January - Tata AIA Life Insurance

January - Tata AIA Life Insurance

January - Tata AIA Life Insurance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

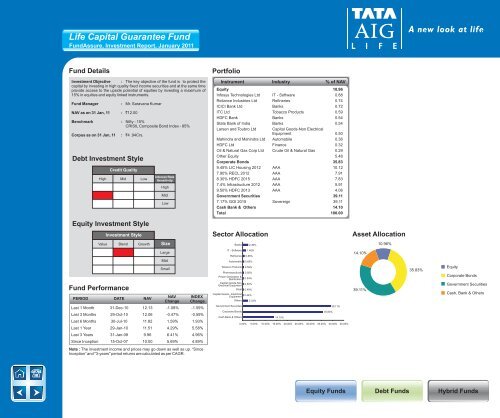

<strong>Life</strong> Capital Guarantee FundFundAssure, Investment Report, <strong>January</strong> 2011Fund DetailsPortfolioInvestment Objective : The key objective of the fund is to protect thecapital by investing in high quality fixed income securities and at the same timeprovide access to the upside potential of equities by investing a maximum of15% in equities and equity linked instruments.Fund ManagerNAV as on 31 Jan, 11 : `12.00Benchmark :: Mr. Saravana KumarCorpus as on 31 Jan, 11 : `4 .94Crs.Debt Investment StyleCredit QualityHigh Mid LowNifty - 15%CRISIL Composite Bond Index - 85%Interest RateSensitivityHighMidLowInstrument Industry % of NAVEquity 10.96Infosys Technologies Ltd IT - Software 0.88Reliance Industries Ltd Refineries 0.74ICICI Bank Ltd Banks 0.72ITC Ltd Tobacco Products 0.59HDFC Bank Banks 0.54State Bank of India Banks 0.54Larsen and Toubro Ltd Capital Goods-Non ElectricalEquipment 0.50Mahindra and Mahindra Ltd Automobile 0.36HDFC Ltd Finance 0.32Oil & Natural Gas Corp Ltd Crude Oil & Natural Gas 0.29Other Equity 5.48Corporate Bonds 35.839.45% LIC Housing 2012 AAA 10.127.90% RECL 2012 AAA 7.918.30% HDFC 2015 AAA 7.837.4% Infrastructure 2012 AAA 5.919.50% HDFC 2013 AAA 4.06Government Securities 39.117.17% GOI 2015 Sovereign 39.11Cash Bank & Others 14.10Total 100.00Equity Investment StyleInvestment StyleSector AllocationAsset AllocationValue Blend Growth SizeBanks2.49%10.96%Fund PerformancePERIOD DATE NAVLargeMidSmallNAVChangeINDEXChangeLast 1 Month 31-Dec-10 12.13 -1.08% -1.59%Last 3 Months 29-Oct-10 12.06 -0.47% -0.59%Last 6 Months 30-Jul-10 11.82 1.59% 1.93%Last 1 Year 29-Jan-10 11.51 4.29% 5.58%IT - SoftwareRefineriesAutomobileTobacco ProductsPharmaceuticalsPower Generation &DistributionCapital Goods-NonElectrical EquipmentSteelCapital Goods - ElectricalEquipmentOthersGovernment SecuritiesCorporate BondsCash Bank & Others1.46%0.88%0.69%0.59%0.56%0.54%0.50%0.49%0.44%2.33%14.10%35.83%39.11%0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 30.00% 35.00% 40.00% 45.00%14.10%39.11%35.83%EquityCorporate BondsGovernment SecuritiesCash, Bank & OthersLast 3 Years 31-Jan-08 9.96 6.41% 4.96%Since Inception 15-Oct-07 10.00 5.69% 4.89%Note : The investment income and prices may go down as well as up. “SinceInception” and "3-years" period returns are calculated as per CAGR.Equity FundsDebt FundsHybrid Funds