elationship and, if it is, the type of hedge relationship. As of December 31, 2011, we hadno derivative instruments in effect.New Accounting Standards. In October 2009, the Financial Accounting Standards Board("FASB") issued an update regarding accounting <strong>for</strong> revenue involving multipledeliverablearrangements that will, in certain circumstances, require sellers to account <strong>for</strong>more products or services ("deliverables") separately rather than as a combined unit.This update establishes a selling price hierarchy <strong>for</strong> determining the selling price of adeliverable. The update also replaces the term fair value in the revenue allocationguidance with selling price to clarify that the allocation of revenue is based on entityspecificassumptions rather than assumptions of a marketplace participant. The updateeliminates the residual method of allocation and requires that arrangement considerationbe allocated at the inception of the arrangement to all deliverables using the relativeselling price method. The update requires that a seller determine its <strong>best</strong> estimatedselling price in a manner that is consistent with that used to determine the price to sell thedeliverable on a stand-alone basis. The update does not prescribe any specific methodsthat sellers must use to accomplish this objective, but provides guidance.For us, the update was effective prospectively <strong>for</strong> revenue arrangements entered into ormaterially modified on or after January 1, 2011. The provisions of the update have nothad a material effect on our financial position or results of operations.In June 2011, the FASB issued an update to allow an entity the option to present the totalof comprehensive income, the components of net income, and the components of othercomprehensive income in either a single continuous statement of comprehensive incomeor two separate but consecutive statements. Under either option, an entity is required topresent each component of net income along with total net income, each component ofother comprehensive income along with a total <strong>for</strong> other comprehensive income, and atotal amount <strong>for</strong> comprehensive income. This update eliminates the option to present thecomponents of other comprehensive income as part of the statement of changes instockholders' equity. This update does not change the items that are required to bereported in other comprehensive income or when an item of other comprehensive incomemust be reclassified to net income and is required to be applied retrospectively. Thisupdate is effective <strong>for</strong> us January 1, 2012. Early adoption is permitted. We have electedto adopt this update and we are reporting the total of comprehensive income, thecomponents of net income, and the components of other comprehensive income in twoseparate consecutive statements.In September 2011, the FASB issued an update regarding an employer's participation ina multiemployer pension plan. For employers that participate in multiemployer pensionplans, the update requires an employer to provide additional quantitative and qualitativedisclosures. The amended disclosures provide users with more detailed in<strong>for</strong>mationabout an employer's involvement in multiemployer pension plans, including:• the significant multiemployer plans in which an employer participates, includingthe plan names and identifying numbers;• the level of an employer's participation in the significant multiemployer plans,including the employer's contributions made to the plans and an indication ofwhether the employer's contributions represent more than 5 percent of the totalcontributions made to the plans by all contributing employers;38 <strong>Oceaneering</strong> International, Inc.

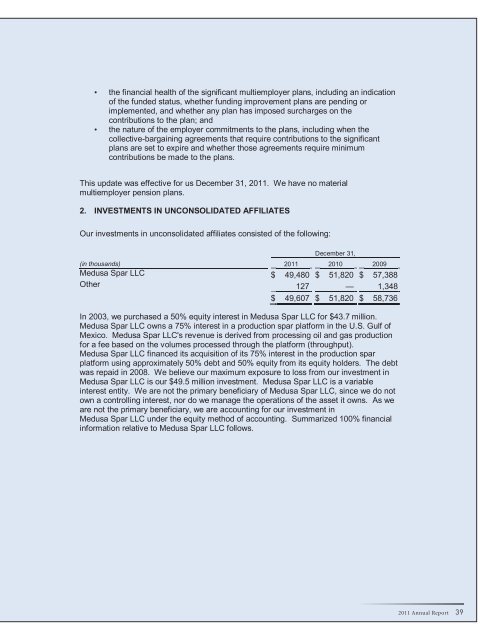

• the financial health of the significant multiemployer plans, including an indicationof the funded status, whether funding improvement plans are pending orimplemented, and whether any plan has imposed surcharges on thecontributions to the plan; and• the nature of the employer commitments to the plans, including when thecollective-bargaining agreements that require contributions to the significantplans are set to expire and whether those agreements require minimumcontributions be made to the plans.This update was effective <strong>for</strong> us December 31, 2011. We have no materialmultiemployer pension plans.2. INVESTMENTS IN UNCONSOLIDATED AFFILIATESOur investments in unconsolidated affiliates consisted of the following:December 31,(in thousands) 2011 2010 2009Medusa Spar LLC $ 49,480 $ 51,820 $ 57,388Other 127 — 1,348$ 49,607 $ 51,820 $ 58,736In 2003, we purchased a 50% equity interest in Medusa Spar LLC <strong>for</strong> $43.7 million.Medusa Spar LLC owns a 75% interest in a production spar plat<strong>for</strong>m in the U.S. Gulf ofMexico. Medusa Spar LLC's revenue is derived from processing oil and gas production<strong>for</strong> a fee based on the volumes processed through the plat<strong>for</strong>m (throughput).Medusa Spar LLC financed its acquisition of its 75% interest in the production sparplat<strong>for</strong>m using approximately 50% debt and 50% equity from its equity holders. The debtwas repaid in 2008. We believe our maximum exposure to loss from our investment inMedusa Spar LLC is our $49.5 million investment. Medusa Spar LLC is a variableinterest entity. We are not the primary beneficiary of Medusa Spar LLC, since we do notown a controlling interest, nor do we manage the operations of the asset it owns. As weare not the primary beneficiary, we are accounting <strong>for</strong> our investment inMedusa Spar LLC under the equity method of accounting. Summarized 100% financialin<strong>for</strong>mation relative to Medusa Spar LLC follows.2011 Annual Report 39

- Page 3 and 4: Financial Highlights($ in thousands

- Page 5 and 6: In December we secured a three-year

- Page 7: 2011 Financial SectionOceaneering I

- Page 10 and 11: Oceaneering Common StockOur common

- Page 12 and 13: Management's Discussion and Analysi

- Page 14 and 15: Critical Accounting Policies and Es

- Page 16 and 17: We establish valuation allowances t

- Page 18 and 19: In 2009, we used $162 million in in

- Page 20 and 21: For 2011, our ROV revenue and opera

- Page 22 and 23: We earn equity income from our 50%

- Page 24 and 25: Controls and ProceduresDisclosure C

- Page 26 and 27: In our opinion, Oceaneering Interna

- Page 28 and 29: OCEANEERING INTERNATIONAL, INC. AND

- Page 30 and 31: OCEANEERING INTERNATIONAL, INC. AND

- Page 32 and 33: OCEANEERING INTERNATIONAL, INC. AND

- Page 34 and 35: for marine services equipment (such

- Page 36 and 37: segment and its Australian assets a

- Page 38 and 39: Revenue in Excess of Amounts Billed

- Page 42 and 43: December 31,(in thousands) 2011 201

- Page 44 and 45: in entities or jurisdictions that h

- Page 46 and 47: 4. SELECTED BALANCE SHEET AND INCOM

- Page 48 and 49: On January 6, 2012, we entered into

- Page 50 and 51: Financial Instruments and Risk Conc

- Page 52 and 53: The table that follows presents Rev

- Page 54 and 55: The following table presents Assets

- Page 56 and 57: Geographic Operating AreasThe follo

- Page 58 and 59: equirements. The Compensation Commi

- Page 60 and 61: in 2011, 2010 and 2009 were subject

- Page 62 and 63: Forward-Looking StatementsAll state

- Page 64: Oceaneering International, Inc.1191