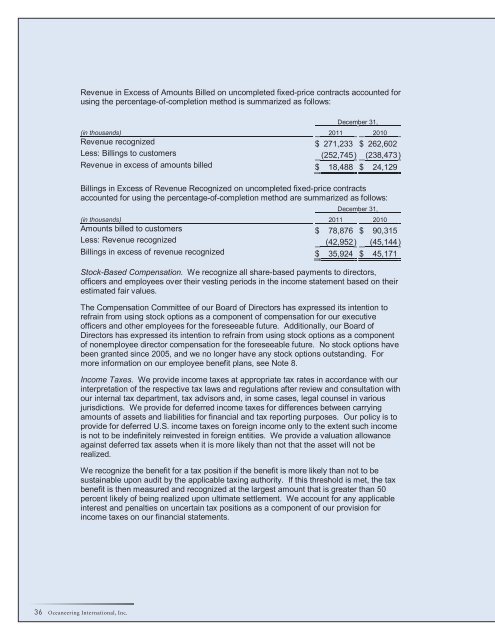

Revenue in Excess of Amounts Billed on uncompleted fixed-price contracts accounted <strong>for</strong>using the percentage-of-completion method is summarized as follows:December 31,(in thousands) 2011 2010Revenue recognized $ 271,233 $ 262,602Less: Billings to customers (252,745) (238,473)Revenue in excess of amounts billed $ 18,488 $ 24,129Billings in Excess of Revenue Recognized on uncompleted fixed-price contractsaccounted <strong>for</strong> using the percentage-of-completion method are summarized as follows:December 31,(in thousands) 2011 2010Amounts billed to customers $ 78,876 $ 90,315Less: Revenue recognized (42,952 ) (45,144 )Billings in excess of revenue recognized $ 35,924 $ 45,171Stock-Based Compensation. We recognize all share-based payments to directors,officers and employees over their vesting periods in the income statement based on theirestimated fair values.The Compensation Committee of our Board of Directors has expressed its intention torefrain from using stock options as a component of compensation <strong>for</strong> our executiveofficers and other employees <strong>for</strong> the <strong>for</strong>eseeable future. Additionally, our Board ofDirectors has expressed its intention to refrain from using stock options as a componentof nonemployee director compensation <strong>for</strong> the <strong>for</strong>eseeable future. No stock options havebeen granted since 2005, and we no longer have any stock options outstanding. Formore in<strong>for</strong>mation on our employee benefit plans, see Note 8.Income Taxes. We provide income taxes at appropriate tax rates in accordance with ourinterpretation of the respective tax laws and regulations after review and consultation withour internal tax department, tax advisors and, in some cases, legal counsel in variousjurisdictions. We provide <strong>for</strong> deferred income taxes <strong>for</strong> differences between carryingamounts of assets and liabilities <strong>for</strong> financial and tax reporting purposes. Our policy is toprovide <strong>for</strong> deferred U.S. income taxes on <strong>for</strong>eign income only to the extent such incomeis not to be indefinitely reinvested in <strong>for</strong>eign entities. We provide a valuation allowanceagainst deferred tax assets when it is more likely than not that the asset will not berealized.We recognize the benefit <strong>for</strong> a tax position if the benefit is more likely than not to besustainable upon audit by the applicable taxing authority. If this threshold is met, the taxbenefit is then measured and recognized at the largest amount that is greater than 50percent likely of being realized upon ultimate settlement. We account <strong>for</strong> any applicableinterest and penalties on uncertain tax positions as a component of our provision <strong>for</strong>income taxes on our financial statements.36 <strong>Oceaneering</strong> International, Inc.

