January - Tata AIA Life Insurance

January - Tata AIA Life Insurance

January - Tata AIA Life Insurance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

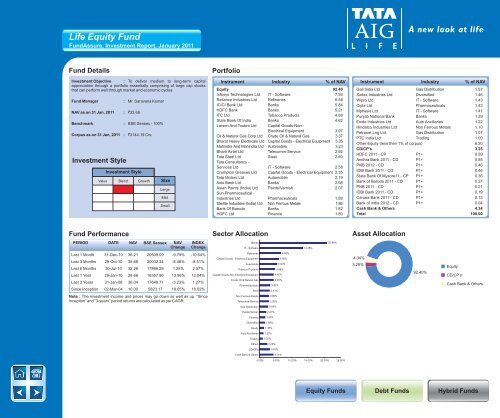

<strong>Life</strong> Equity FundFundAssure, Investment Report, <strong>January</strong> 2011Fund DetailsInvestment Objective : To deliver medium to long-term capitalappreciation through a portfolio essentially comprising of large cap stocksthat can perform well through market and economic cycles.Fund ManagerNAV as on 31 Jan, 2011 : `32.66Investment Style: Mr. Saravana KumarBenchmark : BSE Sensex - 100%Corpus as on 31 Jan, 2011: `3144.19 Crs.Investment StyleValue Blend Growth SizeLargeMidSmallPortfolioInstrument Industry % of NAVEquity 92.40Infosys Technologies Ltd IT - Software 7.93Reliance Industries Ltd Refineries 6.58ICICI Bank Ltd Banks 5.84HDFC Bank Banks 5.21ITC Ltd Tobacco Products 4.88State Bank Of India Banks 4.62Larsen And Toubro Ltd Capital Goods-Non -Electrical Equipment 3.97Oil & Natural Gas Corp Ltd Crude Oil & Natural Gas 3.37Bharat Heavy Electricals Ltd Capital Goods - Electrical Equipment 3.35Mahindra And Mahindra Ltd Automobile 3.23Bharti Airtel Ltd Telecomm-Service 2.92<strong>Tata</strong> Steel Ltd Steel 2.60<strong>Tata</strong> Consultancy -Services Ltd IT - Software 2.58Crompton Greaves Ltd Capital Goods - Electrical Equipment 2.35<strong>Tata</strong> Motors Ltd Automobile 2.19Axis Bank Ltd Banks 2.08Asian Paints (India) Ltd Paints/Varnish 2.07Sun Pharmaceutical -Industries Ltd Pharmaceuticals 1.89Sterlite Industries (India) Ltd Non Ferrous Metals 1.86Bank Of Baroda Banks 1.82HDFC Ltd Finance 1.80Instrument Industry % of NAVGail India Ltd Gas Distribution 1.57Sintex Industries Ltd Diversified 1.46Wipro Ltd IT - Software 1.43Cipla Ltd Pharmaceuticals 1.43Mphasis Ltd IT - Software 1.41Punjab National Bank Banks 1.39Exide Industries Ltd Auto Ancillaries 1.22Hindalco Industries Ltd Non Ferrous Metals 1.10Petronet Lng Ltd Gas Distribution 1.07PTC India Ltd Trading 1.00Other Equity (less then 1% of corpus) 6.20CD/CP's 3.25HDFC 2011 - CP P1+ 0.59Andhra Bank 2011 - CD P1+ 0.55PNB 2012 - CD P1+ 0.46IDBI Bank 2011 - CD P1+ 0.46State Bank Of Mysore11 - CP P1+ 0.36Bank of Baroda 2011 - CD P1+ 0.27PNB 2011 - CD P1+ 0.21IDBI Bank 2011 - CD P1+ 0.19Canara Bank 2011 - CD P1+ 0.13Bank of india 2012 - CD P1+ 0.04Cash Bank & Others 4.34Total 100.00Fund PerformanceSector AllocationAsset AllocationPERIOD DATE NAV BSE Sensex NAV INDEXChange ChangeBanksIT - Software13.35%20.96%Last 1 Month 31-Dec-10 36.21 20509.09 -9.79% -10.64%Last 3 Months 29-Oct-10 35.68 20032.34 -8.46% -8.51%Last 6 Months 30-Jul-10 32.26 17868.29 1.25% 2.57%Last 1 Year 29-Jan-10 28.66 16357.96 13.96% 12.04%Last 3 Years 31-Jan-08 36.04 17648.71 -3.23% 1.27%Since Inception 02-Mar-04 10.00 5823.17 18.65% 18.02%Note : The investment income and prices may go down as well as up. “SinceInception” and "3-years" period returns are calculated as per CAGR.RefineriesCapital Goods - Electrical EquipmentAutomobileTobacco ProductsCapital Goods-Non Electrical EquipmentCrude Oil & Natural GasPharmaceuticalsSteelNon Ferrous MetalsTelecomm-Service6.58%5.96%5.42%4.88%4.40%4.35%3.32%3.13%2.96%2.92%4.34%3.25%92.40%EquityCD/CP’sCash Bank & OthersGas Distribution2.64%Paints/Varnish2.07%Finance1.80%Diversified1.68%Realty1.36%Auto Ancillaries1.22%Trading1.00%Others2.39%CD/CP's3.25%Cash Bank & Others4.34%0.00% 5.00% 10.00% 15.00% 20.00% 25.00%Equity FundsDebt FundsHybrid Funds