January - Tata AIA Life Insurance

January - Tata AIA Life Insurance

January - Tata AIA Life Insurance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

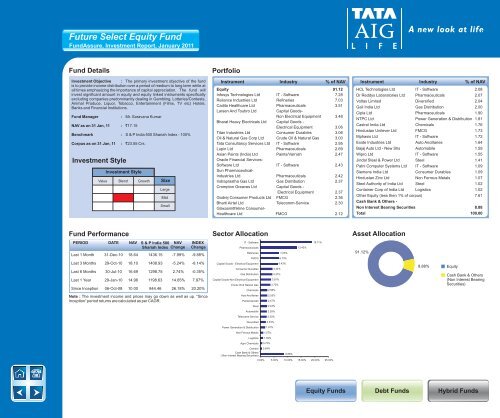

Future Select Equity FundFundAssure, Investment Report, <strong>January</strong> 2011Fund DetailsInvestment Objective : The primary investment objective of the fundis to provide income distribution over a period of medium to long term while atall times emphasizing the importance of capital appreciation. The fund willinvest significant amount in equity and equity linked instruments specificallyexcluding companies predominantly dealing in Gambling, Lotteries/Contests,Animal Produce, Liquor, Tobacco, Entertainment (Films, TV etc) Hotels,Banks and Financial Institutions.Fund ManagerNAV as on 31 Jan, 11 : `17.15Investment Style: Mr. Saravana KumarBenchmark : S & P India 500 Shariah Index - 100%Corpus as on 31 Jan, 11: `23.55 Crs.Investment StyleValue Blend Growth SizeLargeMidSmallPortfolioInstrument Industry % of NAVEquity 91.12Infosys Technologies Ltd IT - Software 7.28Reliance Industries Ltd Refineries 7.03Cadila Healthcare Ltd Pharmaceuticals 3.51Larsen And Toubro LtdCapital Goods-Non Electrical Equipment 3.48Bharat Heavy Electricals Ltd Capital Goods -Electrical Equipment 3.06Titan Industries Ltd Consumer Durables 3.06Oil & Natural Gas Corp Ltd Crude Oil & Natural Gas 3.00<strong>Tata</strong> Consultancy Services Ltd IT - Software 2.95Lupin Ltd Pharmaceuticals 2.69Asian Paints (India) Ltd Paints/Varnish 2.47Oracle Financial Services-Software Ltd IT - Software 2.43Sun Pharmaceutical-Industries Ltd Pharmaceuticals 2.42Indraprastha Gas Ltd Gas Distribution 2.37Crompton Greaves Ltd Capital Goods -Electrical Equipment 2.37Godrej Consumer Products Ltd FMCG 2.36Bharti Airtel Ltd Telecomm-Service 2.30Glaxosmithkline Consumer-Healthcare Ltd FMCG 2.12Instrument Industry % of NAVHCL Technologies Ltd IT - Software 2.08Dr Reddys Laboratories Ltd Pharmaceuticals 2.07Voltas Limited Diversified 2.04Gail India Ltd Gas Distribution 2.00Cipla Ltd Pharmaceuticals 1.90NTPC Ltd Power Generation & Distribution 1.81Castrol India Ltd Chemicals 1.76Hindustan Unilever Ltd FMCG 1.73Mphasis Ltd IT - Software 1.72Exide Industries Ltd Auto Ancillaries 1.64Bajaj Auto Ltd - New Shs Automobile 1.59Wipro Ltd IT - Software 1.55Jindal Steel & Power Ltd Steel 1.41Patni Computer Systems Ltd IT - Software 1.09Siemens India Ltd Consumer Durables 1.09Hindustan Zinc Ltd Non Ferrous Metals 1.07Steel Authority of India Ltd Steel 1.02Container Corp of India Ltd Logistics 1.02Other Equity (less then 1% of corpus) 7.61Cash Bank & Others -Non Interest Bearing Securities 8.88Total 100.00Fund PerformanceSector AllocationAsset AllocationPERIOD DATE NAV S & P India 500 NAV INDEXShariah Index Change ChangeLast 1 Month 31-Dec-10 18.64 1436.15 -7.99% -9.88%Last 3 Months 29-Oct-10 18.10 1408.93 -5.24% -8.14%Last 6 Months 30-Jul-10 16.69 1298.75 2.74% -0.35%Last 1 Year 29-Jan-10 14.96 1198.63 14.65% 7.97%Since Inception 06-Oct-08 10.00 844.46 26.18% 20.20%IT - SoftwarePharmaceuticalsRefineriesFMCGCapital Goods - Electrical EquipmentConsumer DurablesGas DistributionCapital Goods-Non Electrical EquipmentCrude Oil & Natural GasChemicals4.44%4.37%3.91%3.70%2.56%7.03%6.73%6.43%13.40%19.11%91.12%8.88%EquityCash Bank & Others(Non Interest BearingSecurities)Note : The investment income and prices may go down as well as up. “SinceInception” period returns are calculated as per CAGR.Auto AncillariesPaints/Varnish2.53%2.47%Steel2.43%Automobile2.39%Telecomm-Service2.30%Diversified2.04%Power Generation & Distribution1.81%Non Ferrous Metals1.07%Logistics1.02%Agro Chemicals0.72%CementCash Bank & Others( Non Interest Bearing Securities)0.64%8.88%0.00% 5.00% 10.00% 15.00% 20.00% 25.00%Equity FundsDebt FundsHybrid Funds