Foreign Currency Translation. The functional currency <strong>for</strong> several of our <strong>for</strong>eignsubsidiaries is the applicable local currency. Results of operations <strong>for</strong> <strong>for</strong>eignsubsidiaries with functional currencies other than the U.S. dollar are translated into U.S.dollars using average exchange rates during the period. Assets and liabilities of these<strong>for</strong>eign subsidiaries are translated into U.S. dollars using the exchange rates in effect atthe balance sheet date, and the resulting translation adjustments are recognized inaccumulated other comprehensive income as a component of shareholders' equity. All<strong>for</strong>eign currency transaction gains and losses are recognized currently in theConsolidated Statements of Income. We recorded $(0.4) million, $(2.8) million and$2.0 million of <strong>for</strong>eign currency transaction gains (losses) in 2011, 2010 and 2009,respectively, and those amounts are included as a component of Other income(expense), net.Based on changes in the economic facts and circumstances of our operations in Brazil,we have changed the functional currency of our Brazilian subsidiary from the U.S. dollarto the Brazilian real effective January 1, 2011. This change had no material effect on ourfinancial statements.Earnings Per Share. The table that follows presents our earnings per share calculations.Year Ended December 31,2011 2010 2009(in thousands, except per share data)Basic earnings per share:Net income per consolidated statements of income $ 235,658 $ 200,531 $ 188,353Income allocable to participating securities — (709 ) (1,324 )Earnings allocable to common shareholders $ 235,658 $ 199,822 $ 187,029Basic shares outstanding 108,308 109,119 109,532Basic earnings per share $ 2.18 $ 1.83 $ 1.71Diluted earnings per share:Net income per consolidated statements of income $ 235,658 $ 200,531 $ 188,353Income allocable to participating securities — (706 ) (1,318 )Earnings allocable to diluted common shareholders $ 235,658 $ 199,825 $ 187,035Diluted shares outstanding 109,001 109,535 110,053Diluted earnings per share $ 2.16 $ 1.82 $ 1.70Financial Instruments. We recognize all derivative instruments as either assets orliabilities in the balance sheet and measure those instruments at fair value. Subsequentchanges in fair value are reflected in current earnings or other comprehensive income,depending on whether a derivative instrument is designated as part of a hedge2011 Annual Report 37

- Page 3 and 4: Financial Highlights($ in thousands

- Page 5 and 6: In December we secured a three-year

- Page 7: 2011 Financial SectionOceaneering I

- Page 10 and 11: Oceaneering Common StockOur common

- Page 12 and 13: Management's Discussion and Analysi

- Page 14 and 15: Critical Accounting Policies and Es

- Page 16 and 17: We establish valuation allowances t

- Page 18 and 19: In 2009, we used $162 million in in

- Page 20 and 21: For 2011, our ROV revenue and opera

- Page 22 and 23: We earn equity income from our 50%

- Page 24 and 25: Controls and ProceduresDisclosure C

- Page 26 and 27: In our opinion, Oceaneering Interna

- Page 28 and 29: OCEANEERING INTERNATIONAL, INC. AND

- Page 30 and 31: OCEANEERING INTERNATIONAL, INC. AND

- Page 32 and 33: OCEANEERING INTERNATIONAL, INC. AND

- Page 34 and 35: for marine services equipment (such

- Page 36 and 37: segment and its Australian assets a

- Page 40 and 41: elationship and, if it is, the type

- Page 42 and 43: December 31,(in thousands) 2011 201

- Page 44 and 45: in entities or jurisdictions that h

- Page 46 and 47: 4. SELECTED BALANCE SHEET AND INCOM

- Page 48 and 49: On January 6, 2012, we entered into

- Page 50 and 51: Financial Instruments and Risk Conc

- Page 52 and 53: The table that follows presents Rev

- Page 54 and 55: The following table presents Assets

- Page 56 and 57: Geographic Operating AreasThe follo

- Page 58 and 59: equirements. The Compensation Commi

- Page 60 and 61: in 2011, 2010 and 2009 were subject

- Page 62 and 63: Forward-Looking StatementsAll state

- Page 64: Oceaneering International, Inc.1191