January - Tata AIA Life Insurance

January - Tata AIA Life Insurance

January - Tata AIA Life Insurance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

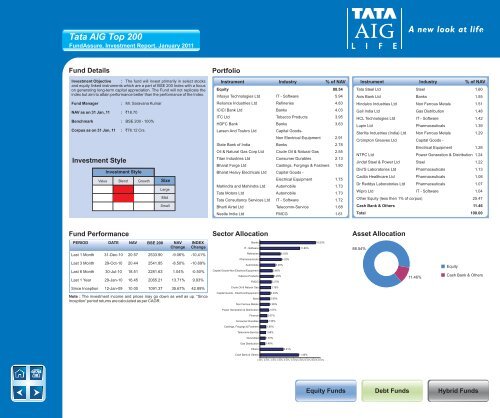

<strong>Tata</strong> AIG Top 200FundAssure, Investment Report, <strong>January</strong> 2011Fund DetailsInvestment Objective : The fund will invest primarily in select stocksand equity linked instruments which are a part of BSE 200 Index with a focuson generating long-term capital appreciation. The Fund will not replicate theindex but aim to attain performance better than the performance of the Index.Fund ManagerNAV as on 31 Jan, 11 : `18.70Investment Style: Mr. Saravana KumarBenchmark : BSE 200 - 100%Corpus as on 31 Jan, 11: `76.12 Crs.Investment StyleValue Blend Growth SizeLargeMidSmallPortfolioInstrument Industry % of NAVEquity 88.54Infosys Technologies Ltd IT - Software 5.94Reliance Industries Ltd Refineries 4.83ICICI Bank Ltd Banks 4.03ITC Ltd Tobacco Products 3.95HDFC Bank Banks 3.63Larsen And Toubro Ltd Capital Goods-Non Electrical Equipment 2.91State Bank of India Banks 2.78Oil & Natural Gas Corp Ltd Crude Oil & Natural Gas 2.55Titan Industries Ltd Consumer Durables 2.13Bharat Forge Ltd Castings, Forgings & Fastners 1.80Bharat Heavy Electricals Ltd Capital Goods -Electrical Equipment 1.75Mahindra and Mahindra Ltd Automobile 1.73<strong>Tata</strong> Motors Ltd Automobile 1.73<strong>Tata</strong> Consultancy Services Ltd IT - Software 1.72Bharti Airtel Ltd Telecomm-Service 1.68Nestle India Ltd FMCG 1.61Instrument Industry % of NAV<strong>Tata</strong> Steel Ltd Steel 1.60Axis Bank Ltd Banks 1.55Hindalco Industries Ltd Non Ferrous Metals 1.51Gail India Ltd Gas Distribution 1.48HCL Technologies Ltd IT - Software 1.42Lupin Ltd Pharmaceuticals 1.39Sterlite Industries (India) Ltd Non Ferrous Metals 1.29Crompton Greaves Ltd Capital Goods -Electrical Equipment 1.28NTPC Ltd Power Generation & Distribution 1.24Jindal Steel & Power Ltd Steel 1.22Divi'S Laboratories Ltd Pharmaceuticals 1.13Cadila Healthcare Ltd Pharmaceuticals 1.08Dr Reddys Laboratories Ltd Pharmaceuticals 1.07Wipro Ltd IT - Software 1.04Other Equity (less then 1% of corpus) 25.47Cash Bank & Others 11.46Total 100.00Fund PerformanceSector AllocationAsset AllocationPERIOD DATE NAV BSE 200 NAV INDEXChange ChangeLast 1 Month 31-Dec-10 20.57 2533.90 -9.06% -10.41%Last 3 Month 29-Oct-10 20.44 2541.85 -8.50% -10.69%Last 6 Month 30-Jul-10 18.51 2281.63 1.04% -0.50%Last 1 Year 29-Jan-10 16.45 2065.21 13.71% 9.93%BanksIT - SoftwareRefineriesPharmaceuticalsAutomobileCapital Goods-Non Electrical EquipmentTobacco ProductsFMCG6.03%6.32%4.49%3.66%3.95%3.37%11.86%16.53%88.54%11.46%EquityCash Bank & OthersSince Inception 12-Jan-09 10.00 1091.37 35.67% 42.89%Note : The investment income and prices may go down as well as up. “SinceInception” period returns are calculated as per CAGR.Crude Oil & Natural GasCapital Goods - Electrical EquipmentSteelNon Ferrous Metals3.19%3.03%2.90%2.80%Power Generation & DistributionFinanceConsumer DurablesCastings, Forgings & FastnersTelecomm-ServiceDiversifiedGas Distribution2.57%2.07%2.30%1.80%1.68%1.57%1.48%Others6.91%Cash Bank & Others11.46%0.00% 2.00% 4.00% 6.00% 8.00% 10.00%12.00%14.00%16.00%18.00%Equity FundsDebt FundsHybrid Funds