 $ 4,267 $ 6,595Our 50% share of the underlying equity of the net assets of Medusa Spar LLC isapproximately equal to its carrying value. Our 50% share of the cumulative undistributedearnings of Medusa Spar LLC was $7.8 million and $10.2 million at December 31, 2011and 2010, respectively. We received cash distributions of $6.3 million, $7.7 million and$8.5 million from Medusa Spar LLC in 2011, 2010 and 2009, respectively.3. INCOME TAXESOur provisions <strong>for</strong> income taxes and our cash taxes paid are as follows:Year Ended December 31,(in thousands) 2011 2010 2009Current:Domestic $ 14,027 $ 16,501 $ 10,659Foreign 80,698 57,006 69,132Total current 94,725 73,507 79,791Deferred:Domestic 8,934 19,730 12,029Foreign (1,432 ) 11,454 9,602Total deferred 7,502 31,184 21,631Total provision <strong>for</strong> income taxes $ 102,227 $ 104,691 $ 101,422Cash taxes paid $ 72,825 $ 121,440 $ 54,50440 <strong>Oceaneering</strong> International, Inc.

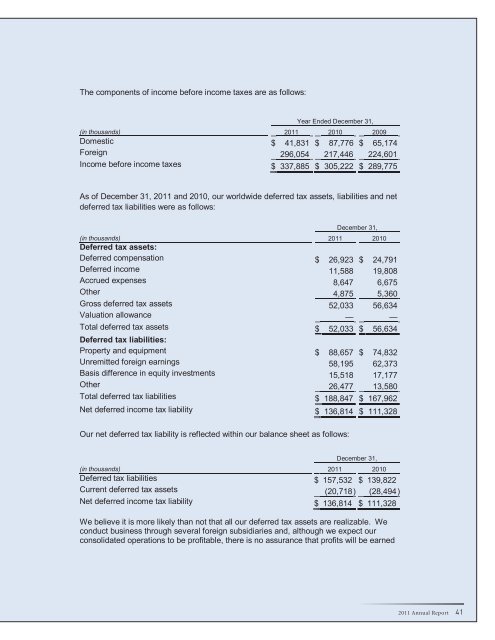

The components of income be<strong>for</strong>e income taxes are as follows:Year Ended December 31,(in thousands) 2011 2010 2009Domestic $ 41,831 $ 87,776 $ 65,174Foreign 296,054 217,446 224,601Income be<strong>for</strong>e income taxes $ 337,885 $ 305,222 $ 289,775As of December 31, 2011 and 2010, our worldwide deferred tax assets, liabilities and netdeferred tax liabilities were as follows:December 31,(in thousands) 2011 2010Deferred tax assets:Deferred compensation $ 26,923 $ 24,791Deferred income 11,588 19,808Accrued expenses 8,647 6,675Other 4,875 5,360Gross deferred tax assets 52,033 56,634Valuation allowance — —Total deferred tax assets $ 52,033 $ 56,634Deferred tax liabilities:Property and equipment $ 88,657 $ 74,832Unremitted <strong>for</strong>eign earnings 58,195 62,373Basis difference in equity investments 15,518 17,177Other 26,477 13,580Total deferred tax liabilities $ 188,847 $ 167,962Net deferred income tax liability $ 136,814 $ 111,328Our net deferred tax liability is reflected within our balance sheet as follows:December 31,(in thousands) 2011 2010Deferred tax liabilities $ 157,532 $ 139,822Current deferred tax assets (20,718) (28,494)Net deferred income tax liability $ 136,814 $ 111,328We believe it is more likely than not that all our deferred tax assets are realizable. Weconduct business through several <strong>for</strong>eign subsidiaries and, although we expect ourconsolidated operations to be profitable, there is no assurance that profits will be earned2011 Annual Report 41

- Page 3 and 4: Financial Highlights($ in thousands

- Page 5 and 6: In December we secured a three-year

- Page 7: 2011 Financial SectionOceaneering I

- Page 10 and 11: Oceaneering Common StockOur common

- Page 12 and 13: Management's Discussion and Analysi

- Page 14 and 15: Critical Accounting Policies and Es

- Page 16 and 17: We establish valuation allowances t

- Page 18 and 19: In 2009, we used $162 million in in

- Page 20 and 21: For 2011, our ROV revenue and opera

- Page 22 and 23: We earn equity income from our 50%

- Page 24 and 25: Controls and ProceduresDisclosure C

- Page 26 and 27: In our opinion, Oceaneering Interna

- Page 28 and 29: OCEANEERING INTERNATIONAL, INC. AND

- Page 30 and 31: OCEANEERING INTERNATIONAL, INC. AND

- Page 32 and 33: OCEANEERING INTERNATIONAL, INC. AND

- Page 34 and 35: for marine services equipment (such

- Page 36 and 37: segment and its Australian assets a

- Page 38 and 39: Revenue in Excess of Amounts Billed

- Page 40 and 41: elationship and, if it is, the type

- Page 44 and 45: in entities or jurisdictions that h

- Page 46 and 47: 4. SELECTED BALANCE SHEET AND INCOM

- Page 48 and 49: On January 6, 2012, we entered into

- Page 50 and 51: Financial Instruments and Risk Conc

- Page 52 and 53: The table that follows presents Rev

- Page 54 and 55: The following table presents Assets

- Page 56 and 57: Geographic Operating AreasThe follo

- Page 58 and 59: equirements. The Compensation Commi

- Page 60 and 61: in 2011, 2010 and 2009 were subject

- Page 62 and 63: Forward-Looking StatementsAll state

- Page 64: Oceaneering International, Inc.1191