PDF Download Link (best for mobile devices) - Oceaneering

PDF Download Link (best for mobile devices) - Oceaneering

PDF Download Link (best for mobile devices) - Oceaneering

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

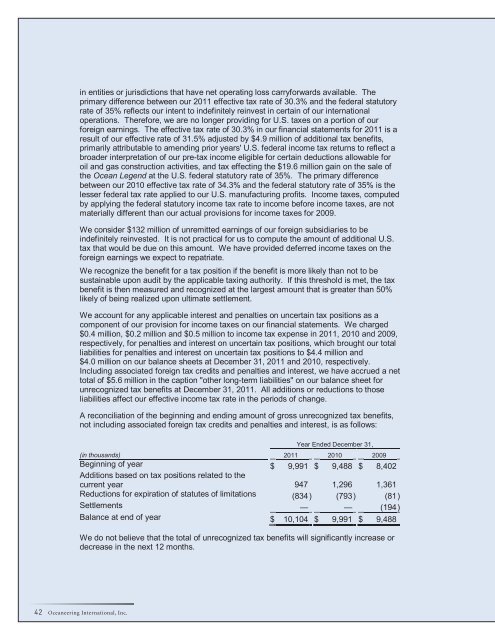

in entities or jurisdictions that have net operating loss carry<strong>for</strong>wards available. Theprimary difference between our 2011 effective tax rate of 30.3% and the federal statutoryrate of 35% reflects our intent to indefinitely reinvest in certain of our internationaloperations. There<strong>for</strong>e, we are no longer providing <strong>for</strong> U.S. taxes on a portion of our<strong>for</strong>eign earnings. The effective tax rate of 30.3% in our financial statements <strong>for</strong> 2011 is aresult of our effective rate of 31.5% adjusted by $4.9 million of additional tax benefits,primarily attributable to amending prior years' U.S. federal income tax returns to reflect abroader interpretation of our pre-tax income eligible <strong>for</strong> certain deductions allowable <strong>for</strong>oil and gas construction activities, and tax effecting the $19.6 million gain on the sale ofthe Ocean Legend at the U.S. federal statutory rate of 35%. The primary differencebetween our 2010 effective tax rate of 34.3% and the federal statutory rate of 35% is thelesser federal tax rate applied to our U.S. manufacturing profits. Income taxes, computedby applying the federal statutory income tax rate to income be<strong>for</strong>e income taxes, are notmaterially different than our actual provisions <strong>for</strong> income taxes <strong>for</strong> 2009.We consider $132 million of unremitted earnings of our <strong>for</strong>eign subsidiaries to beindefinitely reinvested. It is not practical <strong>for</strong> us to compute the amount of additional U.S.tax that would be due on this amount. We have provided deferred income taxes on the<strong>for</strong>eign earnings we expect to repatriate.We recognize the benefit <strong>for</strong> a tax position if the benefit is more likely than not to besustainable upon audit by the applicable taxing authority. If this threshold is met, the taxbenefit is then measured and recognized at the largest amount that is greater than 50%likely of being realized upon ultimate settlement.We account <strong>for</strong> any applicable interest and penalties on uncertain tax positions as acomponent of our provision <strong>for</strong> income taxes on our financial statements. We charged$0.4 million, $0.2 million and $0.5 million to income tax expense in 2011, 2010 and 2009,respectively, <strong>for</strong> penalties and interest on uncertain tax positions, which brought our totalliabilities <strong>for</strong> penalties and interest on uncertain tax positions to $4.4 million and$4.0 million on our balance sheets at December 31, 2011 and 2010, respectively.Including associated <strong>for</strong>eign tax credits and penalties and interest, we have accrued a nettotal of $5.6 million in the caption "other long-term liabilities" on our balance sheet <strong>for</strong>unrecognized tax benefits at December 31, 2011. All additions or reductions to thoseliabilities affect our effective income tax rate in the periods of change.A reconciliation of the beginning and ending amount of gross unrecognized tax benefits,not including associated <strong>for</strong>eign tax credits and penalties and interest, is as follows:Year Ended December 31,(in thousands) 2011 2010 2009Beginning of year $ 9,991 $ 9,488 $ 8,402Additions based on tax positions related to thecurrent year 947 1,296 1,361Reductions <strong>for</strong> expiration of statutes of limitations (834) (793) (81)Settlements — — (194)Balance at end of year $ 10,104 $ 9,991 $ 9,488We do not believe that the total of unrecognized tax benefits will significantly increase ordecrease in the next 12 months.42 <strong>Oceaneering</strong> International, Inc.