Annual Report 2009 - Rieter

Annual Report 2009 - Rieter

Annual Report 2009 - Rieter

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

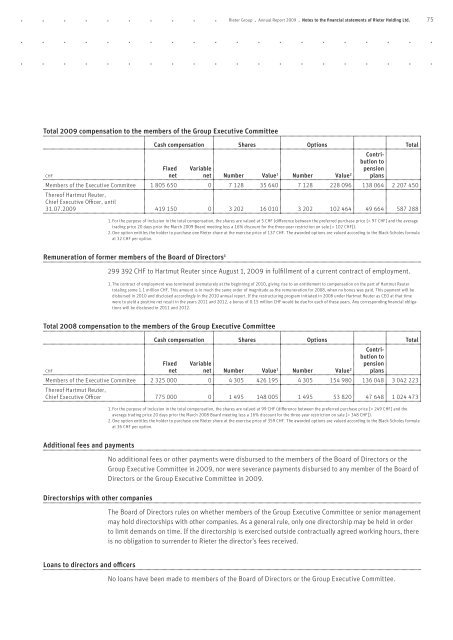

Total <strong>2009</strong> compensation to the members of the Group Executive Committee<br />

CHF<br />

<strong>Rieter</strong> Group . <strong>Annual</strong> <strong>Report</strong> <strong>2009</strong> . Notes to the financial statements of <strong>Rieter</strong> Holding Ltd.<br />

Cash compensation Shares Options Total<br />

Fixed<br />

net<br />

Variable<br />

net Number Value 1 Number Value 2<br />

Contribution<br />

to<br />

pension<br />

plans<br />

Members of the Executive Commitee 1 805 650 0 7 128 35 640 7 128 228 096 138 064 2 207 450<br />

Thereof Hartmut Reuter,<br />

Chief Executive Officer, until<br />

31.07.<strong>2009</strong> 419 150 0 3 202 16 010 3 202 102 464 49 664 587 288<br />

1. For the purpose of inclusion in the total compensation, the shares are valued at 5 CHF (difference between the preferred purchase price [= 97 CHF] and the average<br />

trading price 20 days prior the March <strong>2009</strong> Board meeting less a 16% discount for the three-year restriction on sale [= 102 CHF]).<br />

2. One option entitles the holder to purchase one <strong>Rieter</strong> share at the exercise price of 137 CHF. The awarded options are valued according to the Black-Scholes formula<br />

at 32 CHF per option.<br />

Remuneration of former members of the Board of Directors 1<br />

299 392 CHF to Hartmut Reuter since August 1, <strong>2009</strong> in fulfillment of a current contract of employment.<br />

1. The contract of employment was terminated prematurely at the beginning of 2010, giving rise to an entitlement to compensation on the part of Hartmut Reuter<br />

totaling some 1.1 million CHF. This amount is in much the same order of magnitude as the remuneration for 2008, when no bonus was paid. This payment will be<br />

disbursed in 2010 and disclosed accordingly in the 2010 annual report. If the restructuring program initiated in 2008 under Hartmut Reuter as CEO at that time<br />

were to yield a positive net result in the years 2011 and 2012, a bonus of 0.15 million CHF would be due for each of these years. Any corresponding financial obligations<br />

will be disclosed in 2011 and 2012.<br />

Total 2008 compensation to the members of the Group Executive Committee<br />

CHF<br />

Cash compensation Shares Options Total<br />

Fixed<br />

net<br />

Variable<br />

net Number Value 1 Number Value 2<br />

Contribution<br />

to<br />

pension<br />

plans<br />

Members of the Executive Commitee 2 325 000 0 4 305 426 195 4 305 154 980 136 048 3 042 223<br />

Thereof Hartmut Reuter,<br />

Chief Executive Officer 775 000 0 1 495 148 005 1 495 53 820 47 648 1 024 473<br />

Additional fees and payments<br />

Directorships with other companies<br />

Loans to directors and officers<br />

1. For the purpose of inclusion in the total compensation, the shares are valued at 99 CHF (difference between the preferred purchase price [= 249 CHF] and the<br />

average trading price 20 days prior the March 2008 Board meeting less a 16% discount for the three-year restriction on sale [= 348 CHF]).<br />

2. One option entitles the holder to purchase one <strong>Rieter</strong> share at the exercise price of 359 CHF. The awarded options are valued according to the Black-Scholes formula<br />

at 36 CHF per option.<br />

No additional fees or other payments were disbursed to the members of the Board of Directors or the<br />

Group Executive Committee in <strong>2009</strong>, nor were severance payments disbursed to any member of the Board of<br />

Directors or the Group Executive Committee in <strong>2009</strong>.<br />

The Board of Directors rules on whether members of the Group Executive Committee or senior management<br />

may hold directorships with other companies. As a general rule, only one directorship may be held in order<br />

to limit demands on time. If the directorship is exercised outside contractually agreed working hours, there<br />

is no obligation to surrender to <strong>Rieter</strong> the director’s fees received.<br />

No loans have been made to members of the Board of Directors or the Group Executive Committee.<br />

75