PDF Download Link (best for mobile devices) - Oceaneering

PDF Download Link (best for mobile devices) - Oceaneering

PDF Download Link (best for mobile devices) - Oceaneering

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

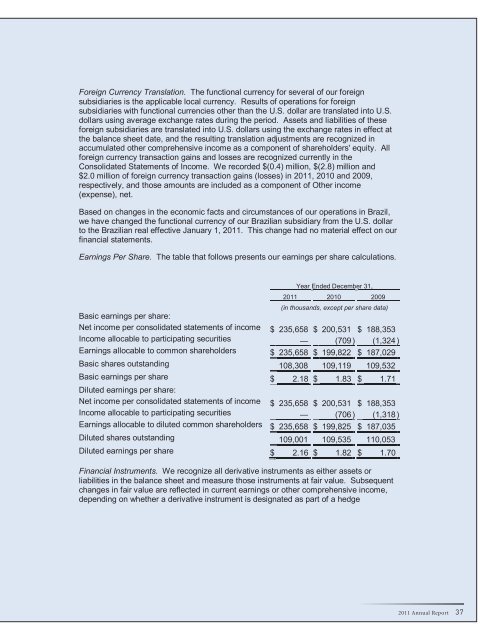

Foreign Currency Translation. The functional currency <strong>for</strong> several of our <strong>for</strong>eignsubsidiaries is the applicable local currency. Results of operations <strong>for</strong> <strong>for</strong>eignsubsidiaries with functional currencies other than the U.S. dollar are translated into U.S.dollars using average exchange rates during the period. Assets and liabilities of these<strong>for</strong>eign subsidiaries are translated into U.S. dollars using the exchange rates in effect atthe balance sheet date, and the resulting translation adjustments are recognized inaccumulated other comprehensive income as a component of shareholders' equity. All<strong>for</strong>eign currency transaction gains and losses are recognized currently in theConsolidated Statements of Income. We recorded $(0.4) million, $(2.8) million and$2.0 million of <strong>for</strong>eign currency transaction gains (losses) in 2011, 2010 and 2009,respectively, and those amounts are included as a component of Other income(expense), net.Based on changes in the economic facts and circumstances of our operations in Brazil,we have changed the functional currency of our Brazilian subsidiary from the U.S. dollarto the Brazilian real effective January 1, 2011. This change had no material effect on ourfinancial statements.Earnings Per Share. The table that follows presents our earnings per share calculations.Year Ended December 31,2011 2010 2009(in thousands, except per share data)Basic earnings per share:Net income per consolidated statements of income $ 235,658 $ 200,531 $ 188,353Income allocable to participating securities — (709 ) (1,324 )Earnings allocable to common shareholders $ 235,658 $ 199,822 $ 187,029Basic shares outstanding 108,308 109,119 109,532Basic earnings per share $ 2.18 $ 1.83 $ 1.71Diluted earnings per share:Net income per consolidated statements of income $ 235,658 $ 200,531 $ 188,353Income allocable to participating securities — (706 ) (1,318 )Earnings allocable to diluted common shareholders $ 235,658 $ 199,825 $ 187,035Diluted shares outstanding 109,001 109,535 110,053Diluted earnings per share $ 2.16 $ 1.82 $ 1.70Financial Instruments. We recognize all derivative instruments as either assets orliabilities in the balance sheet and measure those instruments at fair value. Subsequentchanges in fair value are reflected in current earnings or other comprehensive income,depending on whether a derivative instrument is designated as part of a hedge2011 Annual Report 37