Annual Report 2009 - Rieter

Annual Report 2009 - Rieter

Annual Report 2009 - Rieter

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

42 <strong>Rieter</strong> Group . <strong>Annual</strong> <strong>Report</strong> <strong>2009</strong> . Notes to the consolidated financial statements<br />

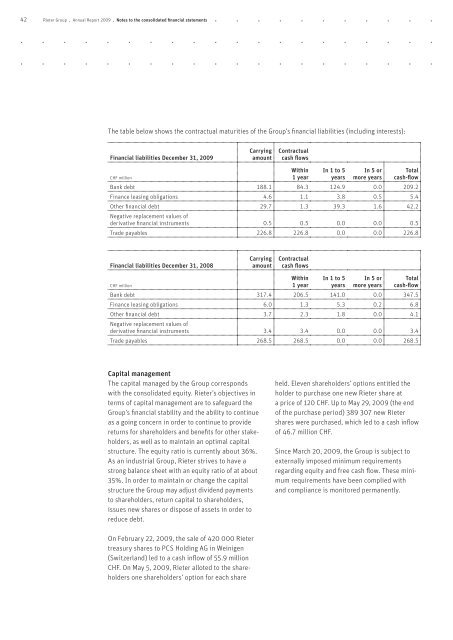

The table below shows the contractual maturities of the Group’s financial liabilities (including interests):<br />

Financial liabilities December 31, <strong>2009</strong><br />

CHF million<br />

Capital management<br />

The capital managed by the Group corresponds<br />

with the consolidated equity. <strong>Rieter</strong>’s objectives in<br />

terms of capital management are to safeguard the<br />

Group’s financial stability and the ability to continue<br />

as a going concern in order to continue to provide<br />

returns for shareholders and benefits for other stakeholders,<br />

as well as to maintain an optimal capital<br />

structure. The equity ratio is currently about 36%.<br />

As an industrial Group, <strong>Rieter</strong> strives to have a<br />

strong balance sheet with an equity ratio of at about<br />

35%. In order to maintain or change the capital<br />

structure the Group may adjust dividend payments<br />

to shareholders, return capital to shareholders,<br />

issues new shares or dispose of assets in order to<br />

reduce debt.<br />

On February 22, <strong>2009</strong>, the sale of 420 000 <strong>Rieter</strong><br />

treasury shares to PCS Holding AG in Weinigen<br />

(Switzerland) led to a cash inflow of 55.9 million<br />

CHF. On May 5, <strong>2009</strong>, <strong>Rieter</strong> alloted to the shareholders<br />

one shareholders’ option for each share<br />

Carrying<br />

amount<br />

Contractual<br />

cash flows<br />

Within<br />

1 year<br />

In 1 to 5<br />

years<br />

In 5 or<br />

more years<br />

Total<br />

cash-flow<br />

Bank debt 188.1 84.3 124.9 0.0 209.2<br />

Finance leasing obligations 4.6 1.1 3.8 0.5 5.4<br />

Other financial debt 29.7 1.3 39.3 1.6 42.2<br />

Negative replacement values of<br />

derivative financial instruments 0.5 0.5 0.0 0.0 0.5<br />

Trade payables 226.8 226.8 0.0 0.0 226.8<br />

Financial liabilities December 31, 2008<br />

CHF million<br />

Carrying<br />

amount<br />

Contractual<br />

cash flows<br />

Within<br />

1 year<br />

In 1 to 5<br />

years<br />

In 5 or<br />

more years<br />

Total<br />

cash-flow<br />

Bank debt 317.4 206.5 141.0 0.0 347.5<br />

Finance leasing obligations 6.0 1.3 5.3 0.2 6.8<br />

Other financial debt 3.7 2.3 1.8 0.0 4.1<br />

Negative replacement values of<br />

derivative financial instruments 3.4 3.4 0.0 0.0 3.4<br />

Trade payables 268.5 268.5 0.0 0.0 268.5<br />

held. Eleven shareholders’ options entitled the<br />

holder to purchase one new <strong>Rieter</strong> share at<br />

a price of 120 CHF. Up to May 29, <strong>2009</strong> (the end<br />

of the purchase period) 389 307 new <strong>Rieter</strong><br />

shares were purchased, which led to a cash inflow<br />

of 46.7 million CHF.<br />

Since March 20, <strong>2009</strong>, the Group is subject to<br />

externally imposed minimum requirements<br />

regarding equity and free cash flow. These minimum<br />

requirements have been complied with<br />

and compliance is monitored permanently.